UK families set for another year of cost of living crisis and £65bn hit to finances

UK families are poised to be gripped by the cost of living crisis for nearly another whole year due to the Bank of England keeping interest rates higher for longer in a bid to vanquish inflation, a new report out today claims.

Household finances will be corroded by rising living costs and elevated rates until at least May 2024, according to calculations by consultancy Retail Economics and accountancy firm Grant Thornton.

By the time the living standards crunch ends, it will have lasted 19 months, amounting to a cumulative £65bn hit to household budgets, the two organisations said in a report today.

That would mean the typical British family will be £2,300 worse off when the crisis finishes.

So far, wages trailing sky high inflation and higher borrowing costs has swiped £50bn from pay packets, meaning an additional £15bn of pain is to come by next May.

Retail Economics and Grant Thornton’s report reinforces calculations from the Office for National Statistics (ONS) yesterday that found wages have lagged behind price rises since November 2021.

Living standards are still falling despite workers bagging a record pay increase of 7.3 per cent over the last three months, the ONS said yesterday.

As a result, the Bank of England is tipped by financial markets to repeat last month’s shock 50 basis point interest rate rise on 3 August, lifting them to 5.5 per cent.

Traders think more tightening is to come, pricing in a rate peak of around 6.5 per cent.

Wage increases that aren’t offset by workers becoming more productive raise businesses’ operating costs, which can compel them to lift prices to shield profit margins.

Bank Governor Andrew Bailey and co are trying to stomp down on consumer spending by making it more attractive to save and slow the economy. They have already jacked up rates 13 times in a row. Experts have said raising interest rates amid a cost of living crisis caused by supply shocks is ineffective.

Britain’s poorest families have absorbed the sharpest blow from soaring energy and food costs.

However, higher mortgage rates are now poised to drag richer households into the cost of living crisis.

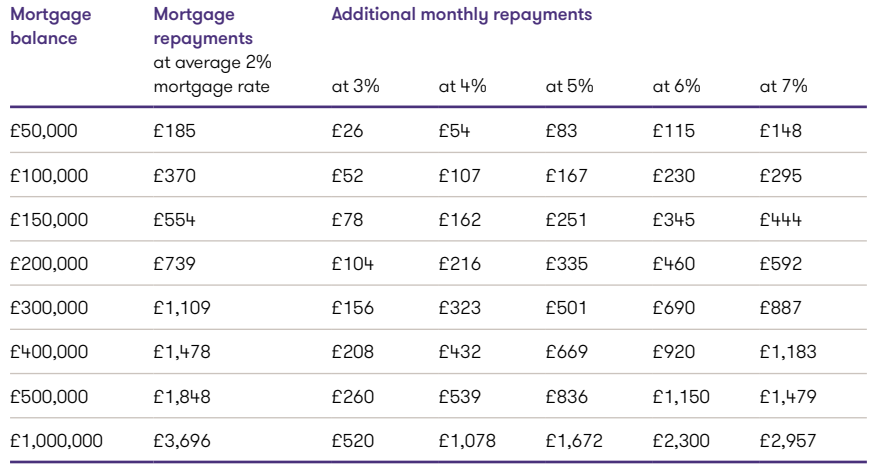

Yesterday, financial data company Moneyfacts said the average rate on the 2-year mortgage reached its highest level in 15 years, up to more than 6.6 per cent.

That means a deluge of wealthier homeowners will have a large chunk of their disposable income eaten up by higher home loan repayments when they remortgage. There is expected to be around 1.5m people remortgaging over the second half of this year.

Additional monthly mortgage repayments broken down by balance and rate

“Many middle and higher income households bracing for significant increases in mortgage repayments over the year ahead,” the report said.

Richard Lim, chief executive at Retail Economics, said: “The relentless rise in interest rates has completely changed the narrative around the cost of living crisis.”

“What started as a crisis among the least affluent households has evolved to capture a much wider array of income groups as housing affordability comes under enormous pressure,” he added.

There is growing concern that a reduction in consumer spending after a wave of homeowners switch onto mortgage contracts with more punitive rates will send the UK into recession.

Retail Economics and Grant Thornton said consumers are also exhibiting “recessionary” behaviours by cutting back on non-essentials.

But, Brits’ appetite to get away for some sun doesn’t appear to be fading any time soon.

Summer holidays are being prioritised “above clothing, electricals, and household goods,” the paper said.

“Once seen as a ‘luxury’, holidays are now seen almost as a must-have for households,” Retail Economics and Grant Thornton said.