UK faces blackouts threat if more plants taken offline, warns nuclear boss

Nuclear power has been “absolutely vital to keeping the lights on this winter”, warned a leading industry boss, after the UK narrowly avoided bringing in emergency measures last year to stave off supply shortages.

Tom Greatrex, chief executive of the Nuclear Industry Association, told City A.M. nuclear is essential for the UK’s energy security.

He said: “If the right conditions are in place, nuclear can keep providing clean, reliable, sovereign power for our energy security and net zero future.”

His comments follow EDF announcing it is still weighing up whether to extend the lifespan of two key legacy nuclear power plants.

The French energy giant is expected to make a decision in the next two months over whether to continue operating the Heysham 1 and Hartlepool plants for a further two years – with both sites currently set to close down in March 2024.

The two plants have a collective generation capacity of around 2.5GW, enough to provide zero-carbon power to over four million homes and meet nearly five per cent of the UK’s electrical demand in the winter.

| Nuclear power plant | Closing date |

| Sizewell B | 2035 |

| Torness | 2028 |

| Heysham II | 2028 |

| Heysham I | 2024 |

| Hartepool | 2024 |

However, the French energy firm is smarting over the introduction of the Electricity Generator Levy – a new 45 per cent tax on legacy renewable generators, covering “exceptional receipts” of £75 per MWh and above.

Rachael Glaving, commercial director of generation at EDF UK, told the Telegraph last month it was that’s going to” factor in the business case of life extension and we’ll have to take that [the windfall tax] into consideration.”

She said: “It’s not going to make it easier.”

EDF confirmed to City A.M it remains “open to discussions” with the Government on a potential nuclear contracts for difference scheme for its existing nuclear fleet to replace its current

A spokesperson said: “Power generation at both the Hartlepool and Heysham 1 stations is currently due to finish in March 2024, after 41 years operation. EDF is reviewing whether there is the potential to go longer but any extension would need regulatory support and a clear business case.

This includes taking into account the “implications of the new tax that comes into force” in the New Year.

The measure was brought in by Chancellor Jeremy Hunt as part of his fiscal event last November, and is intended to replace the two-decades old renewable obligation contracts, which allowed energy developments including nuclear plants to harness record gas prices as part of their profits.

The levy is expected to raise £14bn by 2028, to help fund support for households and businesses grappling with soaring energy bills, with around 40 per cent of the nuclear and renewable energy market currently operating on legacy deals.

The tax will not be apply to newer renewable generation supported through the Government’s Contracts for Difference scheme.

When approached for comment, a Treasury spokesperson said “This temporary measure is not designed to penalise electricity generators, it is a response to the fact that, as a result of exceptional and unforeseen geopolitical events, some electricity generators are realising extraordinary returns from higher electricity prices.

“The continued investment of generators in the industry is vital to our long-term energy security and this levy leaves them with a share of the upside they receive at times of high wholesale prices”.

Nuclear power essential to ease blackout fears

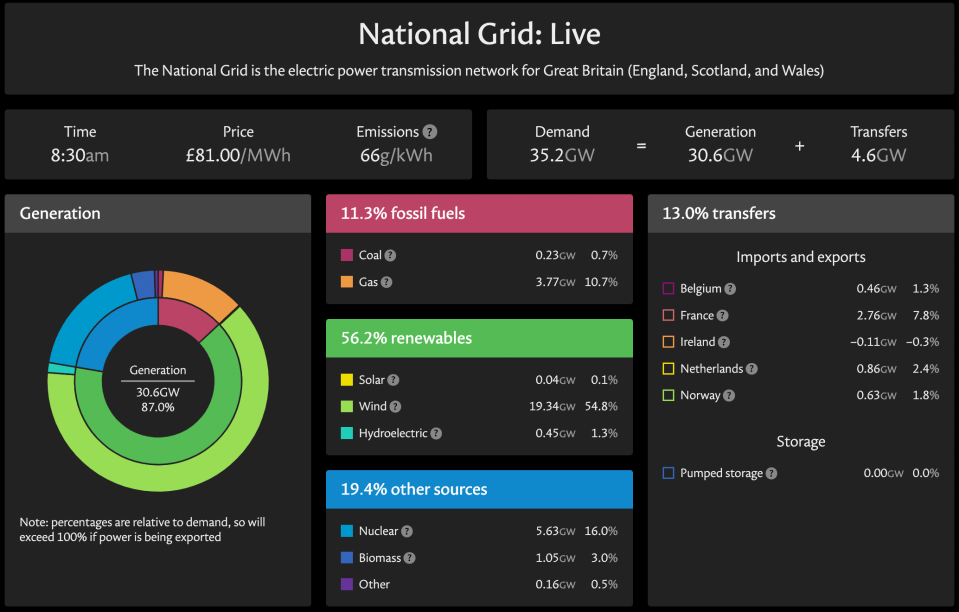

The UK has so far avoided National Grid’s worst-case scenario in its winter outlook of rolling blackouts in January, benefitting from unseasonal warmth this winter and Europe’s successful topping up of energy supplies.

However, the UK’s capacity margins dropped to below 500MW on multiple occasions this winter – making the 2.5GW provided by both plants vital to the country’s energy supplies.

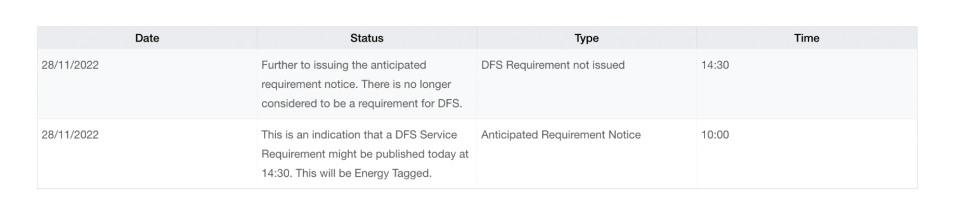

This caused the National Grid to announce two electricity capacity market notices last November before aborting them when more power was secured.

These notices would have triggered early phase emergency plans to avoid blackouts, including consensual energy saving from volunteer households.

With the impending closure of two more nuclear power plants, there are fears the National Grid could be left scrambling to meet the country’s energy demands in the coming winters unless the lifespan of the plants is extended or more power is brought online.

EDF currently operates all five of the UK’s remaining, ageing nuclear fleet, and is also overseeing the developments of new plants Hinkley Point C and Sizewell C.

Currently, nuclear power is responsible for around 15 per cent of the UK’s generation, but with the rest of the fleet set to be taken offline in the next 13 years, the UK will need to build new plants to sustain nuclear’s role in the energy mix.

The UK’s energy security strategy unveiled last April is targeting a ramp up of the UK’s nuclear generation capacity from 7GW to 24GW, with the aim of eight new reactors greenlit this decade.

Andy Mayer, energy analyst at free market think tank the Institute of Economic Affairs, told City A.M. that the “chickens are coming home to roost” with energy suppliers withdrawing from the UK following the introduction of further taxes.

He said: “The UK faces the very real risk of blackouts and freezeouts next winter. It should be securing new supplies with urgency, and doing so through trade deals, streamlined regulation, and saner simpler stable taxes. Doing otherwise takes us closer to state bailouts and nationalisation, which we cannot afford, and will leave us shivering in the dark.”

National Grid and EDF have both been approached for comment.