UK economy ‘turned a corner’ despite slight weakening in services sector

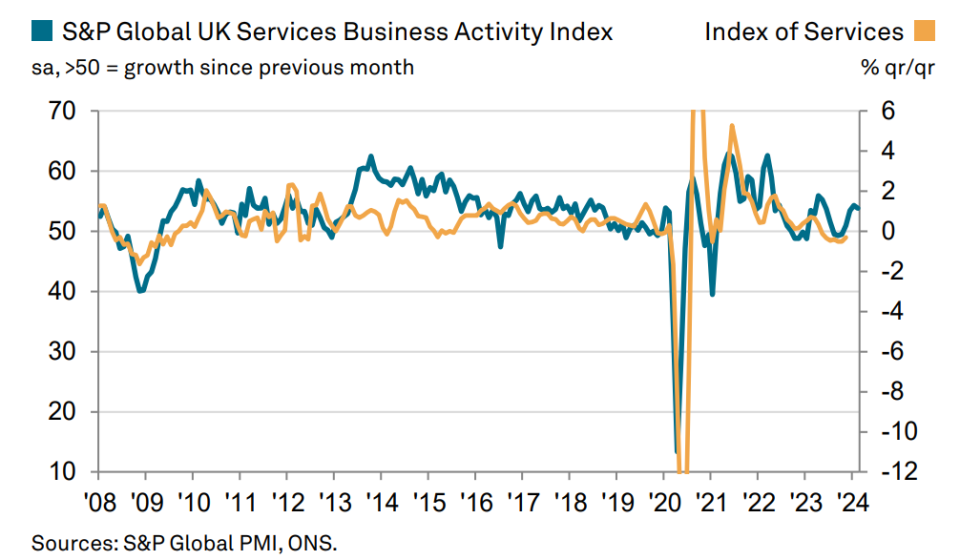

Business activity in the UK’s all-important services sector was weaker than first thought in February, but it remained higher than at any point in the second half of 2023, a closely watched survey revealed.

S&P’s purchasing managers’ index (PMI) for the services sector showed a reading of 53.8, down from the flash reading of 54.3 which was in line with January’s figures.

However, the index remained above the 50 no-change mark for the fourth consecutive month, pointing to the “sustained rebound” in business activity.

New business orders drove the increase, with the survey showing the sharpest rate of new business growth since May 2023. “Service providers commented on rising business and consumer spending, linked to more supportive economic conditions,” the survey noted.

The prospect of lower interest rates and strong overseas demand, which hit its highest level since June 2023, also helped to lift new orders in February.

Strong order books strengthened business expectations for the year ahead, which climbed to its highest level since February 2022.

The survey adds to the impression that the UK economy has made a relatively strong start to 2024 after slipping into a shallow recession in the second half of last year.

Tim Moore, economics director at S&P Global Market Intelligence said: “Another solid expansion of business activity across the service sector in February adds to signs that the UK economy has turned a corner after entering a technical recession during the second half of 2023”.

“Don’t focus on the small drop in the services PMI in February,” Rob Wood, chief UK economist at Pantheon Macroeconomics said. “It remains comfortably in expansionary territory”.

“The PMI details suggest solid growth will continue. Businesses were the most upbeat about the year-ahead outlook since February last year and more optimistic than on average between 2012—when the question was first posed—and 2019,” Wood said.

However, the survey highlighted continuing cost pressures, with input price inflation accelerating to its highest level since September on the back of higher wage bills.

“A number of firms also reported increased costs due to shipping surcharges,” the survey showed.

Higher input costs contributed to an increase in prices charged, which rose at a “robust pace”. Some firms noted that resilient customer demand had allowed firms to pass on higher bills to consumers.

The final PMI reading for February, which includes the manufacturing sector, was 53.0. Although this was slightly higher than January, it was below the 53.3 recorded in the ‘flash’ reading.