UK economy to emerge from recession 10 per cent smaller than pre-Covid path

The UK economy will be 10 per cent smaller compared to its pre-Covid growth path after the Bank of England’s forecasted two year recession, a top Wall Street bank has warned.

JP Morgan said in a note to clients Britain is on course to miss out on a large chunk of much needed economic growth if the Bank’s downbeat projections play out.

Last week, governor Andrew Bailey and the rest of the monetary policy committee (MPC) warned the UK economy will contract eight quarters in a row, beginning this winter, which would be the longest recession in around a century.

The UK economy will emerge from the recession around three per cent smaller, meaning the contraction would be far less severe than the financial crisis, the Bank said.

However, JP Morgan factored in the country’s growth trend before the Covid-19 hobbled the UK economy to arrive at the 10 per cent figure.

Britain has endured sluggish growth in the decade or so after the financial crisis, primarily caused by awful productivity gains.

This has left households and businesses heavily exposed to the current cost of living crisis, fuelled by inflation surging to a 40-year high of 10.1 per cent.

The Bank’s recession projections were based on interest rates hitting 5.25 per cent, as priced into markets in mid-October. However, Bailey and other MPC members have said borrowing costs are unlikely to reach that level.

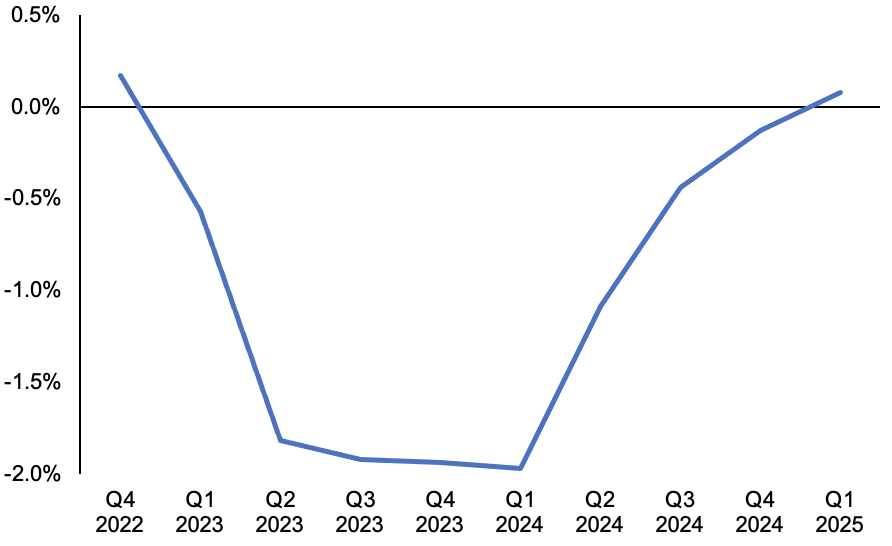

Bank of England’s bleak UK GDP forecasts

“But even leaving this caveat to one side, it should be noted that the BoE expects a 1.7 per cent GDP contraction” even if borrowing costs stay at three per cent, analysts at JP Morgan said.

Last week, the nine strong MPC voted 7-2 in favour of raising rates 75 basis points to three per cent, the biggest jump in over 30 years.

“Remarkably, [the Bank’s] projections do not include any fiscal tightening that is to be announced on November 17 (perhaps worth two per cent of GDP) and assume fiscal policy will be used to protect households from half of the rise in energy prices that would occur from next April based on the current forward rates,” JP Morgan added.

Prime minister Rishi Sunak and chancellor Jeremy Hunt are expected to launch sweeping spending cuts and raise taxes sharply next Thursday to plug an around £55bn hole in the UK’s finances. Those moves would likely intensify the coming recession.