UK economy: Survey suggests growth is slowing ahead of July general election

The UK economy is likely to continue growing at a reasonable clip in the second quarter, but at a slower pace than earlier in the year, a closely watched survey suggests.

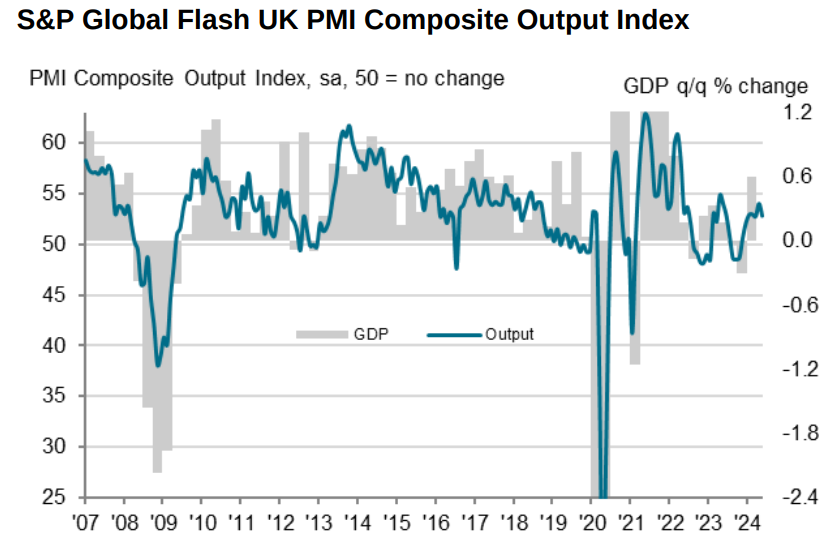

S&P’s purchasing managers’ index (PMI), which measures activity in the private sector, came in at 52.4. This was down from 54.1 in April and below the 54 expected by economists. Anything above 50 indicates economic expansion.

The figures are consistent with the economy growing 0.3 per cent in the second quarter.

“The flash PMI survey data for May signalled a further expansion of UK business activity, suggesting the economy continues to recover from the mild recession seen late last year,” Chris Williamson, chief business economist at S&P Global Market Intelligence said.

Activity in the UK’s dominant services sector fell to its slowest rate in six months, with the PMI coming in at 52.9. This was down from 55.0 the month before.

Firms in the service sector noted that cost-of-living pressures and greater economic uncertainty had impacted consumer spending.

However, the survey showed a significant improvement in manufacturing, with activity in the sector rising to a 22-month high of 51.3.

“Higher output was often linked to stronger client demand and emerging signs of a recovery in both export sales and inventory purchases,” the survey said.

The economy is likely to be at the heart of the election campaign, with both parties putting growth at the centre of their pitch to voters.

The economy surprised pundits in the first quarter, growing 0.6 per cent. Rishi Sunak has argued the economy showed “gangbusters” growth as he seeks to close a 20 point gap on Labour ahead of the July vote.

Although the survey was a mixed bag for the government, there was better news for the Bank of England as they consider when to cut interest rates.

Input price inflation dropped to its lowest level in seven months, with prices falling in both sectors. Service providers experienced their weakest cost pressures in over three years, although they still suffered from faster cost increases than manufacturing firms.

This helped push selling price inflation to its lowest level since February 2021. “Some panellists indicated greater efforts to stimulate new work intakes amid competitive pressures,” the survey noted.

“A temporary surge in wage-related cost growth seen in April is showing signs of fading in May. Firms are also reporting that strong competition is limiting their scope to raise prices, especially in the face of weakened demand due to the elevated cost of living,” Williamson said.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said: “The PMI can give the MPC some hope that services inflation will slow once more in future months, and April’s surge was mainly about annual price resets.”

A key question for rate-setters at the Bank is the extent to which firms pass on higher costs to consumers.

Many surveys suggest that firms will be forced to absorb extra costs rather than pass them on, limiting the inflationary impact of higher costs. This would enable interest rates to be cut sooner rather than later.

However, the latest inflation figures, released yesterday, showed that price pressures eased at a slower rate than expected. Markets now doubt whether the Bank will be in a position to cut interest rates in June.