UK economy stalls in February but is just about on track to dodge recession in early 2023

Britain is just about on track to dodge a recession in the first half of this year, defying gloomy predictions from experts heading into 2023 that the economy would suffer the largest slump in recent memory, figures out today show.

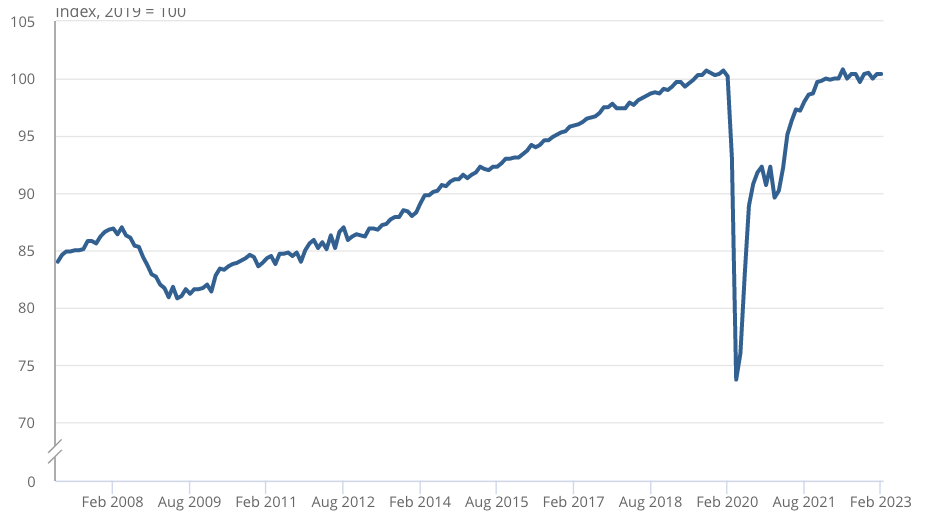

Gross domestic product (GDP) – which measures the value of all goods and services produced in the UK – stalled in February, according to the Office for National Statistics (ONS).

The number was below the City’s expectations of a 0.1 per cent expansion, but the ONS hiked its estimates for January’s GDP growth to 0.4 per cent from 0.3 per cent.

February’s worse than anticipated number was caused by public sector workers striking in a bid to bag a pay rise.

Strong growth in the private economy, led by the construction sector expanding 2.4 per cent and 0.4 per cent growth among consumer-facing firms like high street retailers, was dragged down by teachers and nurses embarking on a wave of industrial action.

Private sector expansion was “offset by the effects of Civil Service and teachers’ strike action, which impacted the public sector,” Darren Morgan, director of economic statistics at the ONS, said.

Although stalling in February, over the three months, the economy expanded 0.1 per cent, meaning the UK is poised to avoid a quarterly GDP contraction in the first three months of this year, raising the chances of the country swerving a technical recession – two consecutive quarters of contraction – in the first half of 2023.

UK GDP growth is stalling

British output has performed much better than analysts had projected just a few months ago.

The Bank of England at the turn of the year was forecasting the longest recession in a century, shaving around three per cent off of GDP. Office for Budget Responsibility officials had also projected a tough economic hit.

Both organisations have now canned their UK recession bets this year, as have many top City economists.

Chancellor Jeremy Hunt said the “massive package of cost of living support for families and radical reforms to boost the jobs market and business investment” launched at last month’s budget will help steer the country away from recession.

Hunt injected around £20bn into the economy, mainly via expanding childcare support and giving tax reliefs to businesses that invest.

Stronger than feared global demand, mainly from China, and January’s upward GDP revision means the UK will “avoid a recession this year,” Yael Selfin, chief economist at KPMG UK, said.

However she cautioned elevated inflation – still in the double digits at 10.4 per cent – and the full effects of the Bank of England’s eleven straight interest rate rises to a post-financial crisis high of 4.25 per cent means “economic activity will remain subdued in the near term”.

Others highlighted the government’s decision to ditch the 130 per cent business investment relief, known as the super-deduction, and the end of state backed help to buy scheme that helps first time buyers get on the property ladder could peg back GDP growth.

“Business investment and residential investment look set to fall sharply in the second quarter, in response to the jump in interest rates and government policies, such as the end of the super-deduction for capital investment and the phasing out of the help to buy scheme in the first quarter,” Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, said.

A report out this week from the International Monetary Fund (IMF), the world’s economic watchdog, warned the country is poised to suffer the worst economic contraction of any G7 country at 0.3 per cent.

Germany is the only other rich nation the IMF reckons will shrink this year, although the lender of last resort did revise up its call for UK GDP from a 0.6 per cent drop, the largest upgrade among developed countries.

Rachel Reeves MP, Labour’s shadow Chancellor, said: “Despite our enormous promise and potential as a country, Britain is still lagging behind on the global stage with growth on the floor.”

“The reality of growth inching along is families worse off, high streets in decline and a weaker economy that leaves us vulnerable to shocks,” she added.