UK economy shrugs off recession risk after growing faster than expected

The UK grew faster than expected in the second quarter of the year as the economy proved itself more resilient to rising rates than many had expected, helping to reduce the risk of recession.

Across the second quarter, the economy grew 0.2 per cent following a 0.1 per cent expansion in the first quarter, the Office for National Statistics (ONS) estimated. The Bank of England forecast a 0.1 per cent expansion in the second quarter.

Across the period, production – which includes manufacturing – saw the strongest growth, seeing an expansion of 0.7 per cent, while services grew 0.1 per cent and construction 0.3 per cent.

Although the rate of growth was not fast, it demonstrates that the UK has managed to withstand the pressure that rising interest rates have put on it.

In June, the UK economy grew 0.5 per cent, rebounding from a 0.1 per cent contraction in May. Markets had predicted a smaller 0.2 per cent expansion.

GDP in June was lifted by 1.8 per cent growth in production output while the construction sector grew 1.6 per cent. The all important services sector grew 0.2 per cent in June. It was the first time since October 2022 that all three sectors of the economy recorded growth.

Prime Minister Rishi Sunak said: “This is good news. At the beginning of the year I made growing the economy one of my top priorities, and we are making progress.

“There’s still more work to do, but today’s figures show the plan is working.”

The pound climbed 0.3 per cent against the dollar on the news, rising to $1.2714.

ONS director of economic statistics Darren Morgan said: “The economy bounced back from the effects of May’s extra bank holiday to record strong growth in June. Manufacturing saw a particularly strong month with both cars and the often-erratic pharmaceutical industry seeing particularly buoyant growth.”

“Construction also grew strongly, as did pubs and restaurants, with both aided by the hot weather,” Morgan continued.

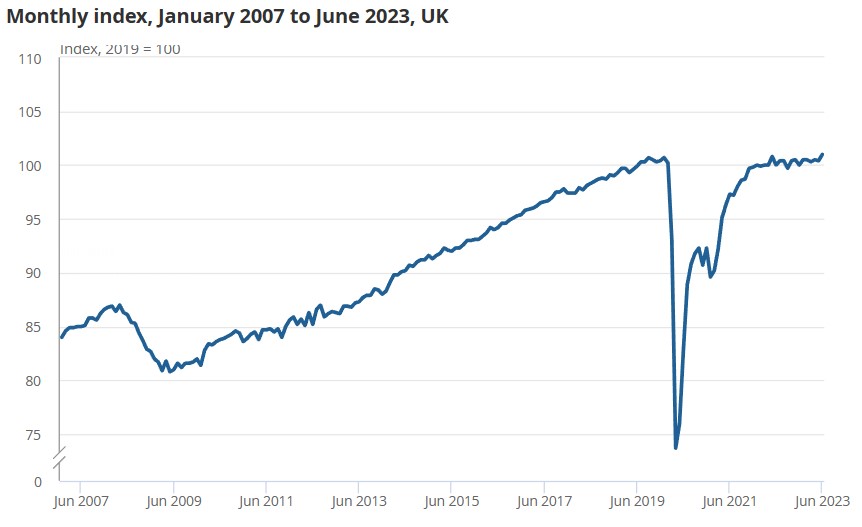

On a monthly basis, the UK economy is now predicted to be 0.8 per cent larger than it was before Covid-19. However, on a quarterly basis , the economy is still 0.2 per cent below its pre-covid peak, making it the only G7 economy to be smaller than it was at the end of 2019.

Chancellor Jeremy Hunt said “the actions we’re taking to fight inflation are starting to take effect, which means we’re laying the strong foundations needed to grow the economy.”

“If we stick to our plan to help people into work and boost business investment, the IMF have said over the longer-term we will grow faster than Germany, France and Italy,” he continued.

Commentators have become increasingly concerned by the UK’s sluggish rate of growth over the past few years.

A recent report published by the National Institute for Economic and Social (NIESR) research warned that it will take until the end of 2024 for UK output – a broader measure than GDP – to surpass its pre-pandemic level, with the think tank highlighting five years of lost economic growth.

NIESR director Jagjit Chadha described the challenges facing Britain, including high inflation, as “the re-emergence of ‘the British disease’.”

Although the UK is forecast to avoid a recession, GDP is expected to grow just 0.4 per cent this year and 0.3 per cent next year. With an election looming, politicians are likely to set out their plans to boost the low rate of growth over the next few months.