UK economy shockingly grows in November on back of World Cup pub boost, raising hopes of shallow recession

The UK economy expanded in November, smashing downbeat market expectations and signalling the coming recession could be short lived, official figures out today reveal.

Gross domestic product (GDP) climbed 0.1 per cent in November, defying analysts’ bets on a 0.2 per cent contraction, the Office for National Statistics (ONS) said today.

The expansion was driven by the services industry bagging an income boost from football fans heading to pubs and bars to watch the 2022 Qatar World Cup.

Recruitment activity also jumped 2.1 per cent, the biggest contribution from the services industry, likely driven by companies enlisting consultancies to help fill vacancies amid a worker shortage.

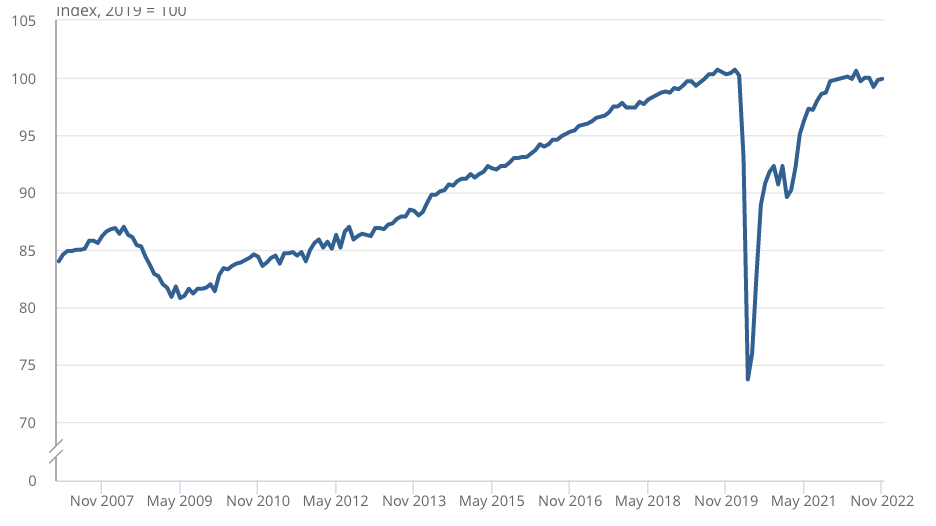

While the monthly figures are good news, taking a longer term view paints a bleak picture for the UK economy.

Over the three months to November, GDP dropped 0.3 per cent, sending a clear signal that “GDP growth continues to head in [the] wrong direction,” David Bharier, head of research at the British Chambers of Commerce, said.

UK economy grew in November but GDP is stalling

The November rise means the economy is teetering between slipping into or avoiding a recession, defined as two consecutive quarters of contraction.

GDP dropped over the summer, but has grown in October and November, suggesting the country could actually narrowly avert a slump

In fact, output would have to shrink around 0.6 per cent in December for the UK economy to contract in the final months of 2022.

“A drop of that magnitude in December is certainly possible, given that all the main business surveys point to falling production, and both heavy snowfall and, to a lesser extent, rail strikes, likely weighed temporarily on activity,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Experts throughout last year warned rampant inflation driven by swelling energy bills will kick the country into the longest slumps in the past century.

The Bank of England in November forecast the recession will last the whole of this year, while the Office for Budget Responsibility also projected a drawn out slow down in the same month.

Chancellor Jeremy Hunt called inflation “an insidious hidden tax which has led to hikes in interest rates and mortgage costs, holding back growth here and around the world”.

Prime minister Rishi Sunak last week promised to halve inflation in 2023, although experts months ago had already predicted that would happen.

A slump in demand in response to its nine successive interest rate hikes and the cost of living crunch should, in theory, naturally bring inflation down in 2023.

However, the shock GDP rise will cause the Bank to continue “raising rates unnecessarily when they meet in early February. The risk now is that rates will rise too far if inflation is already on a downward path due to changes in global energy prices,” Kitty Ussher, chief economist at the Institute of Directors, said.

Investors reckon the Bank will kick rates to a peak of under 4.5 per cent this year, a huge climb down from the around six per cent predicted after Liz Truss’s mini-budget sparked financial market chaos.

Pound sterling was broadly flat against the US dollar after today’s GDP news.