UK economy off to ‘promising start’ in 2024 but firms reveal impact of Red Sea crisis

Activity in the UK economy’s private sector accelerated for the third straight month, but the impact of the crisis in the Red Sea is starting to hit firms, a new survey suggests.

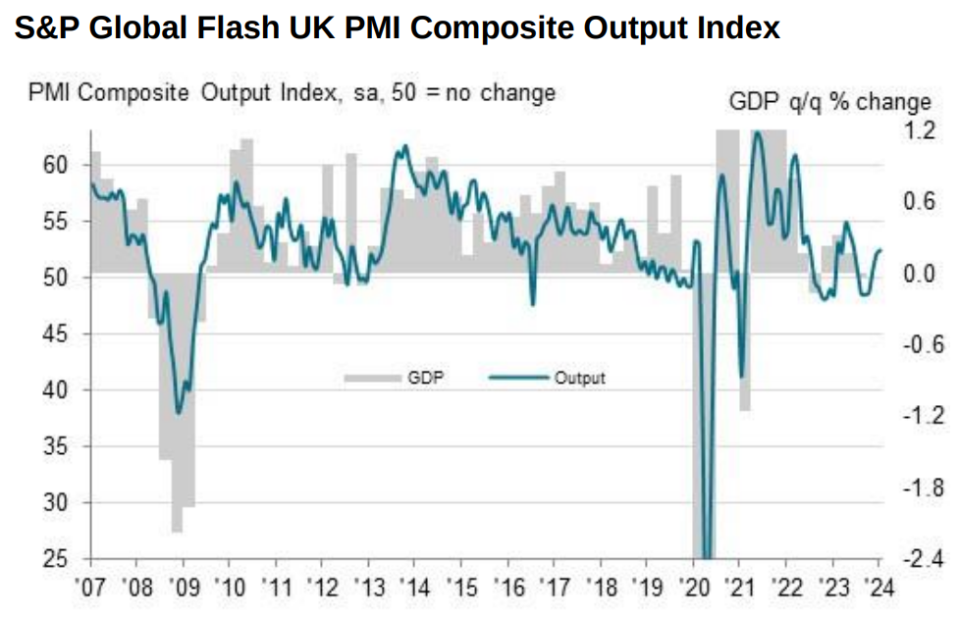

The closely watched S&P Global/CIPS flash UK purchasing managers’ index (PMI) showed a reading of 52.5 for January, up from 52.1 in December.

The survey measures business activity in the private sector. Anything above 50 indicates business activity is expanding. Economists had expected a reading of 52.2.

The survey showed that the UK economy’s all-important services sector recorded another month of expansion, taking it to an eight-month high of 53.8.

Respondents in the service sector noted improved confidence among clients while some noted “a turnaround in demand due to lower borrowing costs”.

The manufacturing sector also saw an improvement taking it to a 9-month high of 47.3, although it remained in contraction.

Chris Williamson, chief business economist at S&P Global Market Intelligence said the survey marks “a promising start to the year” while Gabriella Dickens, senior UK economist at Pantheon Macroeconomics, said “the economy is quickly escaping the mild recession that it went into in the second half of last year”.

However, the survey also revealed the worrying impact of disruption in the Red Sea on UK firms. Manufacturing firms saw their supply chains hit by longer wait times, with vendor delivery times rising for the first time since September 2022.

This contributed to the fastest rate of cost inflation for the manufacturing sector since March 2023.

Service providers also saw rising costs due to strong wage growth, although input cost inflation in services rose at the slowest pace for three months.

Williamson warned that inflation may remain stubbornly around three or four per cent due to the impact of persistently high wage growth and higher costs from the Red Sea.

Other economists also sounded the alarm on the threat of lingering inflation. “The stickiness of price pressures gives us a bit less confidence that services CPI inflation will return to its long-run average of 3.5 per cent towards the end of this year,” Ashley Webb, UK economist at Capital Economics said.

Despite growing concerns about disruption in the Red Sea, business confidence rose to its highest level since May last year.

“Stronger confidence was attributed to positive signals for client spending, long-term business investment plans, and hopes of a turnaround in the broader economic backdrop,” the survey said.

PMI data was also published for the eurozone this morning. The survey showed private sector activity in the bloc fell at its slowest rate for six months, largely thanks to an improvement in the manufacturing sector.

“The commencement of the year brings positive tidings for the Eurozone as manufacturing experiences a widespread easing of the downward trajectory witnessed in the past year,” Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said.