UK economy much more volatile after series of sharp shocks

The UK economy has become much more volatile compared to three decades ago, a new survey out today reveals.

Since the global financial crisis in 2008, the economy has grown much slower compared to the decade and a half in before the catastrophe, according to consultancy BDO.

The firm said in the first 15 years of its “business trends,” Britain experienced “an almost consistent period of economic growth”.

However, the following 15 years have been characterised by sluggish output, weaker business optimism and soaring inflation.

The swing has been fuelled by a series of crises that have rocked the UK economy, including the banking shock, Covid-19 pandemic and Russia’s invasion of Ukraine.

In fact, the latest quarterly reading of nearly 119 is the highest in the survey’s 30 year history.

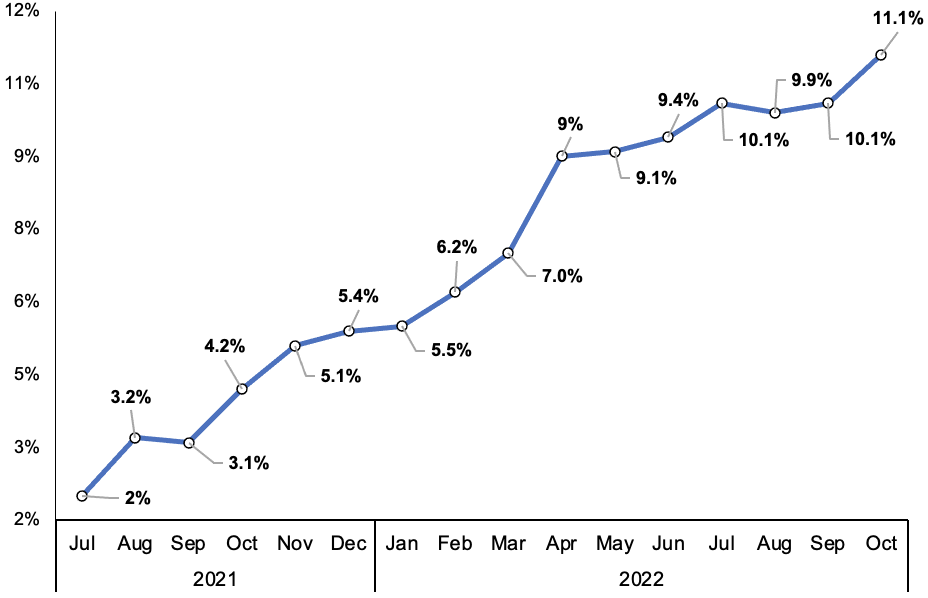

Prices have risen 11.1 per cent over the last year, turning the screw on households and businesses’ finances.

Experts expect the economy to suffer an around year long recession starting this winter, driven by spending falling in response to rising prices, meaning BDO’s survey is likely to undergo another downturn.

Inflation has climbed sharply this year, likely sparking a recession

The Bank of England has also raised interest rates eight times in a row to tame rising prices, heaping yet more pressure on households and companies.

The firm’s employment index has held up well amid the economic slowdown, while official figures show the unemployment rate is running at 3.6 per cent, a historical low.

“Whilst it is positive to see the resilience of UK employment levels, as the cost of living crisis continues and the country navigates a period of recession, the UK is likely to see a more significant drop in employment along with further falls in optimism and output,” Kaley Crossthwaite, partner at BDO, said.