UK economy headed for record recession if rates rise sharply, BoE warns

The UK economy is on course to suffer the longest recession since records began if interest rates rise sharply, triggered by a toxic mix of higher mortgage costs, prices and energy bills, the Bank of England said today.

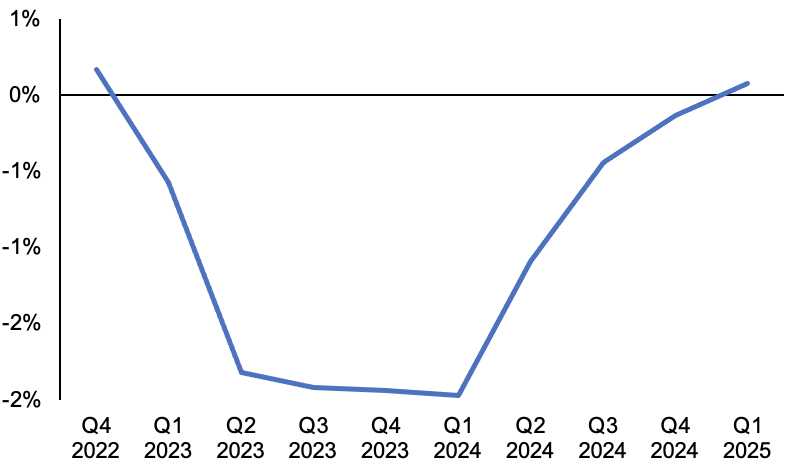

Gross domestic product (GDP) will shrink for 24 consecutive months, beginning in the early stages of next year and lasting until the end of 2024.

The cumulative slump will shave around three per cent off output.

Despite the recession warning, the Bank of England today raised interest rates 75 basis points, the biggest jump since 1989 and the eighth successive rise.

Borrowing costs are now three per cent, the steepest level since November 2008.

The rise is needed to prevent inflation embedding in the UK economy. However, even at their current level, inflation falls below the Bank’s two per cent target in the middle of 2024, officials reckon.

The record recession projection assumes interest rates hit mid-October market expectations of around 5.2 per cent.

Bank of England’s GDP projections are bleak

Bank officials have signalled they are unprepared to bump borrowing costs that high.

In fact, if rates stay at three per cent, inflation dips below the central bank’s two per cent target over the long run, suggesting the Bank is unlikely to fulfil the market’s demands.

Unemployment will jump to a peak of 6.4 per cent in three years, while households are on course to suffer two consecutive years of falling real incomes.

The Bank revised down its expectations for the scale of the living standards hit due to the government capping energy bills at £2,500 until next April.

Some 2m mortgagors are set to absorb a £3,000 annual increase in their bills when they refinance over the next year or so, hit by lenders passing on higher interest rates.

Higher debt servicing costs, inflation racing to a peak of 10.9 per cent and elevated energy bills will squeeze household and business finances, sparking the record recession.

The Bank of England’s nine-strong monetary policy committee voted 7-2 in favour, including governor Andrew Bailey, of raising interest rates 75 basis points.

Rates have risen more than 75 basis points before, on Black Wednesday in 1992. However, the move was discounted swiftly.

Two members, Swati Dhingra and Silvana Tenreyro, wanted a 50 basis points and 25 basis point move respectively.

The Bank will also continue selling government and corporate bonds it hoovered up under its quantitative easing programme in the aftermath of the financial crisis and during the Covid-19 pandemic.

It sold £750m of government bonds earlier this week, marking the start of the bond selling, or quantitative tightening, campaign.