Economic green shoots to coax Bank of England into steepest rate rise since independence

Signs of green shoots in the UK economy will encourage the Bank of England to launch the steepest interest rate hike since it was made independent 25 years ago.

Stronger than expected growth in May suggests the economy can absorb higher interest rates without falling into recession, known as a “soft-landing,” according to City analysts.

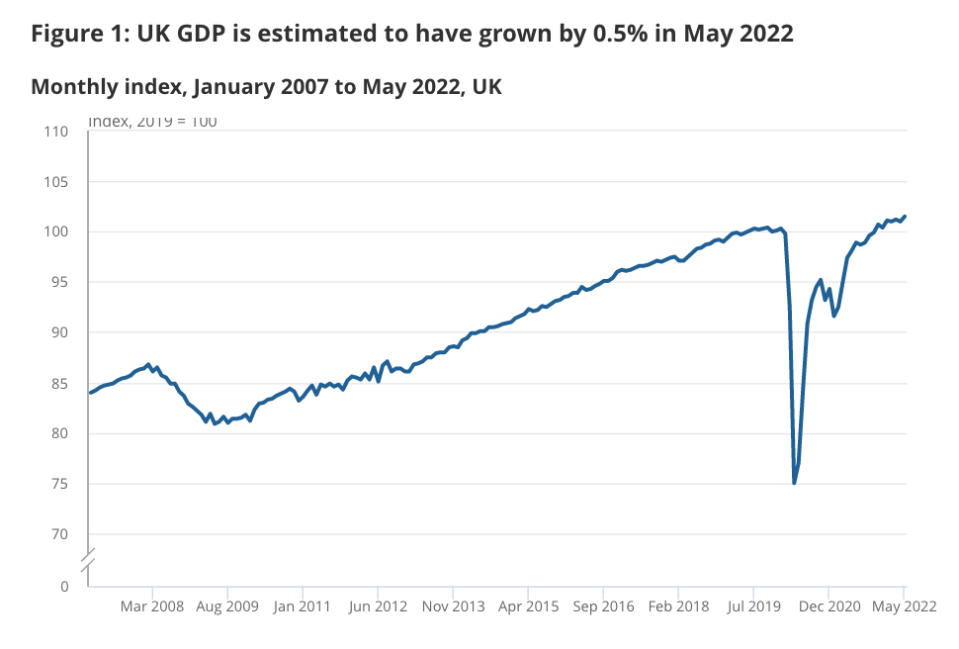

Figures published today by the Office for National Statistics (ONS) revealed gross domestic product (GDP) jumped 0.5 per cent in May, much higher than analysts’ expectations of growth flatlining in the month.

The ONS also revised up its calculations for March from a 0.1 per cent contraction to 0.1 per cent expansion. April’s print was also adjusted upwards.

Brits heading to their GPs and strong activity in the manufacturing sector “due to the recovery in supply chain disruptions enabling manufacturers to start to fulfil the backlog of orders” led GDP higher in May, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

The upside shock suggests the Bank has more room to tackle the worst inflation surge in 40 years.

Living costs are up 9.1 per cent in the UK, the quickest acceleration since 1982. Inflation is expected to peak at over 11 per cent in October, more than five times the Bank’s two per cent target.

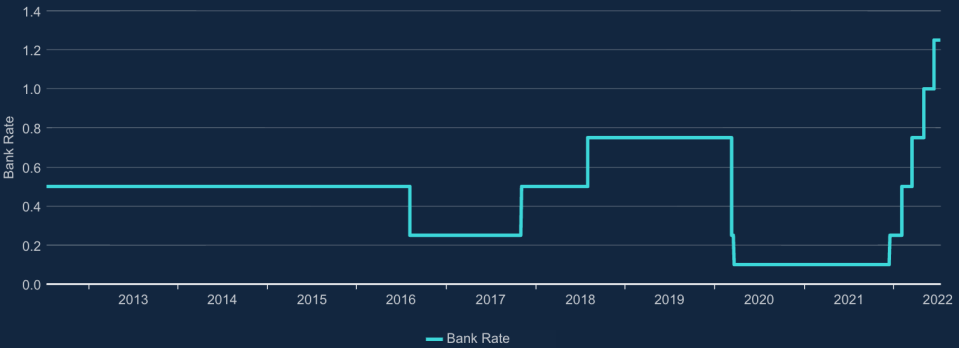

“The surprisingly strong rise in GDP in May might encourage the Bank of England to raise interest rates by 50 basis points, rather than 25 basis points, at its next policy meeting [on 4 August],” Paul Dales, chief UK economist at Capital Economics, said.

Threadneedle Street has never raised rates by more than 25 basis points since it was given control of Britain’s monetary policy in the late 1990s by then chancellor Gordan Brown.

Analysts are sweating over whether governor Andrew Bailey and co may tip the UK into recession by accelerating its rate hike to cool inflation.

However, today’s figures indicate a technical recession – two consecutive quarters of contraction – may have been postponed to later in the year, when consumers are anticipated to respond to the cost of living squeezing their budget by cutting spending.

The GDP bounce “means that the economy may have just flatlined in the second quarter rather than contracting,” Thomas Pugh, economist at RSM UK, said.

Output in the services industry – the economy’s growth engine – dipped 0.1 per cent in May, driven by 0.5 per cent in the retail sector, indicating Brits are already reining in spending.

New chancellor Nadhim Zahawi, who has promised to cut taxes as part of his bid to win the Tory leadership contest, acknowledged that “people are concerned” about inflation straining their living standards.

The higher national insurance threshold took effect earlier this month, which will put money back into workers’ pockets.

Government payments worth around £800 for the poorest households to offset higher energy bills will also relieve the cost of living pressure. All households will receive a £400 grant towards their energy bills.