‘Recession may have begun’: UK economy craters 0.5 per cent in July

The UK economy shrunk by more than expected in July, with all sectors of the economy starting to come under pressure from the Bank of England’s interest rate hikes.

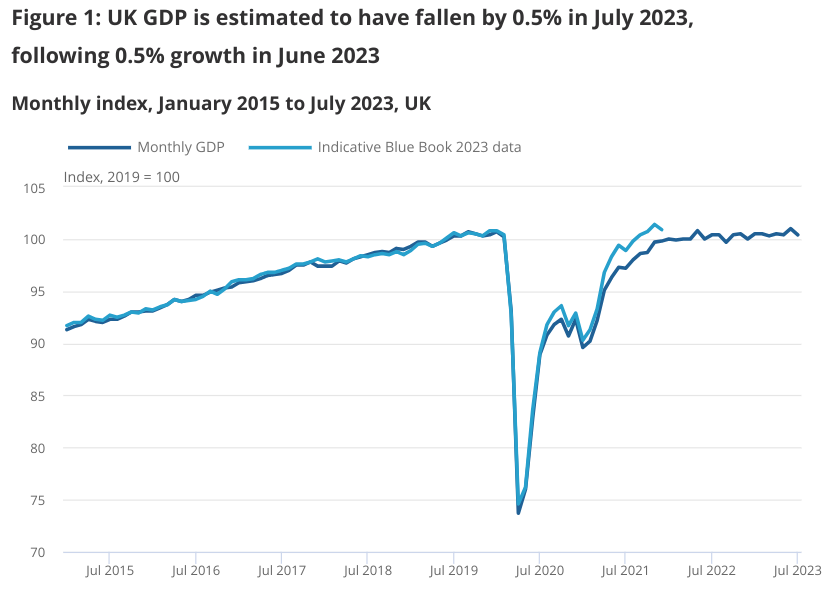

Data from the Office for National Statistics (ONS) showed that the economy contracted 0.5 per cent in July.

Economists had predicted a smaller fall of 0.2 per cent.

Output in the all important services sector declined by 0.5 per cent in July, driving the fall in overall GDP. Production output – which includes manufacturing – dropped by 0.7 per cent while the construction sector also saw a fall of 0.5 per cent.

Strike action in the NHS was the main driver of the monthly fall in services output, with activity in the human health and social work sector falling 2.1 per cent in July.

July’s wet weather was also a contributing factor to the contraction, with the unusually high level of rainfall impacting output in the retail and construction sectors.

Director of economic statistics at the ONS Darren Morgan said:“In July, industrial action by healthcare workers and teachers negatively impacted services and it was a weaker month for construction and retail due to the poor weather.

“Manufacturing also fell back following its rebound from the effect of May’s extra Bank Holiday,” Morgan continued.

July’s contraction comes after faster than expected growth in the second quarter, when the economy grew 0.2 per cent.

It suggests that the Bank of England’s interest rate hikes are starting to slow the economy, with the possibility of a recession in the second half of the year rising.

In fact, Paul Dales, chief UK economist at Capital Economics said the fall could mean that “the mild recession we have been expecting has begun”.

“With output declining in 11 of the other 16 sectors, there is an air of underlying weakness. That would make sense given that the dampening effect of higher interest rates should be starting to be felt a bit harder now,” Dales continued.

Yael Selfin, chief economist at KPMG UK agreed that with the “lagged impact of higher interest rates, the UK economy could struggle to keep its head above water in the remainder of the year.”

Despite slowing growth, Chanceller Jeremy Hunt reiterated the importance of bringing inflation down to target. “Only by halving inflation can we deliver the sustainable growth and pay rises that the country needs,” he said.

The Bank of England is expected to hike interest rates by 25 basis points when the Monetary Policy Committee (MPC) meets next week.

But Kitty Ussher, chief economist at the Institute of Directors, said: “Today’s data supports our call for the Bank of England to keep interest rates steady next week to give time for its medicine to work rather than risking an overdose.”

The ONS has come under pressure recently after it published revised statistics for the UK’s performance since Covid. The revised figures showed that the UK’s recovery from the pandemic was ahead of major European peers.