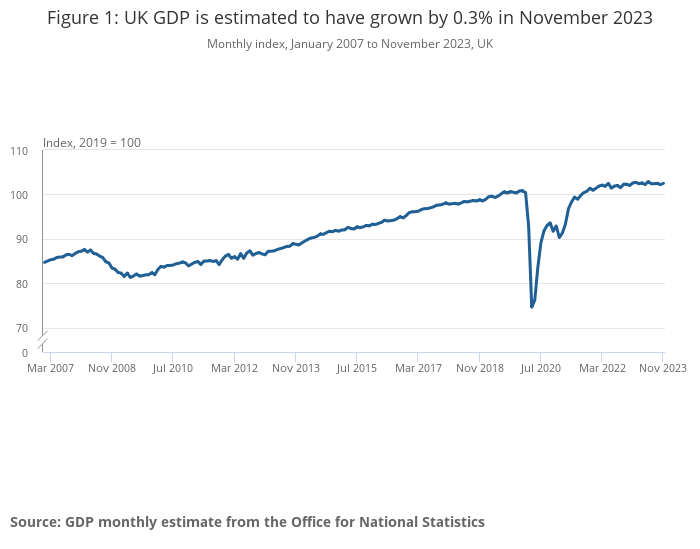

UK economy: GDP rebounds in November but still on recession knife-edge

The UK economy grew 0.3 per cent in November but the UK remains on a recession knife-edge.

The strong showing in November was not enough to turn around the more closely-watched three-month measure of GDP, which fell 0.2 per cent.

Economists had expected November GDP growth to be 0.2 per cent, making the morning figures a technical beat, but downward revisions of previous data took the shine off.

Services were flat while production figures fell -1.5 per cent – but overall the November itself saw GDP grow 0.3 per cent on a monthly basis.

Chancellor of the Exchequer Jeremy Hunt said: “While growth in November is welcome news, it will be slower as we bring inflation back to its two per cent target. But we have seen that advanced economies with lower taxes have grown more rapidly, so our tax cuts for businesses and workers put the UK in a strong position for growth into the future.”

ONS Chief Economist Grant Fitzner said: “The economy contracted a little over the three months to November, with widespread falls across manufacturing industries, which were partially offset by increases in public services, which saw less impact from strike action.

“GDP bounced back in the month of November, however, led by services with retail, car leasing and computer games companies all having a buoyant month.

“The longer-term picture remains one of an economy that has shown little growth over the last year.”

Shadow chancellor Rachel Reeves said: “a decade of low economic growth has left Britain with the highest tax burden in 70 years, with families set to be £1,200 a year worse off under the Tories’ tax plans.

“It’s time for change. Rishi Sunak should call an election and give the people the chance to vote for a Labour government that will get Britain’s future back.”

There was cautious optimism in reaction to the figures, as experts mulled the precarious position of the economy, growing in the short term, but remaining stagnant over the last quarter.

Dr. Roger Barker, director of policy at the Institute of Directors, said: “Although monthly GDP figures can be volatile, it was reassuring to see that GDP grew in November. However, over a longer time horizon, the economy is not going anywhere.

“November’s increase merely clawed back the ground lost in October. We will still need to wait for December’s GDP figure to find out if the UK avoided a technical recession in 2023.

Suren Thiru, economics director at ICAEW, said: “This underwhelming recovery in GDP points to an economy struggling to gain momentum as high borrowing costs and anaemic demand continue to hinder economic activity.”

However, Mike Randall, CEO of Simply Asset Finance said, “November’s GDP uptick is an encouraging result, with many businesses likely benefiting from the build-up to the festive period.”

With November’s figures showing a return to contraction, a winter recession remains a possibility after revised figures for the third quarter showed the economy contracted 0.1 per cent.

In October the economy contracted 0.3 per cent, meaning figures for December will determine whether the UK fell into recession. A technical recession is two consecutive quarters of contraction.

Whether or not the UK ends up falling into recession at the end of 2023, analysts have turned more optimistic on the economy’s prospects over 2024.

Inflation, which fell to a two year low of 3.9 per cent in November, is expected to continue falling fast in the new year, giving households a significant boost in real income.

Analysts at Deutsche Bank predict that real wages will grow at 1.75 per cent in 2024, making it one of the highest growth rates in the last decade.

Markets also think that falling inflation will enable the Bank of England to cut interest rates sooner than it is currently guiding. The first rate cut is expected in May, with a further four reductions pencilled in over 2024.