UK economy continues to ‘skirt with recession’ due to Bank of England’s interest rate hikes

The UK economy is teetering on the edge of a recession under the weight of higher borrowing costs, a closely watched survey suggests.

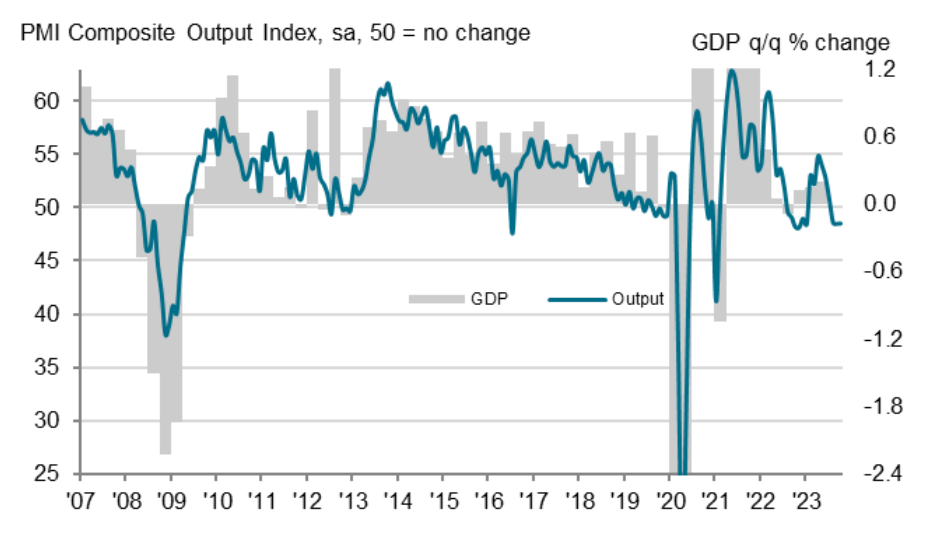

S&P Global’s ‘flash’ Purchasing Managers’ Index (PMI) for the UK economy in October came in at 48.6 – below the 50 reading which indicates flat growth. The PMI assesses the health of an economy’s services and manufacturing sector.

October’s figure was slightly below the City consensus of 48.8 but it was still a slight improvement on last month’s 48.5.

The figure marks the third straight month of contraction, with both sectors recording a fall in output.

The UK’s all important services sector fell to a nine month low of 49.2 while manufacturing picked up to a three month high of 45.2. Despite the increase, manufacturing has remained in contraction for eight consecutive months – the longest period of decline since 2008-09.

“Survey respondents commented on subdued consumer confidence, the impact of elevated borrowing costs, and weak client demand across the real estate sector,” the survey said.

Private sector employment fell for the second successive month with businesses reporting another “solid decline” in backlogs of work. Business confidence meanwhile was at its lowest level this year as concerns around consumer spending pointed to lower growth ambitions for next year.

Chris Williamson, chief business economist at S&P Global Market Intelligence said: “The UK economy continued to skirt with recession in October, as the increased cost of living, higher interest rates and falling exports were widely blamed on a third month of falling output.”

Over the past few months the UK economy has slowed to a halt as higher interest rates have sent a chill through the economy.

In August, the UK economy grew at just 0.2 per cent following a 0.6 per cent fall in July. Many economists have predicted that the UK is heading for a recession, although it will likely only be mild.

Ruth Gregory, deputy chief UK economist at Capital Economics pointed out that although PMIs are rarely a completely reliable proxy for GDP, the “trajectory supports our view that GDP contracted in both Q3 and Q4 (perhaps by 0.2% q/q) and that a mild recession is perhaps already underway”.

There was mixed news on the inflation front too. While input price inflation was at its lowest level since the start of 2021, prices charged jumped to a three-month high due to increases across the services sector.

Respondents noted they were trying to “catch up” on inflationary pressures and limit the impact on operating margins.

“Selling price inflation for services remains somewhat elevated, and even ticked higher in October, pointing to some stickiness of headline inflation around the 4% mark into the early months of next year,” Williamson said.

Questions will be raised over this month’s ‘flash’ survey after last month’s series was revised substantially between the first and final estimates. Updated PMI figures will be published over the next couple of weeks.

Things were little better in Europe. Business activity across the bloc slumped to its lowest level in three years, with the PMI falling to 46.5 in October. Excluding the pandemic, it was the lowest reading since March 2013.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said “in the euro zone, things are moving from bad to worse.”