UK economy avoids recession edge as GDP shows no growth

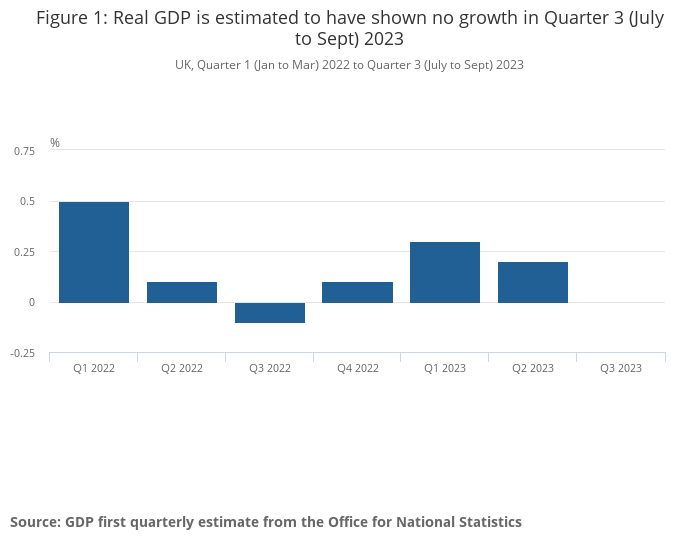

The UK economy has escaped the jaws of a recession after GDP unexpectedly had no growth in the third quarter of the year.

According to figures from the Office for National Statistics (ONS), the economy avoided a contraction in September, which was not in line with economists’ expectations.

The ONS said services fell by 0.1 per cent, construction grew by 0.1 per cent and production was flat at 0.0 per cent, as the UK economy appeared to remain stagnant.

The 0.0 per cent growth comes following an increase of 0.2 in the previous quarter.

ONS Director of Economic Statistics Darren Morgan said: “The economy is estimated to have shown no growth in the third quarter. Services dropped a little with falls in health, management consultancy and commercial property rentals. These were partially offset by growth in engineering, car sales and machinery leasing.

“There were also small growths in manufacturing, led by cars and metal products, while construction grew due to new commercial property work.

“In the month of September the economy grew slightly, with increases in film production, health and education. This growth was partially offset by falls in retail and computer programming.”

Although the UK economy has performed better than expected so far this year, the Bank of England’s interest rate hikes have brought economic activity to a halt. The benchmark Bank Rate now stands at a post-financial crisis high of 5.25 per cent.

Writing on X, the site formerly known as Twitter, Hunt said: “High inflation is the single greatest barrier to economic growth – the best way to sustainably grow our economy right now is to stick to our plan and knock inflation back. That’s what we’re doing.”

“The Autumn Statement will be about how we get the economy growing healthily again for the long term – unlocking investment, getting people back into work and making our economy more productive.”

The stagnation in the UK economy had mixed responses from analysts and experts however.

Muniya, Barua, deputy chief executive at BusinessLDN urged the government to use incentives for tourists and the labour market to promote growth, saying, “all eyes will now be on the Chancellor’s Autumn Statement to help Britain break out of its low-growth trap.”

“Restoring VAT-free shopping for international visitors would be a quick win with rapid payback for the Exchequer by boosting tourist numbers and spending in the capital. Making childcare more affordable and accessible for families would help more people return to the labour market. And committing long-term capital funding for Transport for London will keep the capital moving, enabling it to play its full part in the UK’s economic recovery.”

Rachel Reeves, Labour’s shadow chancellor claimed “these figures are further evidence that the economy is not working”.

“At the start of the year, Rishi Sunak and Jeremy Hunt promised to get the economy growing. These figures show that growth is flat lining and the British people are paying the price, with 25 Tory tax rises and higher mortgages.

Mike Randall, chief executive of Simply Asset Finance said the figures were “certainly an encouraging result and is greatly due to the perseverance and determination of SMEs helping to drive GDP upwards.”

“It’s clear that the economy is now showing signs of recovery, and businesses will now hopefully be able to focus more on some of the pressures impacting them; productivity being top of the agenda for many of the small firms we work with.”

Other experts warned about the risk of stagflation, when there is both slowing growth and high inflation.

Lindsay James, investment strategist at Quilter Investors said the figures “confirmed a UK slowdown that has been increasingly signalled by leading indicators in recent months, with cracks having appeared in consumer spending and business activity with a knock-on effect for labour demand.

“While somehow avoiding a recession this year, today’s no growth reading means the UK economy is flatlining with only 0.2 per cent economic growth in the last six months.”

“Unfortunately, for many the economic pain has only been delayed. As the Bank of England stated earlier this month that more than half of the impact of higher interest rates on the level of GDP is still to come through, the UK economy faces growing headwinds as we approach 2024.”

She added that the UK now stands as “one of the closest of all advanced economies to a stagflation scenario” which poses a question to the Bank of England’s monetary policy committee, when it next meets to decide upon interest rates

While markets are increasingly convinced rates have hit a peak, the Bank of England stressed that it is still far too early to talk about cutting rates.

Consumption, which makes up a large part of domestic demand, has been hammered by the rapid rise in interest rates.

With increasing numbers of households moving onto mortgages with much higher levels of interest payment, higher interest rates will continue to constrain consumer spending in the months to come.

The Bank of England expects GDP to remain stagnant next year. Recent forecasts from the International Monetary Fund (IMF) also suggested that the UK would be the worst performing advanced economy over 2024.

More to follow