UK economy arrests decline but recession still coming

The UK economy has arrested a decline, but it still looks likely to tip into a long recession, a closely watched survey out today has unveiled.

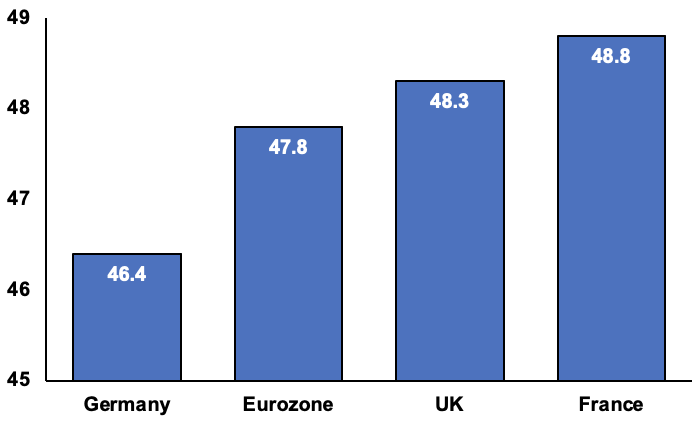

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) flash purchasing managers’ index (PMI) for November inched up to 48.3 points from 48.2 in October.

It is the first time the PMI has risen for months. The reading was far above the City’s consensus forecast of 47.5 points.

UK PMI inched higher in November

The small rise was driven by businesses clearing backlogs of work that swelled due to worker and input shortages and Covid-19 restrictions.

The UK economy is also faring better than the eurozone’s, according to the PMIs. The currency area’s reading inched up this month to 47.8 points.

However, the UK’s composite PMI reading has been beneath the 50-point growth threshold for four months, meaning the economy still contracted in November and suggesting the economy is in the early stages of a recession.

New order growth, an indication of where the PMI is headed in coming months, slumped to its lowest level since January 2021, when the UK was in the throes of the third pandemic lockdown.

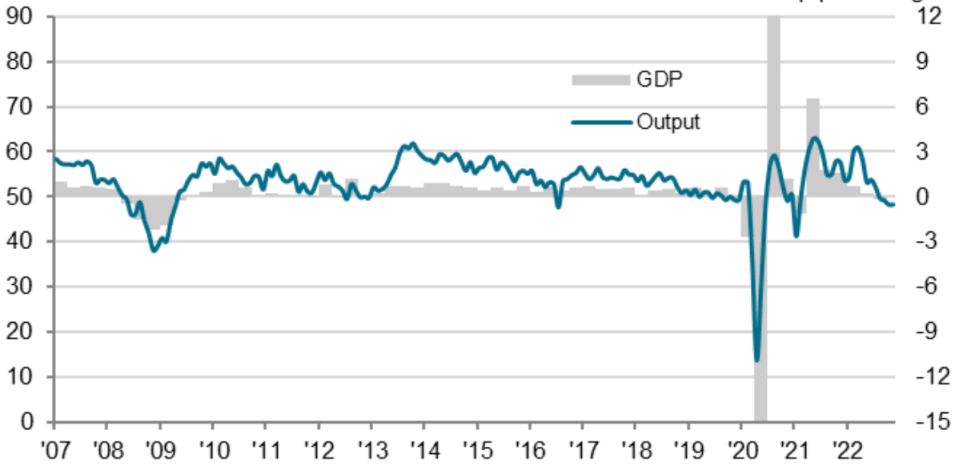

Chris Williamson, chief business economist at S&P Global Market Intelligence, said: “A further steep fall in business activity in November adds to growing signs that the UK is in recession, with GDP likely to fall for a second consecutive quarter in the closing months of 2022.”

Williamson added that excluding pandemic months, the economy is on course to contract at the quickest pace since the height of the global financial crisis in 2009.

The UK and world’s top economic institutions reckon the country is headed for one of the longest recessions on record.

The Bank of England earlier this month warned GDP would shrink for two years, if rates top five per cent, resulting in the economy cumulatively contracting nearly three per cent.

UK not alone in undergoing slump

Yesterday, the Organisation for Economic Co-operation and Development said the UK will suffer the deepest decline of any rich country. Only Russia in the G20 will post a worse economic performance next year.

A 41-year high inflation rate of 11.1 per cent is squeezing consumers and businesses, raising the risk of a spending slowdown.

The Office for Budget Responsibility last week said UK households will suffer the worst hit to living standards on record at 7.1 per cent over the next two years.

But, the PMI signalled the rate of business cost inflation is cooling, suggesting consumer price inflation may fall in the coming months.

The Bank of England has raised interest rates eight times in a row to three per cent and is expected to lift them another 50 basis points in December. That aggressive tightening cycle has eased inflationary pressures.

The UK services PMI was unchanged at 48.8 points, as was the manufacturing reading at 46.2 points.