UK economic data dump set to bolster case against September rate cut

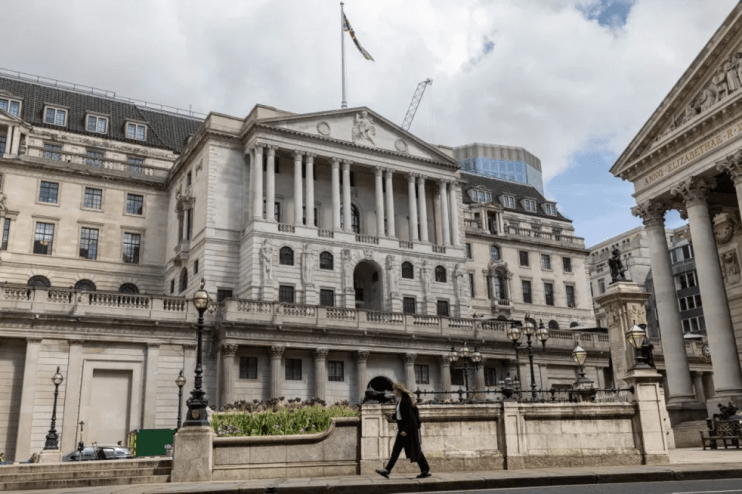

A slew of official UK economic data this week is poised to bolster the case for policymakers at the Bank of England not to cut interest rates next month, with inflation forecast to rise for the first time this year.

The Office for National Statistics’ (ONS) latest inflation reading, due on Wednesday, is expected to show consumer price growth accelerated to 2.3 per cent in July, according to City economists.

This reading would mark the first uptick in inflation since last December and a move away from the central bank’s two per cent target, which was reached in May and sustained in June.

Despite a slowdown in services inflation, analysts expect the headline rate to be driven up by a sharp fall in energy prices last July dropping out of the annual comparisons.

A rise in inflation would bolster the view that the Bank will leave rates on hold at its next meeting in September and wait until November before cutting. At its August meeting, policymakers voted to lower borrowing costs for the first time since March 2020.

The Bank has forecast inflation will reach about 2.75 per cent later this year. Inflation peaked at 11.1 per cent in October 2022 following a surge in energy prices triggered by Russia’s invasion of Ukraine.

Money markets are pricing in two more quarter-percentage point cuts from the Bank by the end of this year.

On Thursday, gross domestic product (GDP) figures are tipped to reveal that the UK economy continued to bounce back from recession in the second quarter of this year. Economists forecast growth of 0.6 per cent over the three months, a slight slowdown compared to 0.7 per cent in the previous quarter.

Policymakers have said they are looking for signs of lower wage growth, a slowdown in services inflation and that the jobs market is cooling before lowering interest rates again.

ONS data on Tuesday is expected to show a weakening labour market in the three months to June, with economists forecasting a rise in unemployment to 4.5 per cent – the most since August 2021 – and a sharp slowdown in wage growth to 4.6 per cent.

A report from the Chartered Institute of Personnel and Development on Monday showed UK employers expected to raise pay by three per cent over the next 12 months, the lowest level in two years and down from 4.1 per cent in a similar survey by the Bank earlier this month.

Still, hawkish ratesetter Catherine Mann said in a podcast published on Monday that it could take years for wage pressures in the economy to dissipate.

Rounding off this week’s data dump, ONS figures due on Friday are expected to show that sunnier weather boosted retail sales by 0.6 per cent month-on-month in July, paring some of the 1.2 per cent fall in June.