UK dividend drought continues into third quarter

The collapse of corporate dividends this year continued into the third quarter, as payouts slumped by nearly half to £18bn.

Companies have scrambled to conserve cash amid the crisis, and the 49 per cent drop last quarter represents the lowest third quarter total in a decade since the aftermath of the global financial crisis.

Although by any normal standards the fall is terrible for investors, it is significantly better than the 57.2 per cent drop in the second quarter.

From early April firms started to suspend dividends altogether with payouts plunging to a record quarterly low. Europe and the UK were significantly hit as they tend to pay dividends just once a year in the second quarter so had an adverse impact on the total.

By the third quarter, companies were likely better able to assess the impact of coronavirus and some sectors of the economy started to reopen.

Link Group’s Dividend Monitor published today that just under half of companies cancelled their dividends altogether in the third quarter, while a further fifth cut them.

While the figures are a stark reminder of the depressed sentiment, Link Group said it was roughly in line with its expectations and there are signs of optimism.

“The good news is that the worst is now behind us. Now that we have real visibility on what companies are doing, we have improved our worst-case scenario for 2020, so that the gap between our best and worst-case has almost disappeared”, the financial administrator said.

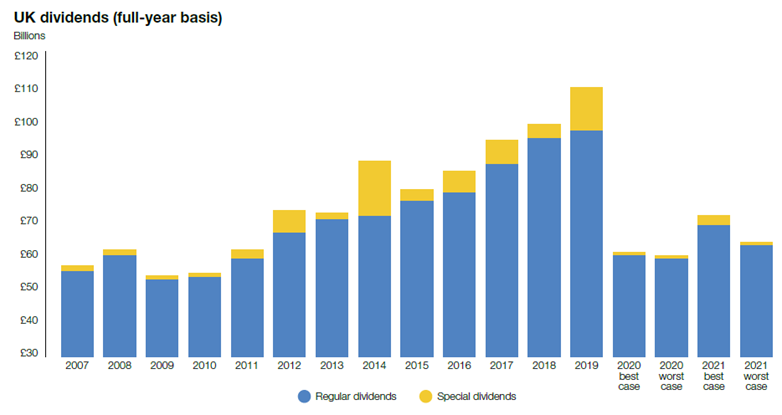

Lin now expects dividends to fall to £60.4bn on a best-case basis and £59.5bn on a worst-case, a decline of 38.7 per cent and 39.2 per cent respectively.

This puts the next year’s best-case at an increase of 15 per cent and a worst case of six per cent. Although the figures mark a bounce back the firm said the path to recovery to pre-Covid levels will take years.

“UK plc is not out of the woods, but the trees are perhaps thinning a bit”, said Susan Ring, chief executive of corporate markets at Link Group.

Indeed this week British Land announced plans to pay dividends in February and August, saying footfall at its retail parks was ahead of the wider market. It previously paid them quarterly but suspended its dividend in March.

Bellway has also resumed the payment of its dividend after a surge in the housing market pushed forward orders up by 43 per cent.

Banks bear the brunt of dividend cuts

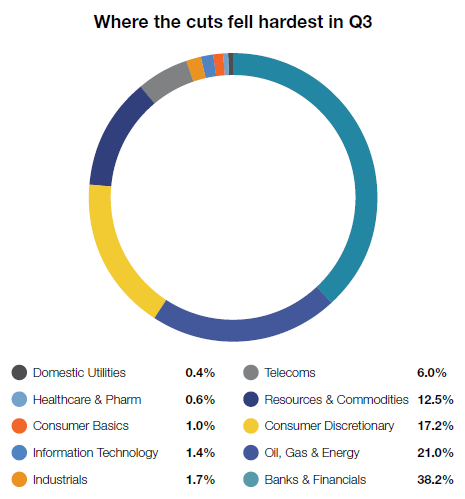

Banks accounted for almost two fifths of the £14.5bn cuts in the third quarter, as they remain barred from paying out dividends.

Following pressure from the Bank of England’s Prudential Regulation Authority (PRA) British lenders agreed in March to scrap dividends totalling roughly £8bn for the year in a bid to shore up their finances against the economic downturn caused by coronavirus.

The oil sector contributed another fifth to the cuts, but the impact of that will be longer lasting. The sector rebasing is a permanent change that has knocked £11.2bn off UK payouts per annum and the loss of that income will be a blow to investors.

In August BP halved its dividend, its first cut in a decade, after booking a £5.13bn loss in the second quarter.

“Oil dividends will not increase significantly (if at all), however, so the big question will be whether the Bank of England permits the banks to begin distributing again. Beyond the obvious economic impacts on their trading, the extent to which companies in other sectors have taken government support will influence their freedom to pay shareholders too”, said Ring.

As a result of these dividend cuts, British American Tobacco will “complete its slow but steady climb” to become the UK’s top dividend payer this year.