UK continues to ‘dodge recession’ as private sector growth at six month high

Britain’s economy continues to prove naysayers wrong and dodge a dreaded recession, with fresh figures showing private sector output growth is at a six-month high.

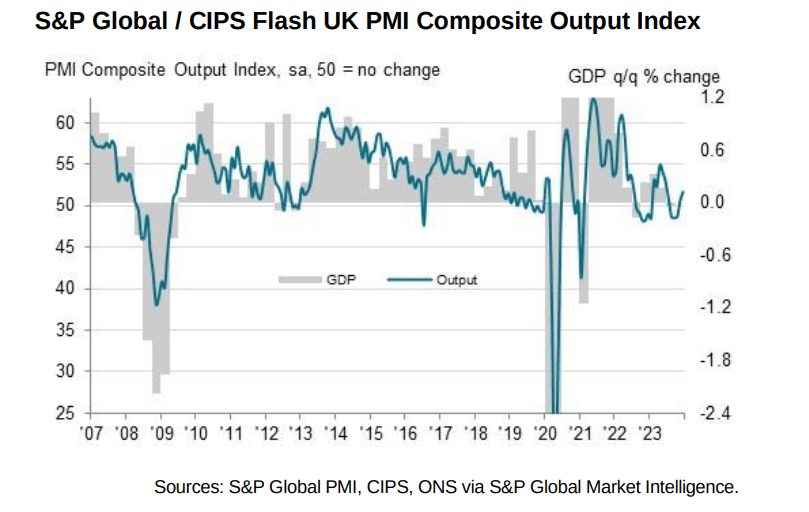

The closely watched S&P Global/CIPS flash UK purchasing managers’ index (PMI) reported a reading of 51.7 for December, up from 50.7 in November. Anything above 50 indicates it is growing.

This comes as the UK economy has been flirting with a recession for more than a year, battling stubborn inflation, high energy bills, and raised interest rates making borrowing more expensive.

The survey showed expansion in the private sector for the second month in a row, with “higher levels of business activity… supported by a renewed improvement in order books, alongside efforts to work through post-pandemic backlogs”.

“A moderate upturn in business activity across the service economy underpinned the rebound in overall private sector output at the end of 2023,” the survey said.

It wasn’t all good news however, with concerns raised about the cost of living pressures on household budgets, while “manufacturing production meanwhile decreased for the tenth month running”.

It said there had been an increase in new work for the first time in June, and a stabilisation of interest rates, now held for the third time in a row in addition to a “modest recovery in underlying economic conditions”, helped to support demand.

“The improvement in order books was nonetheless confined to the service economy,” it said, while total export sales kept decreasing to the end of the year.

There were also concerns raised about staffing numbers in the private sector which fell for the fourth month in a row, as uncertainty and wage growth, led to persistent job losses.

This comes as consumer confidence increased amid Christmas cheer in a small but much-needed boost for retailers, despite recession red flags flaring up.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said: “The UK economy continues to dodge recession, with growth picking up some momentum at the end of the year to suggest that GDP stagnated over the fourth quarter as a whole. While employment meanwhile fell for a fourth month, the decline was only marginal and not indicative of any material rise in unemployment.

“This is, however, a dual-speed economy, with manufacturing contracting sharply while services regained some poise, the latter growing faster in December thanks in part to financial services activity being buoyed by hopes of lower interest rates in 2024.”

Williamson added: “This divergence is also reflected in inflation pressures, with falling prices again evident in the goods-producing sector while service providers report persistent elevated inflationary pressures, often linked to wage growth. The resulting signal is one of inflation remaining stubbornly above 3% in the coming months.

“The service sector’s resilience and sticky inflation picture will add to speculation that it’s too early for the Bank of England to be talking about cutting interest rates and will add fuel to some policymakers’ calls for further rate hikes. However, the fear is that the tentative nature of growth in December, and the impetus from looser financial conditions, means that fears of further policy tightening could tip the economy back into decline.”

This comes after the Bank of England, along with the Federal Reserve in the US and the European Central Bank on the continent, all decided to hold their interest rates this week.

The Bank of England’s decision was not straightforward, however, and was decidedly less optimistic than the Fed, with three of its monetary policy committee voting for an increase — and governor Andrew Bailey warning rates would not be cut anytime soon.

London’s markets rallied on Thursday despite the Bank’s wobble, hitting a two-month high. This morning FTSE 100 was still flat, as investors mulled the impact of rates being higher for longer.

Reflecting on the latest survey, Dr John Glen, CIPS chief economist said: “A revival in the services economy is helping the UK’s private sector end the year on a more positive note.

“However, the persistent nature of inflationary pressures and the continued struggles in manufacturing add a tone of caution as we look ahead to 2024.”

He continued: “The overall growth was underpinned by an upturn from the services economy. Stable interest rates are fuelling a tentative return of customer demand and increase in new work. UK manufacturing will be glad to see the back of 2023, however.

“Overstocked customers mean December is yet another month of decreasing production levels and reducing output volumes for the manufacturing sector. Despite an easing of supply chain pressures, there was little relief from overseas markets, with export sales declining sharply.”

“The increase in input costs shows inflation is proving stickier than hoped and indicates there is still some way to go before costs stabilise. An easing of inflationary pressures and a more robust return of customer demand will be high on the private sector’s wish list as we head into 2024,” Glen added.

Rhys Herbert, senior economist at Lloyds Bank, said: “Another rise in output in December is in line with the more optimistic outlook as we approach 2024. Recent industry data has shown an uptick in business confidence, including our latest Business Barometer, which showed services sector confidence at a two-year high, and that optimism among manufacturing firms is the highest it’s been for five months.

“While these positive signs are good news for businesses when it comes to future activity, we’re continuing to see business caution around the current economic climate given the delicate balancing act the Bank of England will have to consider with its interest rate decision-making next year.”