UK companies are cheap: the smaller the cheaper

UK stocks have lagged their global peers, but is the stage set for a change of fortune?

Many investors in UK stocks have looked on enviously at the super-sized returns that global stocks, and US stocks in particular, have been able to deliver over recent years.

That all changed this month. As of 18 November, the FTSE 100 returned 14.7% since the end of October, as markets responded to the positive news about the potential Covid-19 vaccinations. This eclipsed the 8.2% delivered by the FTSE World index of global stocks and the 6.2% delivered by the S&P 500 index of US stocks (global and US returns expressed in sterling terms).

One swallow doesn’t make a summer and the rebound has come over a pretty short timescale, but is this the wake-up call that investors in UK stocks have been waiting for?

How cheap are UK stocks?

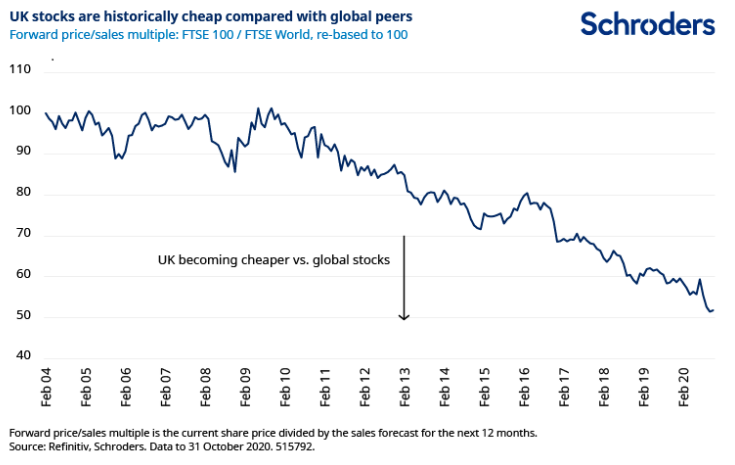

The scene could well be set for a change in fortunes. Whereas US stocks have rarely been more expensively valued across multiple different measures of “value”, UK stocks are outright cheap, based on data at the end of October. Given that US stocks make up around 60% of the global stock market, this is a headwind for typical global stock portfolios. In relative terms, based on the forward price/sales multiple[1], UK stocks have never been cheaper than global stocks.

However, we believe the real opportunity is for those investors who are prepared to look beyond the big name companies that are so familiar to us all. If we dive down into the mid-sized companies which are in the FTSE 250 index (median market capitalisation of £1 billion, as at 31 October 2020), and even further down into the companies in the FTSE small cap index (median market capitalisation of £216 million as at 31 October 2020), then that is where the greatest potential opportunities are likely to lie.

How cheap are UK small caps?

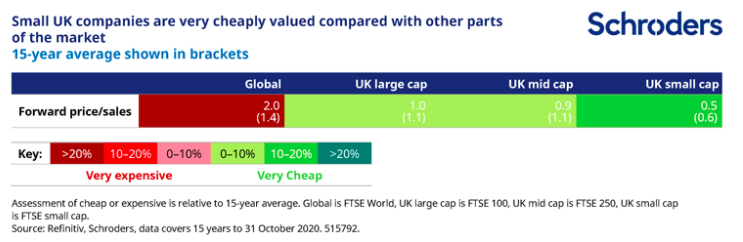

Global stocks are trading on a multiple of around two-times their forecast sales for the next 12 months (see table) – this is 45% more expensive than their average of the past 15 years! Large UK companies are much cheaper, trading on one-times sales. This is slightly cheaper than their average of the past 15 years.

UK mid-cap stocks are cheaper still but it is small caps which really stand out. Investors can gain exposure to these companies on valuations of only 0.5-times forecast sales, far less than larger UK companies, which are themselves already much cheaper than their global peers. Small caps are also 17% cheaper than their own average of the past 15 years.

What are UK stocks growth prospects?

This is not because they are expected to struggle – analysts are forecasting small cap earnings to grow by over 100% in the next 12 months (consensus forecast) as they rebound from the effects of the Covid-19 pandemic. And then by another 34% in 2022, at a time when the earnings of medium-sized companies are also forecast to be growing at over 30% a year.

There are obviously risks to the outlook – Brexit and Covid-19, for example – but cheap valuations and stellar growth prospects are a powerful combination.

What else is attractive about UK stocks?

What smaller companies lack in financial clout, they can make up for in nimbleness. They often have less baggage than their larger peers, which can make them more adpatable to change. Larger companies are no more able to do a quick change of direction than an ocean liner. Smaller companies are more like a jet ski. Given the particularly uncertain world we live in at present, this could be invaluable.

The big proviso to this is that they need to be financially secure enough to cope through the current difficulties. Many will need to raise new capital to be able to do so. The growth opportunities are there, for those who can take them.

Risk considerations

The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

[1] Forward price/sales multiple is the current share price divided by forecast sales for the next 12 months

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.