UK chip sector must seize investment opportunities, says tech minister

Britain’s chip industry must get proactive about seeking investment opportunities and fostering skills, according to the UK’s tech minister, who co-chaired the fourth Semiconductor Advisory Panel (SAP) meeting last week.

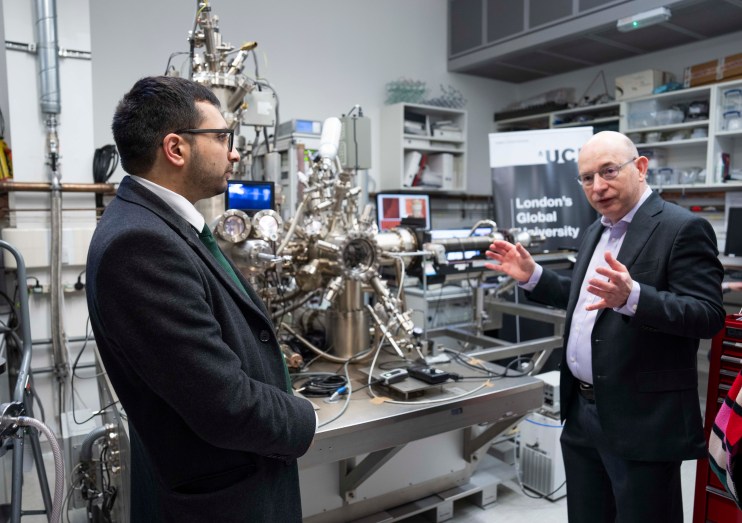

Saqib Bhatti, who became minister for tech and the digital economy in November last year, told City A.M. that UK chip companies need to capitalise on available funding and expertise in order to strengthen the critical sector.

At the recent SAP meeting, Bhatti spearheaded calls among industry leaders to “spread the word” about funding opportunities that are being missed.

In December last year, British chip company Pragmatic company secured £60m in series D funding from the government-owned UK Infrastructure Bank (UKIB). It will allow the company to directly invest in its next two fab lines.

“I’m very keen for other companies, whether it’s startups, whether it’s companies that are looking to scale, to take advantage of the funding available,” Bhatti said.

UKIB is offering £22bn worth of investment to the private sector and local authorities for infrastructure projects. The Pragmatic funding was its first investment into the semiconductor industry but Bhatti said he is “very confident that that model can be followed and replicated.”

Funding like UKIB’s is intended to catalyse both private domestic and foreign investment because it sweetens the deal for investors as the UK effectively takes on a lot of the risk.

But not all investment is welcome. The UK has been tightening up its controls on Chinese cash in recent years as a result of national security concerns. In 2022, ministers blocked the takeover of a chip plant in Newport by Nexperia, a Dutch company owned by China.

Last year, the government sparked criticism for allocating £1bn to bolster Britain’s pivotal chip industry by 2030, a figure dwarfed by the commitments of rival nations.

Bhatti defended the UK’s “very different” approach to the likes of the US and the EU.

Rather than investing in colossal labs entailing high costs, Britain’s semiconductor strategy aims to leverage the nation’s core strengths, in research and development, intellectual property and the manufacturing of compound semiconductors.

Founder and director of Pragmatic, Scott White, has previously suggested that his company would be better off in the US, a sentiment he shares with others. But, speaking to City A.M., he insisted he is “committed to the UK”.

He said the company’s current focus is on scaling UK manufacturing and he is trying to build “as much of the company mass” as possible in the UK, although company will, over time, manufacture in other locations too.

“The fact that Pragmatic has been able to do what it has with UK investors has been hugely encouraging,” White said, adding that he has a “guardedly positive” outlook on the UK’s tech sector despite the protracted challenging funding environment.

“It’s not perfect but it is in decent shape and moving in the right direction,” he said.

But White and Bhatti both agreed that the UK needs to plug its talent dearth if its semiconductor industry is to thrive – something that was also discussed in the SAP meeting.

White said every company in the sector struggles to consistently find talent in an increasingly small pool of talent with a larger competition of employers. Eliminating time and complexity for bringing in overseas talent is one major hurdle that needs to be addressed.

“We spoke about diversity and making sure we get more women into the industry as well and, of course, that is a joint ambition not just by government but also by industry itself,” said Bhatti.