UK ‘can’t afford’ another decade of lost growth, CBI warn

The UK “can’t afford a repeat” of its severe economic underperformance since the 2008 financial crisis, the chief of the country’s top business group will warn chancellor Jeremy Hunt today.

Responding to last week’s autumn statement, Tony Danker, director general of the Confederation of British Industry (CBI), will slam the chancellor for failing to roll out measures to lift UK growth out of the doldrums.

“Growth is good. Growth is a precondition to a stable society,” he will say.

Hunt’s autumn statement last week has helped regain the UK’s financial credibility, Danker will acknowledge, but there were glaring omissions that would have helped businesses turbo charge productivity and output.

Hunt last week confirmed the 130 per cent super-deduction investment relief is set to end next April. Backers of the policy argue it can strengthen the UK economy by incentivising firms to step up investment.

A permanent successor would have unlocked “an extra £50bn in capital investment per year by the end of the decade. The government should have taken this path,” Danker will say.

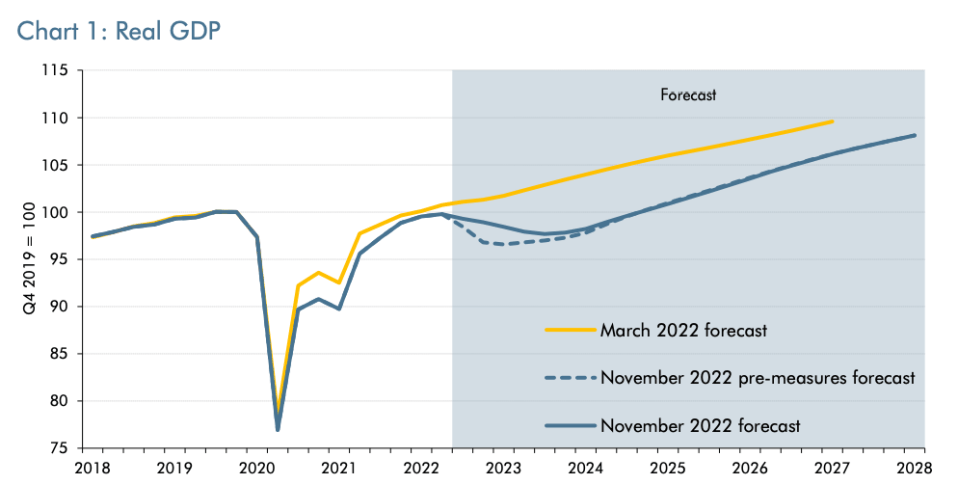

OBR reckons the economy is in recession

The chancellor last week launched £55bn of tax hikes and spending cuts, most of which come into force after the next general election.

A raft of personal and business tax bands were frozen, including a £6bn national insurance stealth tax grab on employers.

Rishi Sunak will speak at the CBI’s annual conference today, with Labour leader Sir Keir Starmer to follow tomorrow.

The prime minister is expected to defend his government’s tax-hiking fiscal statement, while the Sunday Times reports he will also outline the importance of boosting investment in research and development.

There are already murmurings about a potential Tory rebellion against last week’s fiscal statement, with ex-cabinet ministers Jacob Rees-Mogg and Simon Clarke speaking out against the tax rises.

Last week’s statement put the tax burden on course to hit its highest level since the Second World War.

Analysis by the TaxPayers’ Alliance (TPA) out today reckons reducing the burden to 21 per cent would unlock £834bn of growth.

Financial markets were spooked by Liz Truss launching £45bn of unfunded tax cuts in her disastrous mini-budget, forcing her to quit as the shortest serving prime minister ever.

“Truss pursued a short term borrowing splurge… without [Office for Budget Responsibility] assessment – so the markets were scrutinising [the] government’s credibility, not the… tax burden,” the TPA told City A.M.