UK borrowing surges to a record £103.7bn in lockdown

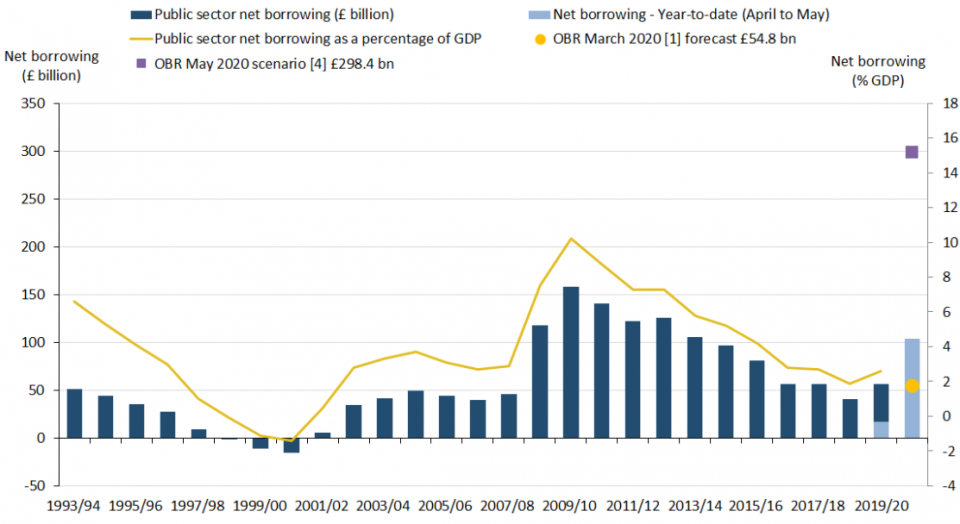

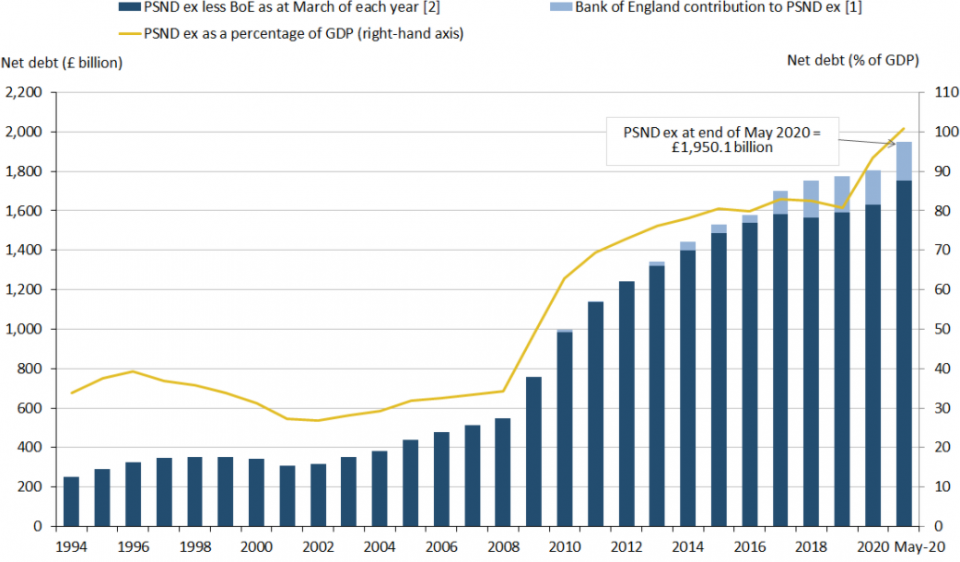

UK borrowing exploded to £103.7bn over April and May’s lockdown, official data showed today, as debt exceeded 100 per cent as a percentage of GDP in May for the first time in 57 years.

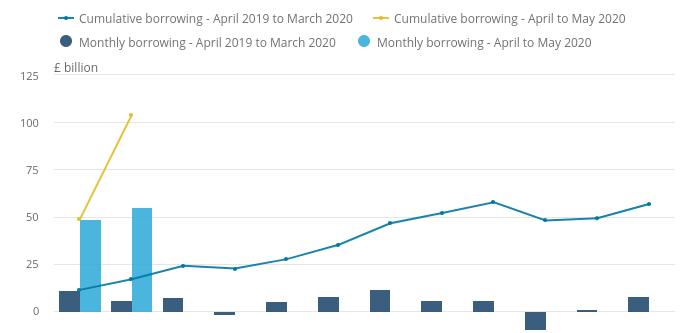

The current financial year to date – April to May 2020 – has already seen borrowing rocket to £103.7bn. That is £87bn more than in the same months last year.

And UK debt rose by 20.5 percentage points to £1.95 trillion last month, an increase of £173.2 billion compared to May 2019, the Office for National Statistics (ONS) said today. That saw debt hit 100.9 per cent as a percentage of GDP, exceeding 100 per cent for the firts time since 1963.

Borrowing excluding public sector banks hit £55.2bn for May alone, nine times more than the year before, and easily the highest month since records began in 1993.

Furlough costs fuel UK public debt

The Treasury has been forced to borrow wildly to fuel unprecedented levels of government spending in response to the coronavirus pandemic.

Chancellor Rishi Sunak’s job retention scheme is set to cost the government around £84bn before it finishes in October. And hundreds of billions of pounds worth of measures include business support loans and relief on business rates for retailers.

In May the government spent £91.6bn, 50 per cent higher than its spending a year ago. That included £10.5bn on paying 80 per cent of the wages of furloughed workers and £6.8bn on payments to self-employed workers.

Furloughed staff numbers exceeded 9m before the scheme closed to new applications in June.

Coupled with this huge outlay, the government is also earning less as businesses collapse or seek relief on tax they would normally pay.

Spending soars as tax receipts sink

May saw central government receipts plunge 28.4 per cent year on year to £40.7bn, including £28.9bn in taxes. And tax income slumped 31.3 per cent compared to May 2019. VAT plunged 46 per cent, PAYE income tax sank 29.4 per cent, and corporation tax fell 14 per cent.

The ONS borrowing data comes a day after the Bank of England moved to ramp up quantitative easing by £100bn, less than some expected.

However, the dire economic data arrived as the ONS reported on the start of a rebound in UK retail sales for May. Excluding fuel, retail sales rose 10.2 per cent month-on-month after plunging in April’s lockdown.

UK borrowing to fall as support schemes wind up

But economists said demands on Treasury cash should ease in the coming months as the government winds up its support mechanisms.

Before the Open newsletter: Start your day with the City View podcast and key market data

The costs of furlough – which almost doubled in May to £9.8bn from April – has pushed up the Treasury’s net cash requirement to £63.7bn for May, compared to £63.5bn in April.

That left the Treasury needing to raise more cash in April and May than in the entirety of any one of the last 10 fiscal years.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the amount of cash the Treasury must raise “should decline over the coming months”. Small business loans are expected to draw to a close and the furlough scheme closed to new joiners on 10 June.

“Tax receipts will pick up as GDP recovers too,” he said. “Nonetheless, the Treasury’s demand for cash will remain high by past standards, given the prospect of rising unemployment and the likelihood that the chancellor will attempt to reinforce the recovery with a stimulative Budget later this year.”

Borrowing could still surpass forecasts

Capital Economics’ chief UK economist Paul Dales concurred: “Both net borrowing and the net cash requirement should trend down from here as the economy reopens. But the government will still have to borrow about £350bn in total this year.”

That would put UK borrowing at higher than the Office for Budget Responsibility’s sky-high forecast of £300bn.

Alex Tuckett, senior economist at PwC, added: “These numbers continue to show the dramatic effect of the coronavirus crisis on the UK economy. The greatest effect on borrowing came from an increase in spending (more than £29bn higher than May 2019), reflecting the government’s various support schemes for the economy.

“In the near term, there are signs the economy is recovering as the country re-opens, and this should boost tax receipts. However, these figures remind us that chancellor Rishi Sunak faces a difficult backdrop to any summer fiscal event, at which he will want to look for ways to help the recovery gather momentum.”