UK borrowing hits December record of £27.4bn piling pressure on Hunt ahead of March budget

UK borrowing in December hit its highest total in 30 years driven upwards by the government’s debt interest bill soaring due to raging inflation, official figures out today show.

The government took on £27.4bn of debt last month, the largest amount since records began in 1993, according to the Office for National Statistics (ONS).

The amount was higher than market expectations.

The big overshot was caused by the amount of money Britain pays investors climbing rapidly last month to £17.3bn.

A huge chunk of the government’s debt stock is linked to an old measure of inflation, the retail price index, meaning investor payouts rise in line with prices.

Interest payments are upgraded in line with the RPI figures from two before, which topped 14 per cent in October, forcing the debt bill to nearly double December 2021’s number.

The government’s energy price cap of £2,500 has seen it spend billions of pounds on protecting households from crippling rises in energy bills.

That has raised spending sharply, widening the gap between what the treasury takes in tax receipts and spends on supporting the UK economy.

Poorer households have also received one off payments to help with eye watering living costs, stepping up spending further.

Today’s borrowing figures are the penultimate ones before the budget on 15 March.

The borrowing figures topped projections by the Office for Budget Responsibility in November, squeezing Hunt’s room to help Brits and businesses grappling with an inflation crunch by cutting taxes and increase spending at next month’s budget.

Hunt “was likely eying up the additional fiscal headroom relative to the OBR’s forecasts stemming from the recent decline in gas prices,” but today’s numbers suggest some of that firepower has vanished, Ellie Henderson, an economist at fund manager Investec, said.

“We have already taken some tough decisions to get debt falling, and it is vital that we stick to this plan so we can halve inflation this year and get growth going again – creating better paid jobs across the country,” the chancellor said today.

Hunt wants to get the debt stock falling in five years and not let the deficit top three per cent of GDP.

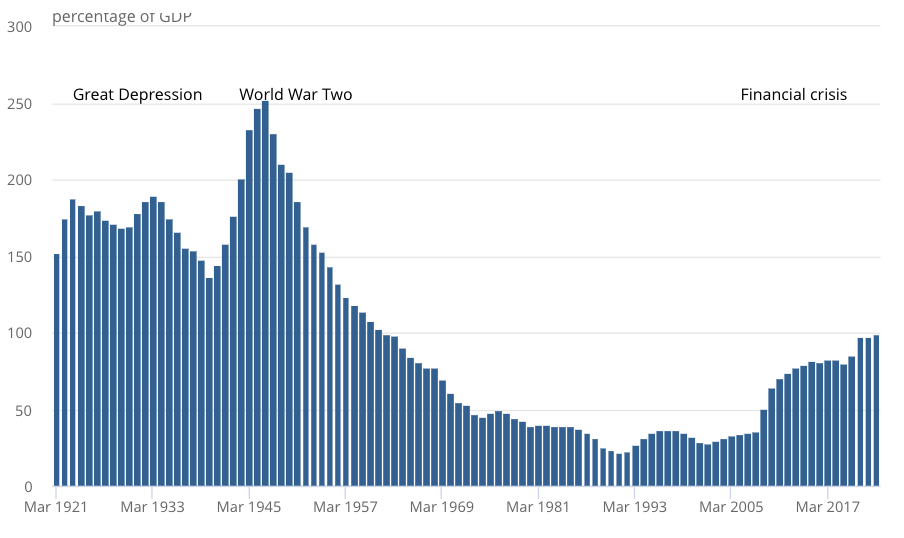

Debt as a share of the economy has risen sharply

Inflation was forecast to halve by the end of the year by the Bank of England in November, two months before the government set that pledge.

Debt as a share of the economy is nearly 100 per cent, a rate not seen since the 1960s, the ONS said today.

However, analysts reckon households are on course for the biggest hit to their living standards on record, due to a combination of tax hikes, multi-decade high inflation wiping out pay growth and higher interest rates.

The tax burden is on track to hit its highest level since the second world war.