UK borrowing costs tank as mini budget U-turn rumours gather pace

UK borrowing costs fell sharply today driven by chancellor Kwasi Kwarteng and prime minister Liz Truss reportedly set to U-turn on more parts of their mini budget.

The chancellor has today cut short his trip to the International Monetary Fund’s Washington meetings to hold emergency talks with Truss in London.

Rumours of a second U-turn on the mini budget have gathered pace over the last couple days, with the government likely to roll back on their plans to reverse the six percentage point corporation tax rise.

Last week, Kwarteng ditched plans to remove the top 45p rate of income tax.

Yields on the 30-year UK gilt – which has suffered the toughest sell off amid the market turmoil since the mini budget – dropped 17 basis points to 4.3 per cent.

Yield on 30-year UK gilt

Just a couple days ago, the 30-year gilt was offering a more than five per cent return. Yields and prices move inversely.

Rates on the 10-year UK gilt were also down over 20 basis points.

The pound, which strengthened two per cent against the US dollar yesterday, fell 0.45 per cent against the greenback today to buy $1.1272.

London’s FTSE 100 added 1.09 per cent, while the domestically-focused mid-cap FTSE 250 jumped 1.03 per cent.

Traders also pared back their bets on where interest rates will peak to 5.5 per cent in May, down from over six per cent yesterday.

Those weakening expectations will ease pressure on mortgage holders, who had been facing the prospect of rates on their loans topping six per cent.

Lenders set mortgage rates based on movements in UK debt markets.

Markets have been rocked by the government on 23 September launching £43bn of unfunded tax cuts and a short-term borrowing surge to fund the two year £2,500 typical energy bill freeze.

Pound/US dollar exchange rate

The pound collapsed to its lowest level against the dollar after the mini budget, while gilt yields have shot higher.

Analysts and economists have been urging Kwarteng and Truss to rethink their economic strategy, which is designed to raise growth out of the mire.

Asked by The Telegraph yesterday if another mini budget U-turn is coming, Kwarteng said “let’s see”. Other MPs have not denied a policy change is on the way.

Markets have been concerned about the government spending money into an economy that is suffering from the worst bout of inflation in 40 years. Prices are up 9.9 per cent over the last year.

The government also did not ask the Office for Budget Responsibility (OBR) to publish independent forecasts breaking down the impact of the tax cuts and borrowing spree to accompany the mini budget.

The OBR’s new workings will be released on 31 October, alongside Kwarteng’s medium term fiscal plan.

Reversing the tax cuts would shore up the public finances by boosting government revenue, watering down the state’s borrowing needs.

The prospect of a huge surge in government borrowing partly triggered a rise in gilt yields late last month, which led to liability driven investment funds, which pensions are invested in, scrambling for cash to pay creditors.

That prompted a near fire sale of gilts, forcing the Bank of England to launch a £65bn bond buying programme to tame rising rates.

The Bank yesterday purchased more than £4bn of bonds, the largest amount since the package was created on 28 September.

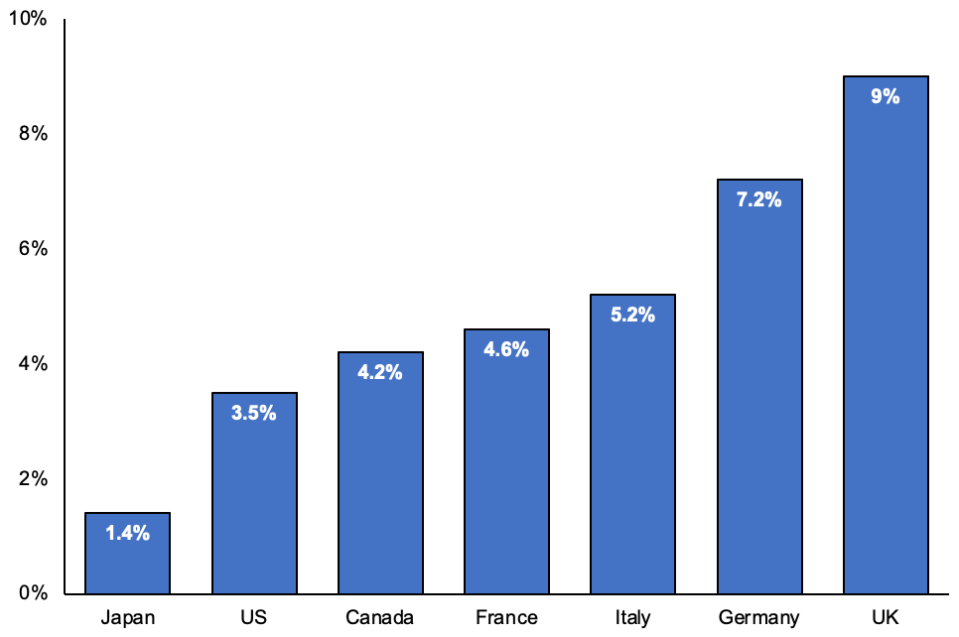

Britain’s inflation crisis stickier than peers

Gilt yields earlier this week raced to their steepest level since before the package was created.

The Bank will today pull the support from the market. Pension industry bigwigs had urged the Bank to extend to prevent further volatility in UK debt markets.

However, governor, Andrew Bailey, earlier this week shot down those calls, confirming the Bank will “out” of the gilt market today.