UK bid to dodge winter recession boosted as service sector recovery continues

The UK’s service sector posted its best performance in six months in December as hopes of lower borrowing costs in 2024 helped demand to recover, a closely watched survey suggested.

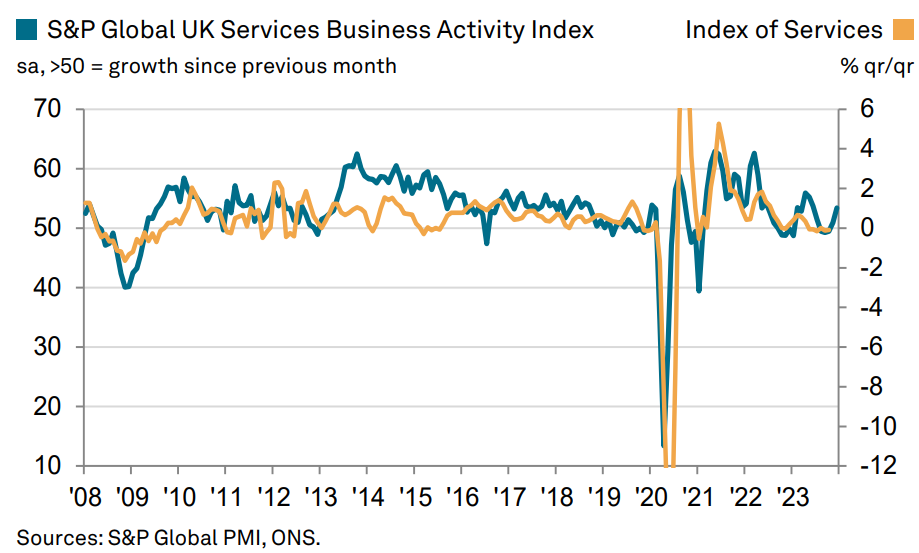

S&P’s global UK services Purchasing Managers’ Index (PMI) climbed to 53.4 in December, higher than the 52.7 recorded in mid-December’s ‘flash’ estimate.

The latest reading was also a significant improvement on November’s reading of 50.9. The 50 mark separates growth from contraction.

Stronger business activity in December reflected strengthening client demand, especially in the finance and technology sectors. Some firms also noted better-than-expected consumer spending on leisure and hospitality services at the end of 2023.

The improvement in demand comes amid hopes that interest rates will fall in the first half of 2024 and an improving macroeconomic outlook, the report noted.

“The UK service sector ended last year on a high, with business activity growth accelerating to its fastest for six months as the turnaround in order books gained momentum,” Tim Moore, economics director at S&P Global Market Intelligence said.

“Business activity expectations for the year ahead are now the most upbeat since last May, supported by signs of a rebound in clients’ appetite to spend,” he continued.

The stronger than expected performance of the UK’s all-important service sector will bolster hopes that the economy can avoid falling into a recession.

Revised figures for the third quarter showed that GDP contracted 0.1 per cent while monthly figures for October showed GDP fell 0.3 per cent, meaning a downturn is a real possibility. A recession is technically defined as two consecutive quarters of negative growth.

Despite December’s improvement in activity, staffing numbers fell for the third time in four months as firms tried to protect their margins.

Worryingly for the Bank of England, input price inflation hit its highest level since September due to rising wages. This meant the increase in prices charged hit its highest level for five months.

“Survey respondents typically cited efforts to pass on higher labour costs, despite competitive pressures limiting their pricing power,” the report said.