UK already in recession but market chaos will make it worse, KPMG forecasts

The UK is already in a recession that is likely to be intensified by turmoil in financial markets, new forecasts published today reveal.

Surging inflation – running at a 40-year high of 9.9 per cent – has squeezed households and businesses, forcing them to cut spending and likely steering the economy into reverse in the current quarter, according to consultancy KPMG.

If the economy shrinks in the current quarter, the UK will meet the official definition of a recession, defined as two back-to-back quarters of negative growth.

The UK is on course for a long-period of “stagnation,” KPMG said, adding the economy will shrink 0.2 per cent next year.

The government’s £160bn energy bill freeze and tax cut package is likely to result in the recession being “shallower compared to previous downturns,” KPMG said.

Pegging energy bills at £2,500 for two years is set to cut the headline rate of inflation five percentage points – to 10.5 per cent in October – from its previously expected peak.

However, the hefty borrowing and tax cutting splurge has rocked UK financial markets, forcing borrowing costs higher and the pound to new lows against the US dollar.

Severe market volatility forced the Bank of England yesterday to launch an emergency round of bond purchases to bring gilt yields back down. Prices and yields move inversely.

The emergency intervention, which ends on 14 October, triggered a collapse in gilt yields yesterday.

However, economists warned it may keep inflation higher for longer by not allowing higher rates to feed through to the economy and is unlikely to calm market fears over the UK’s growth prospects.

The government and the Bank are pulling in different directions that will hurt household and business finances, analysts said.

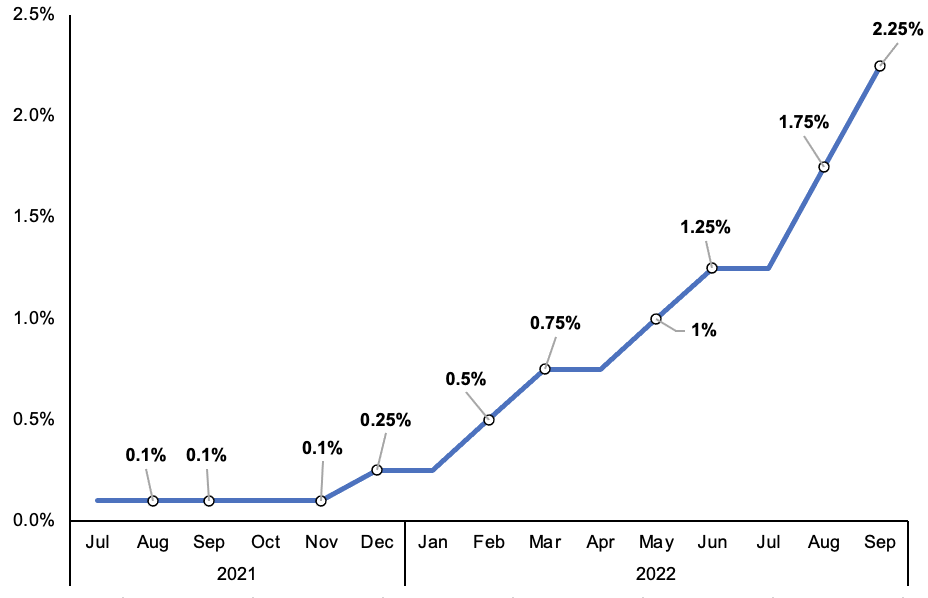

UK interest rates are set climb higher

“While the former is set to boost household budgets and alleviate the impact of higher energy prices, the latter will counteract stronger demand by making borrowing more costly,” Yael Selfin, chief economist at KPMG UK, said.

Markets think borrowing costs will peak near six per cent. That will heap pressure on mortgagors and businesses by raising debt servicing costs.

“A key risk is that a more prolonged period of high inflation and a weak pound would make us all worse off even if the global environment turns a corner,” she added.

Exporters are likely to benefit from the weaker pound due to it making their products more competitive.

Selfin added sterling is not alone in falling far behind the greenback. The dollar has raced ahead of the euro and other major currencies due to a global flight to safety amid fears of a global recession and steep rate hikes from the Federal Reserve.