UBS set for £2.7bn more credit crunch write-offs

UBS IS expected to write off €3.5bn (£2.7bn) in assets damaged by the credit crunch tomorrow, as the interim banking results season limps to a close.

The Swiss banking giant, which had significant exposure to US subprime mortgages, has endured a year of gloom, posting writedowns of $37bn since the beginning of the credit crunch and seeing clients desert its wealth management arm.

Fresh writedowns of between $4.5bn and $6bn are expected in tomorrow’s results, although the impact is likely to be softened by tax credits of around Sfr 3bn.

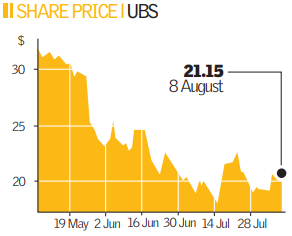

UBS has seen its shares lose 66 per cent in the last 12 months, as its market capitalisation halved from $90bn to $43.5bn.

The results follow hot on the heels of a furore over the bank buy-back of auction rate securities from clients.

The bank has been forced into a settlement with regulators to buy back nearly $18.6bn (£9.7bn) of auction-rate securities (ARS) from angry clients, who claimed they had been misled into thinking of ARS as liquid instruments similar to cash. UBS was also ordered to pay a $150m fine to regulators for misrepresentation of ARS. The settlement comes on top of an agreement announced by the bank to buy back $3.5bn in ARS from clients. UBS declined to comment on the matter.