UBS ‘$1billion’ deal for Credit Suisse to be fast-tracked past shareholders: reports

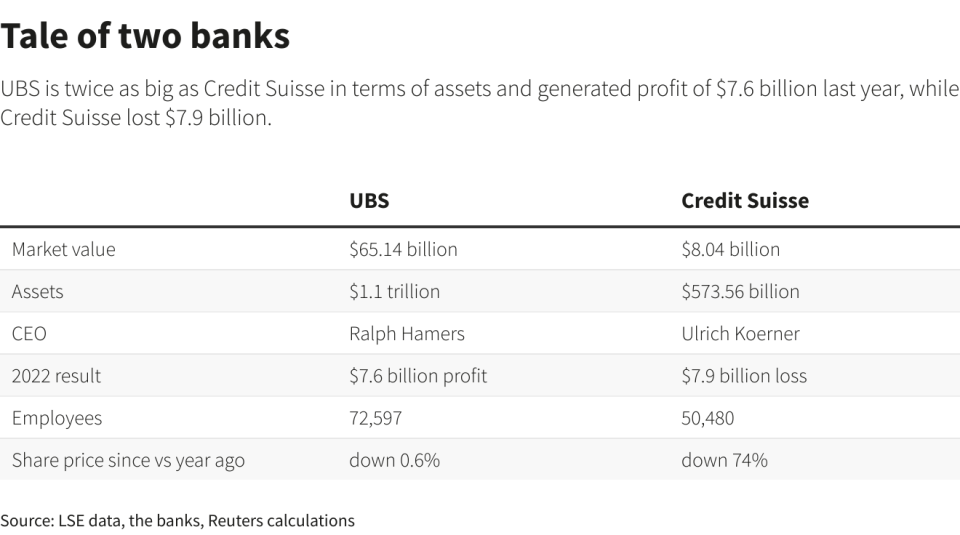

UBS’s possible $1bn acquisition of Credit Suisse is being fast tracked to ensure its completion before markets open on Monday morning in a dramatic attempt to preserve financial stability.

According to the Financial Times, Swiss authorities are considering using emergency measures to bypass normal takeover rules.

It reported that UBS indicated emergency powers would be used to skip the consultation period and pass the deal without a shareholder vote.

UBS would typically have to give shareholders six weeks to consult on the acquisition, with reports that UBS is set to pay ‘up to $1bn’ for its rival.

The $1bn price tag translates to a price of CHF0.25 per share, far below Credit Suisse’s closing price of CHF1.86 on Friday. UBS also insisted on a material adverse change clause that the deal be abandoned if its credit default swaps jump by 100 basis points.

The Swiss banking giant also wants allowances to be made to its capital rules and funds to cover possible legal costs.

In 2022 Credit Suisse set aside CHF1.2bn in legal provisions and warned that regulatory probes and lawsuits could add another CHF1.2bn in future.

The Financial Times reported that the situation is fast-moving with no guarantee that a deal will be reached.

The possible exceptions to normal rules reflect the regulator’s concern that a deal is essential for preserving wider financial stability.

Credit Suisse’s investment bank has also been an obstacle in the talks. The investment bank has been the source of many of Credit Suisse’s scandals over the past few years.

Under existing restructuring plans, Credit Suisse wants to carve out its investment bank under a revived brand, CS First Boston, allowing it to focus on its domestic bank and its wealth management arms.

UBS wants to reassess the case for the spinoff, throwing Credit Suisse’s restructuring plans into doubt.

UBS has not been the only firm circling Credit Suisse. Blackrock was interested in acquiring the bank, the Financial Times reported, although it has since ruled out a move.

Bloomberg reported Deutsche Bank is interested in acquiring some parts of the stricken lender.

The UBS deal is a last ditch attempt to save Credit Suisse which has faced deposit outflows of over CHF10bn a day late last week, according to two people familiar with the matter.

The embattled lender has faced intense speculation about its future after it revealed it had “material weaknesses” in its financial reporting and its top shareholder ruled out further investment.

Its share price fell as much as 30 per cent last Wednesday before the Swiss National Bank issued a CHF50bn liquidity lifeline in an attempt to maintain confidence. However, this did little to arrest Credit Suisse’s share price collapse as it still fell another 10 per cent during the rest of the week.

The cost of insuring company bonds against default have also shot up.

Bank indexes around the world have fallen in the wake of the collapse of Silicon Valley Bank and the turmoil at Credit Suisse.

The European Stoxx 600 banking index fell 11.5 per cent over the course of the week while the US KBW index fell 11.1 per cent

Regulators will hope that a deal between UBS and Credit Suisse can assuage market concerns and stave off further financial instability.