| Updated:

UBM in talks for £550m takeover of US Advanstar

Events and information giant UBM yesterday confirmed it is in takeover talks with US trade show organiser Advanstar, in a deal that might be worth up to $900m (£549m).

UBM, which also owns PR Newswire (PRN) and has a market capitalisation of £1.5bn, said in a statement that it “notes recent market speculation concerning a potential acquisition of Advanstar by UBM.

“UBM confirms that it is involved in discussions which may, or may not, lead to a transaction.”

Advanstar is best known for putting on the biannual Magic fashion trade show in Las Vegas, and is reportedly working with Goldman Sachs and Moelis & Co to help find a buyer.

On a potential deal Liberum analyst Ian Whittaker said: “UBM may not want to raise such an amount via a capital raise. Therefore the other implication is that UBM could be close to selling PRN, which we value at close to the $900m quoted.”

He added that if UBM bought Advanstar, but sold PRN, the move would be seen as a plus “for three reasons: earnings accretion; probable re-rating as UBM would be a pure-play events business; and it reduces the risk to Chinese exposure that has weighed on the shares recently,” He said that Publicis could be a potential bidder should UBM decide to sell PRN.

UBM’s shares rose two per cent yesterday to close up at 613.5p.

PROFILE: ADVANSTAR CEO JOE LOGGIA

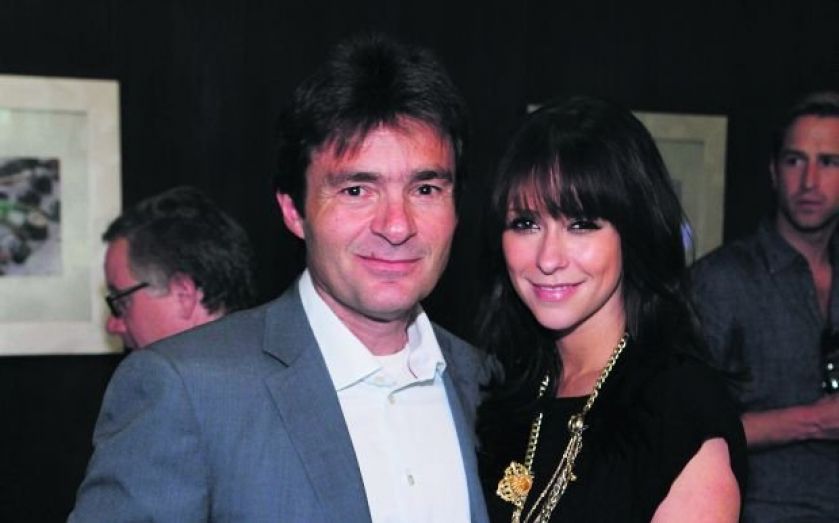

Advanstar's chief executive Joe Loggia may have the star quality now, as he mixes with the likes of actress Jennifer Love-Hewitt, but his career has not always seen him hobnobbing with the rich and famous.

A one-time police officer, he is also a certified public accountant, who was a fraud and financial investigations manager at Coopers & Lybrand before taking up a role at Magic, a widely-known, semi-annual apparel trade show. Starting as financial director there in 1993, he worked his way up to the top job and led Magic’s sale to Advanstar when he joined the company in 1998. Again working through roles within the company, he was president and chief operating officer from 2001 to 2003 and is credited by the firm for “re-engineering key business processes, implementing state-of-the-art data systems, new business development procedures and rewards”. Loggia became chief executive of Advanstar in 2004 and his responsibilities, according to the firm, include “all aspects of business strategy, operating performance, organisational development, finance and administration”.

A sale to UBM would not be the first piece of deal-making he has been involved with. After becoming CEO, he cut debt with the sale of several of its market groups, including those focused on information technology and travel, to Questex Media for $185m in cash. Advanstar itself was sold in 2007 to private equity firm Veronis Suhler Stevenson for $1.15bn. Loggia’s spokesman said he would not comment on the talks.