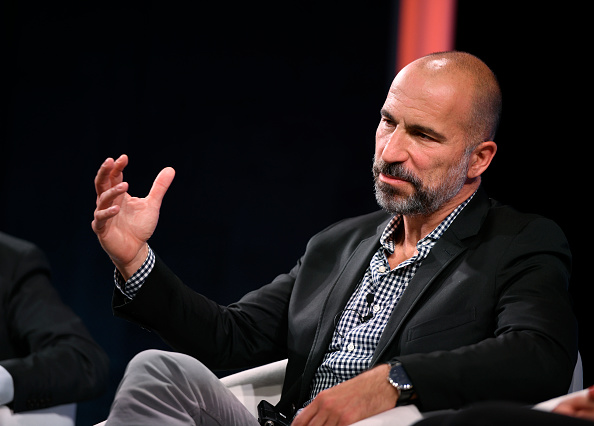

Uber chief: Time to show investors the money

Uber chief Dara Khosrowshahi heralded a change of tack this week when he sent an internal email to staff entitled “the next (best) chapter”, signalling a new era of cost cutting.

Discussing the “seismic shift” that has occurred in the ride-hailing space, Khosrowshahi emphasised the centrality of shareholders in the company’s ongoing journey.

He wrote: “Please bear in mind that while investors don’t run the company, they do own the company – they’ve entrusted us with running it well”.

“Channeling Jerry Maguire, we need to show them the money”, he added.

The email comes just a week after the San Francisco-based firm announced its strong pandemic bounceback in the first quarter.

Uber exceeded analyst expectations, with reported revenue growth of 136 per cent to $6.9bn for the period, with adjusted earnings before interest, tax, amortisation and depreciation of $168m.

Despite strong results, Uber’s stock has struggled to gain momentum, dropping over 42 per cent in the year to date.

As Head of TMT Research at Mirabaud Neil Campling told City A.M.: “Despite all the promises of a path to profitability, this email suggests that investors have grown tired of the app economy sinkhole of losing money”.

Alluding to rival Lyft’s more underwhelming results last week, with both revenues and profits dipping below investors’ expectations, Khosrowshahi said Uber was a “completely different animal” and it was up to them to show competitors how to translate total addressable market into significant profits and cash flow.

He suggested that cost-cutting may be on the company’s horizon, and stated: “We will treat hiring as a privilege and be deliberate about when and where we add headcount”.

Commenting on the move, AJ Bell lead analyst Russ Mould told City A.M.: “The change in tone is interesting. What is of greater importance may be what is prompting it. A sagging share price and shambolic set of first-quarter results may provide some clues.”

“Investors now want to see how customer wins are turned into profit and cash flow – and that is on a statutory basis, not Uber’s preferred metric of adjusted EBITDA, which conjures up a profit once around a dozen items are excluded from the accounts. Only that will provide support to Uber’s still-considerable $50 billion-plus market cap. Jam-tomorrow stories of cash flow tomorrow are not enough for nervous equity investors right now.”