Two thirds of home buyers in London getting help from Bank of Mum and Dad

Over two-thirds (67 per cent) of all homeowners in London receive parental support to purchase their homes, a report released by Legal and General (L&G) has shown.

‘Bank of Family’ recipients in London received £30,200 on average to support their transaction, only beaten by those in the East of England who received an average of £32,100, according to the figures which were sourced by L&G through YouGov.

Elsewhere, aspiring buyers are less reliant on the family and friends. In the East Midlands and West Midlands, people received the least on average from friends and family, at £20,000 and £19,800 in each region, respectively.

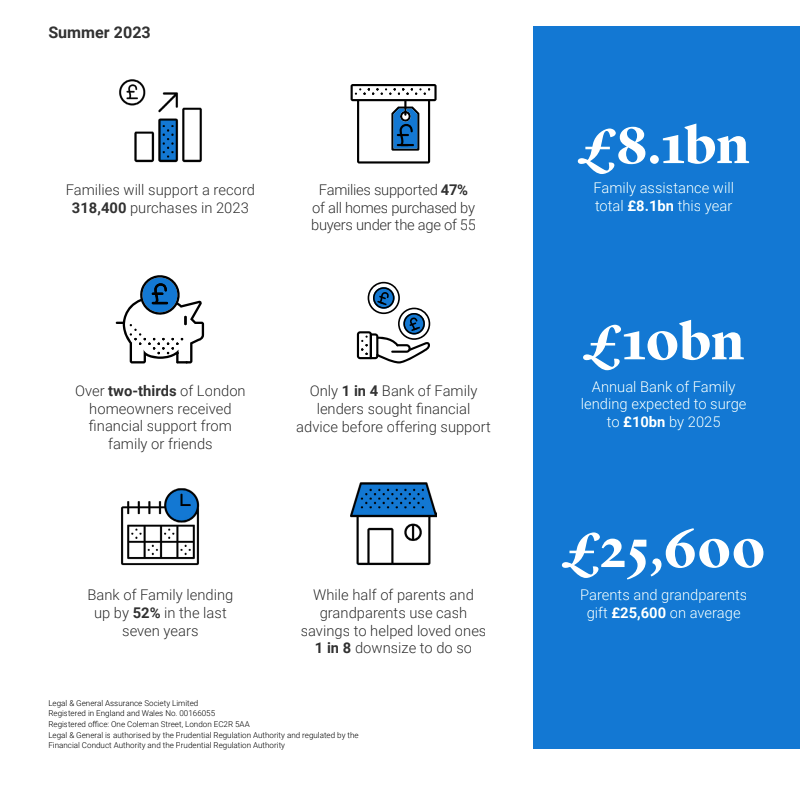

In total, £8.1bn of home-buying funds will be funded by families this year.

While 57 per cent of this is going towards buyers aged under 35, the data showed a third is supporting those aged between 35 and 55 as the average age of first time buyers increase. The average first time buyer is now aged 32, up from 29 a decade ago.

L&G predicts total family contributions will climb to £10bn by 2025, almost double what they were in 2020. Hickman says that with high rates, deposits will need to be bigger so as to render repayments more affordable – opening the door to a sneaky question to auntie or uncle.

Whilst this is good news for those with support, it is bad news for people with relatives unable or unwilling to give them financial aid.

Bernie Hickman, CEO of L&G Retail, told City A.M.: “The stark reality is that it is almost necessary in parts of the UK to have financial support [to buy a home].

“It’s an inequality that is not talked about enough.”

Bank of Mum and Dad

L&G’s survey was launched in 2016 and was then called the Bank of Mum and Dad, but the name has been changed to reflect support given by grandparents, aunts, uncles and more.

The research shows the extent to which buyers at any stage are reliant on friends and family as house prices remain high – although there are signs that the London market is cooling – and mortgage rates have rocketed.

Hickman told City A.M. the problem had been exacerbated by house prices going up faster than wages.

He noted that aside from financial gifting, there was also evidence that relatives are “getting more creative” in finding ways to help younger buyers get on the ladder.

“One of the inevitabilities is families recognising housing wealth of those over 55 is a massive amount and is not yet being tapped into.”

This included things like hosting a child rent-free in order to allow them to save money, or taking on childcare duties that would otherwise be very costly.

2023 was the busiest year ever for relatives helping house-buyers , with family members expected to support 318,400 property purchases – the highest level ever supported since L&G began tracking family lending in 2016.

This is a big increase from 2019 when there were 225,400 purchases made with additional help from relatives.

Hickman said: “We’d like to see a fairer society where people who work hard and save are able to buy a house without relying on support of the bank of family.”

Hickman added that L&G would like to see more ambitious housing targets and planning permission relaxed. He argued more houses could produce a market with better rates and prices for buyers, resulting in less reliance on family gifts for support.

“And that would be a better outcome for society,” he said.