Two lessons from the underperformance of alternative energy

Renewable energy is playing an ever-greater part in the mix of energy we use to power our daily lives.

Potential investors in the sector may assume that it’s too late to get involved.

Surely the best returns from companies exposed to the energy transition have already been made by now?

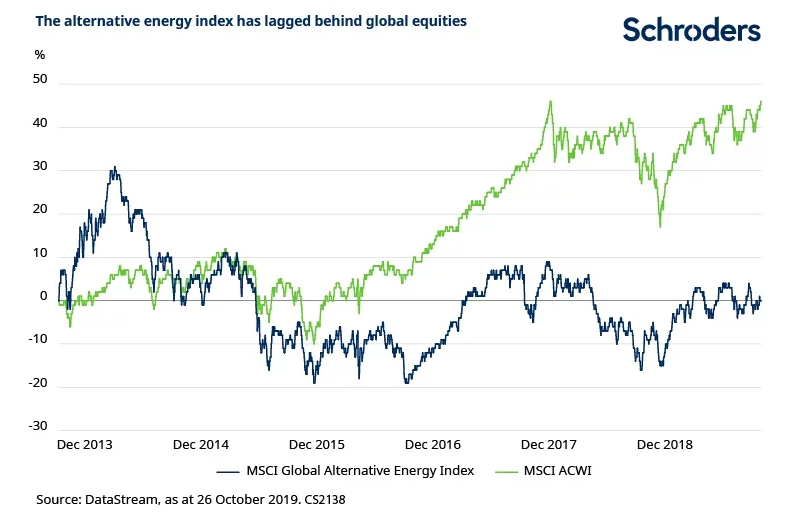

Investors making that assumption may be mistaken. As the chart below shows, the MSCI Global Alternative Energy Index has lagged the MSCI All-Country World equity index substantially over the past five years. In fact, investors would have made scarcely any return at all on their initial capital.

Past Performance is not a guide to future performance and may not be repeated.

It’s not too late to invest

I draw two conclusions from this.

Firstly, I believe it’s absolutely not too late to start investing in the sector.

We have argued elsewhere that there are three factors coming together right now that are creating the tipping point for the transition to renewable energy.

That the index has underperformed to date seems to be another piece of evidence that you haven’t missed the boat.

What’s more, this investment opportunity has huge longevity to it.

We are talking about the transformation of the energy sector over the next 20-30 years.

But the opportunity doesn’t end even when renewables make up a larger part of the energy mix.

The infrastructure, such as storage and transmission networks, will still need to be updated and improved. New capacity will need to be added as the global population rises.

Active vs passive investment

The second conclusion I draw is that a passive approach, such as investing in a fund that simply tracks the index, is not necessarily the best way to access the opportunities thrown up by the energy transition.

Part of the reason why the MSCI Global Alternative Energy Index has underperformed is that there have been several high profile instances of companies in the benchmark going bust.

For example, the wind turbine maker Senvion filed for insolvency this year after losing out on orders to bigger rivals. Solar power developer SunEdison went bankrupt in 2016 after a series of debt-fuelled acquisitions.

These examples demonstrate that it pays to be selective when picking investments.

Innovation is a key part of the energy transition story but as active investors we also keep our eye on more prosaic elements, such as balance sheet strength, real return on invested capital and, importantly, management teams that are aligned with equity holders.

Investments starting to “bear fruit”

Another reason why the index has underperformed is that many companies in it have had to make large investments during recent years.

Only now are those investments starting to bear fruit. Take, for example, the manufacturers of lithium-ion batteries.

This is an industry where a significant amount of capital has already been sunk in new capacity, with limited return to show for it so far.

However, we expect demand to grow faster than supply from 2021 onwards, helped by the shift to electric vehicles.

This means existing capacity will be more fully utilised, allowing costs to fall and feeding through to higher profit margins.

Active investors have the flexibility to invest in companies only during this phase of their activities, when profits are coming through, rather than the phase when investments are being made.

Passive exposure via an index means owning the company regardless of what phase it is in.

Unwelcome surprises

There are other reasons too why a passive investment in an index tracker could lead to some unwelcome surprises.

At the time of writing, the MSCI Global Alternative Energy Index is largely composed of companies whose activities focus on clean energy generation and renewable energy equipment.

It fails to offer much exposure to the other associated technologies and markets, such as storage, electrical equipment, the grid and smart metering.

For us, filtering for companies that derive a high proportion of revenues from energy transition activities, and that do not have fossil fuel or nuclear exposure at all, is the central driver of creating an investment universe.

This shows why investors looking for exposure to the energy transition may want to consider a standalone approach. Such an approach can focus only on companies directly involved in sustainable energy and select those with a sustainable business model that can generate the highest potential returns for investors.

- For more on how energy transition could affect your investments visit Schroders’ insights.

Risk factors:

Concentrating your investment portfolio in a single industry or sector may result in large changes in the value of the investment, both up or down, which may adversely impact the performance of your portfolio.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Important information:

This information is not an offer, solicitation or recommendation to adopt any investment strategy.

If you are unsure as to the suitability of any investment speak to a financial adviser.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.