Twitter frenzy as investors rush in

TWITTER held one of the most highly-anticipated public debuts of the year yesterday at the New York Stock Exchange (NYSE) with intense investor interest that caused the company’s stock to jump 92 per cent at the start of trading.

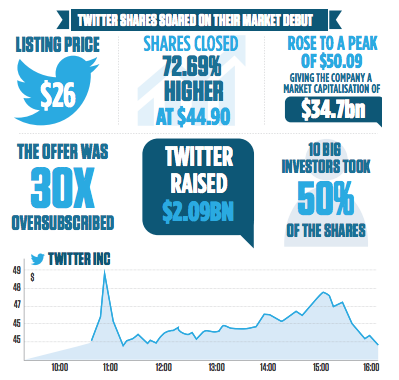

The social media darling eventually settled at $44.90 (£27.90) a share, up 73 per cent from the $26 that the company had priced ahead of its debut, but slightly down from its $45.10 open.

Chief executive Dick Costello, who saw his paper fortune soar to more than $340m during trading, attributed the company’s ongoing success to its growing core of 232m monthly users, he said, “We’ve had consistent tremendous growth across the globe for the past few years…”

Twitter raised $2.09bn from the float making it the second largest internet IPO by an American company ever, behind Facebook ($16bn) and ahead of Google ($1.92bn).

Costello was joined to ring the opening bell at the NYSE by Twitter co-founders Evan Williams, Jack Dorsey and Biz Stone, along with notable Twitter users including British actor Sir Patrick Stewart.

Costello said that his aim for Twitter’s initial public offering (IPO) was for a “clean, methodical” process, and with Facebook’s troubled float last year still in recent memory, his approach was given a vote of support by the market yesterday.

“Demand has clearly been through the roof with institutions all scrambling to get a piece of the Twitter pie,” said ETX Capital analyst Ishaq Siddiqi, who also offered some words of warning to prospective investors.

“Although we have seen a staggering entry by Twitter today, unless management can continue to reassure the market that this company’s growth profile looks as phenomenal as they claim, we could see the stock drift lower. It’s all about turning those Tweets into dollars now.”

Looking ahead Costello said that the next priority for the company is improving the experience for new users, something he said that Twitter has a set of strategies planned for.

But not everyone thought Twitter’s explosive debut was warranted. Pivotal Research analyst Brian Wieser called the price “simply too expensive” as Pivotal reduced its Twitter rating to sell with a target price of $30.

“Twitter is simply too expensive. Nearly the same valuation as CBS or the combined Publicis Omnicom Group… or even Yahoo,” said Wieser.

Yesterday’s trading pushed Twitter to a diluted market capitalisation of over $31.6bn. On the London Stock Exchange Twitter would be the 28th largest company of the FTSE 100, knocking advertising giant WPP down a spot.

Twitter’s valuation also dwarfs those of British heavyweights ARM, BSkyB and BAE, despite the company having yet to turn a profit, with a reported loss of $64.6m during its third quarter and revenues of only $168.6m.

- Bottom Line: Investors may be sorry they friended Twitter

- Two billionaires emerge from Twitter rich list