Tumbling Chinese currency drags down stock markets on trade war fears

China’s currency the renminbi today slumped against the dollar to a level not seen since the financial crisis, sparking an equities sell off due to fears of a further escalation of trade tensions.

Read more: Donald Trump accuses Beijing of currency manipulation

The currency, which the Chinese government lets fluctuate two per cent either side of a set figure, fell 1.6 per cent so that one dollar bought 7.047 yuan, the unit of the renminbi.

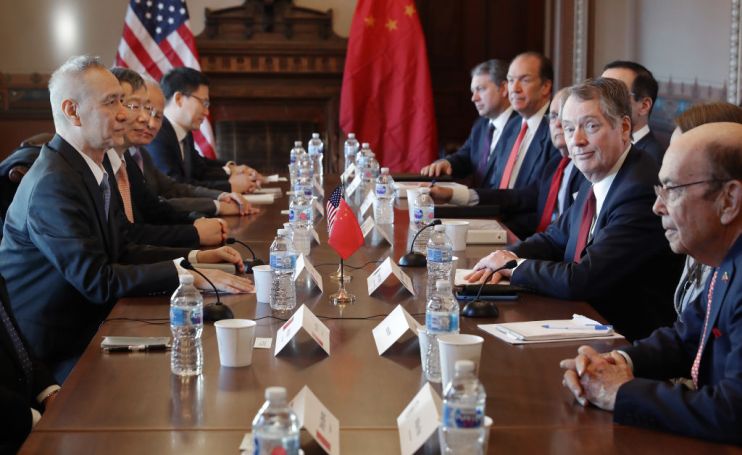

The dramatic fall came after US President Donald Trump on Thursday slapped 10 per cent tariffs on $300bn of Chinese goods in a dramatic escalation of the two sides’ trade war. China has vowed retaliation.

Trump responded to the renminbi’s slide by accusing China of “currency manipulation”. A lower renminbi makes Chinese goods more competitive.

He tweeted: “Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!”

Stock markets also reacted badly, with investors viewing the falling renminbi as a sign that China has given up hope of a resolution to the ongoing trade conflict.

The FTSE 100 led European stock markets downwards, falling 2.5 per cent by the afternoon as investors also took the rising chances of a no-deal Brexit into consideration.

US stock markets opened sharply down. The tech-heavy Nasdaq had fallen 2.7 per cent while the S&P 500 had dropped 2.1 per cent.

Germany’s benchmark Dax index was 1.9 per cent down, while the pan-European Euronext 100 was 2.5 per cent down.

“The main driver of today’s selloff in risk assets is China’s decision to stop defending the renminbi against the US dollar,” said Nick Wall, a fund manager at Merian Global Investors.

Nick Wall, a fund manager at Merian Global Investors, said China holding its currency steady “was seen as key if there was any chance of trade talks succeeding”. But “China has decided to let it go,” he said.

The equities sell off saw investors pile into so-called safe-haven assets. The Japenese yen was 0.5 per cent higher against the dollar, while yields on US 10-year government bonds had fallen 0.09 percentage points to 1.76 per cent. Yields move inversely to prices.

Read more: Tariffs hurting US manufacturers, says Trump’s ex-economic adviser

Julian Evans-Pritchard, senior China economist at Capital Economics, said of China: “Given that their goal is presumably to offset some of the impact from additional US tariffs, they are likely to allow the currency to weaken further, probably by five to 10 per cent over the coming quarters.”