Tullow refutes takeover talk after dry spell

TULLOW Oil’s chief executive yesterday denied that the energy explorer had become a takeover target, after a swathe of exploration write-offs led to a 72 per cent drop in full-year profits.

The FTSE 100-quoted firm reported pre-tax profits of $313m (£189.5m), down from $1.12bn the previous year, hit by a $200m increase in exploration write-offs and a $670m decrease in profit on disposals. A $2.9bn Uganda farm-down in 2012 had caused Tullow’s profits to spike that year.

Aidan Heavey said that the company’s “world-class assets” always make it the subject of takeover rumours, but confirmed that it is “not for sale”.

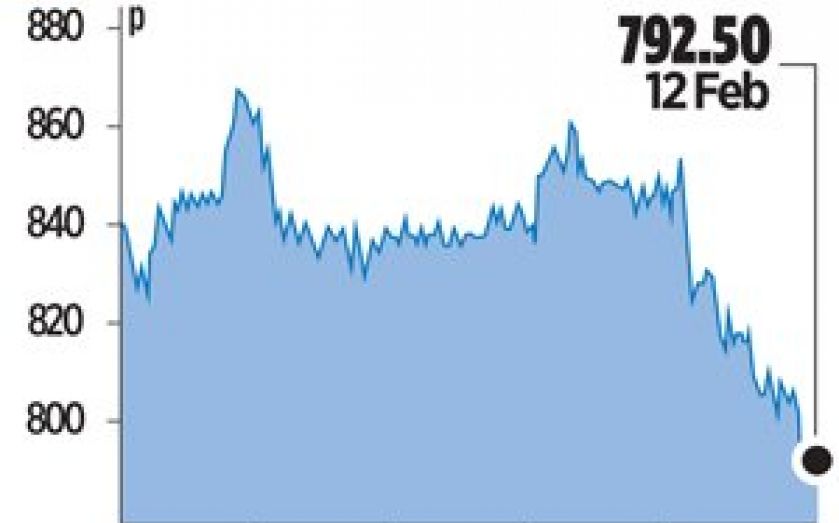

Tullow’s share price has come under pressure over the past year after it unveiled a flurry of dry exploration wells, particularly off French Guiana.

Exploration director Angus McCoss said that the company’s exploration strategy for this year would centre around “capital efficiency”, with a particular focus on its most successful areas, East Africa and Norway.

Tullow also announced the completion of its first exploration well in Mauritania, which encountered oil. McCoss said that the findings signified “a new oil play in a deeper horizon that was thought to be non-prospective until now”.

Broker Investec called Mauritania a positive, “demonstrating that Tullow can drill good wells outside of Kenya.”

In 2014, Tullow is planning to invest around $1bn in exploration across Mauritania, Norway, Kenya, Ethiopia and a first well offshore Guinea.

The firm’s revenue went up 13 per cent to $2.65bn and the dividend was flat at 12p.