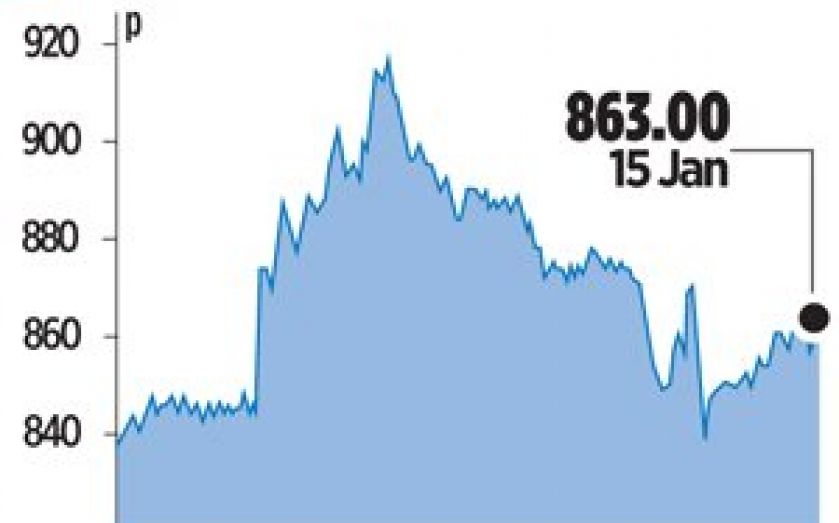

Tullow climbs on new Kenyan oil discoveries

FTSE 100-quoted Tullow Oil’s share price edged up yesterday, after mixed updates unveiled new discoveries in Kenya alongside mammoth exploration write-offs that startled analysts.

The oil explorer said it made “significant oil discoveries” at the Amosing and Ewoi wells in Kenya and updated its estimate of discovered resources in the basin to over 600m barrels of oil. “Tullow believes that the overall potential for the basin, which will be fully assessed over the next two years…is in excess of one billion barrels of oil,” the company said.

In a separate statement, Tullow reported exploration write-offs of $730m (£444.5m) in 2013, over double Deutsche Bank and Barclays analysts’ estimates of $300m and $340m respectively. The larger-than-expected costs reflect a disappointing year of drilling for Tullow, with the oil explorer plugging and abandoning dry wells in French Guiana, Mozambique, Ethiopia and Norway.

Tullow said production for 2013 had averaged 84,200 barrels of oil per day. It set production guidance for 2014 at 79,000 to 85,000 barrels of oil per day, missing analysts’ forecasts.

“We made good progress across the business over the past year despite facing challenges within the oil and gas sector,” said chief executive Aidan Heavey. “Our exploration successes in Kenya and Norway mean that Tullow is meeting its resource addition targets and expects to deliver in excess of 200 million barrels of oil in 2014.”

The firm made revenues of $2.6bn in 2013, up from $2.34bn in 2012.

Shares closed 0.8 per cent higher.