Truss ‘giving with one hand and taking with other’ through stealth taxes, IFS says

Liz Truss is “giving with one hand and taking with the other” by keeping stealth taxes, a new study out today reveals.

Some £2 for every £1 returned to Brits in the prime minister and chancellor Kwasi Kwarteng’s tax cutting mini-budget will be lost to “fiscal drag,” the Institute for Fiscal Studies (IFS) said today.

The pair last month launched a £45bn tax bonfire and ramped up borrowing to cap households’ energy bills at £2,500 for two years.

Despite handing £20bn back to households by reversing the 1.25 percentage point national insurance hike and bringing forward a 1p income tax cut, the government will claw back £41bn by freezing tax bands and benefits.

Income tax thresholds were frozen for four years by former chancellor Rishi Sunak in March 2021, a policy still intact. That measure was forecast to raise £8bn a year for the treasury when it was announced last year.

But, soaring inflation, which is running at a 40-year high of 9.9 per cent, means “it is now expected to raise £30bn per year,” the IFS said.

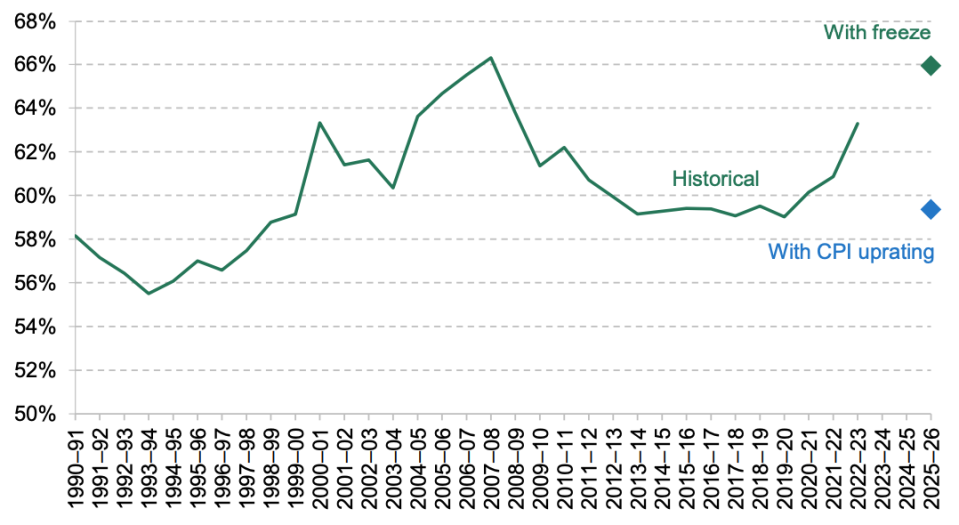

Proportion of UK population paying income tax is set to soar

Freezing tax thresholds creates “fiscal drag,” a process in which people are forced to pay more tax by inflation.

“Freezes far more than outweigh headline policies such as the 1p cut to the basic rate of income tax, or the reversal of the health and social care levy,” Tom Wernham, research economist at the IFS, said.

“Giving with one hand and taking with the other in this way is opaque and stealthy,” he added.

Truss yesterday in her Tory conference speech pledged to smash the “high-tax, low-growth cycle”. The pound slumped two per cent after the speech and UK borrowing costs surged.

The IFS thinks 1.4m more Brits will be netted by the tax system under current plans. There will be three times as many top 45 per cent rate taxpayers compared to when the rate was introduced in 2010.

Truss was forced to scrap plans to ditch the top 45 per cent income tax rate earlier this week due to MPs warning it would be voted down in parliament.

The UK’s income tax system has four tiers. People pay zero tax on income up to £12,570.

After that, they can pay 20 per cent, 40 per cent and 45 per cent depending on their income. Truss wanted to abolish the top rate of income tax.

An HM Treasury spokesperson told City A.M.: “This government is committed to a high growth and low tax economy and helping people to keep more of their hard-earned money is a key priority, as seen by our commitments to cancel the rise in National Insurance and reduce the basic rate of income tax.”

“The income tax system is highly progressive. This year, the top 50 percent of income taxpayers are expected to pay around 92 per cent of total income tax, while the bottom 25 per cent are expected to pay just two per cent.”