TP ICAP reports revenue drop in the first quarter after market volatility

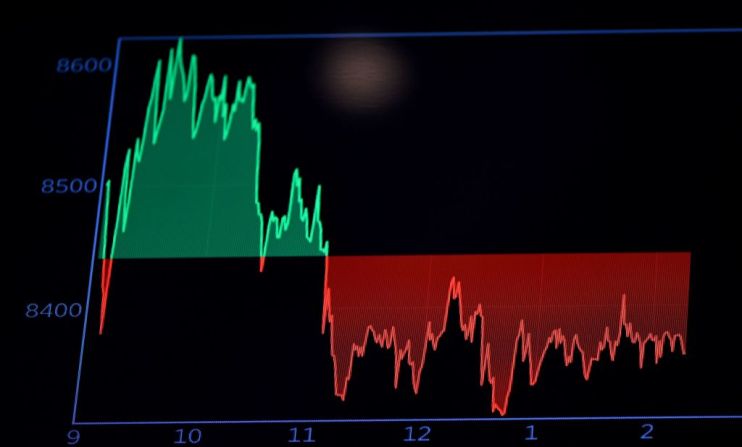

TP ICAP reported a decline in first-quarter revenue, reflecting the extent of the impact of the pandemic on markets.

The interdealer broker posted a nine per cent fall in revenue to £483m from £530m a year earlier, which the company said reflected the volatility of the market in March last year.

It noted revenues in March 2020 had been “exceptional” amid extreme trading conditions triggered by the pandemic.

TP ICAP said trading had returned to normal levels in April and was in line with its forecasts.

It has stuck to its full-year forecast of low single-digit revenue, excluding results for Liquidnet, the electronic trading firm it bought earlier this year.

Revenues in its global broking segment fell 10 per cent to £312m, reflecting lower client volumes across the majority of its asset classes. Its equities revenue however grew “significantly”, benefiting from higher volumes and diversification from the acquisition.

Revenue for its energy and commodities business dropped 12 per cent, also due to exceptionally high volumes in the comparative period.

Shares in the firm are up 1.32 per cent.

“It is too difficult at this stage in the year to assess where the risks are now to our forecasts and much will depend on Liquidnet’s contribution. We also note that if TCAP’s recent activity levels hold up, and we continue to see scope for macro surprises to support volatility in the near term, YoY growth rates will look much better in H2 as easier comps are lapped,” Shore Capital analysts said.

“Over the longer term, we see TCAP’s investment case as being principally about the D2C rates franchise to be built following Liquidnet’s acquisition, however, for now it isn’t clear to us how material the associated earnings and growth potential could be and how quickly this can become a meaningful part of the business.”