Top Tories demand simpler tax system as they step up to defend internet giant Google

Leading Conservative MPs lined up to defend Google yesterday as the technology giant’s corporation tax bill came under fresh political scrutiny.

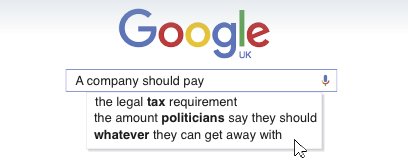

“A corporation’s duty to shareholders will be to minimise its tax liability. It should be the duty of those making tax policy to find better ways to limit the elasticity,” Treasury Committee chair Andrew Tyrie said as he revealed that his committee was launching an inquiry into tax policy and the tax base.

“Google may be the symptom, but it is not the cause,” Tyrie said. “There is a lot the government could be doing. Tax policy must be made more practicable and the tax system more coherent.”

Committee member Chris Philp backed Tyrie, telling City A.M. that the government “has taken a lot of action, but there is more that we can do” to collect corporation tax: “We need to make sure we have a way of taxing corporate profits that works in the 21st century.”

The Treasury Committee’s intervention came after London mayor Boris Johnson said it was “absurd” to blame Google for not paying taxes: “It is the nature of the beast; and not only is it the nature of the beast – it is the law.”

Google revealed late Friday that it had reached a deal with HM Revenue & Customs (HMRC) to hand over £130m to settle claims covering a 10-year period. News of the deal drew sharp criticism from MPs and others who said the tech firm had been given unfair treatment.

Meg Hillier, the Labour MP who chairs the Public Accounts Committee, said she would call Google and HMRC to publicly answer questions about the deal. Shadow chancellor John McDonnell, who asked an urgent question on the issue in the Commons yesterday, said chancellor George Osborne “must transparently publish the full details of what HMRC believed [Google] owed”.

Standing in for Osborne in the Commons, Treasury minister David Gauke said he could not answer a question about Google’s effective tax rate “because of taxpayer confidentiality”.

“To look at profits from sales in the United Kingdom is not a way in which one can calculate [the effective tax rate],” Gauke added. “The tax rate is currently 20 per cent. That applies to everybody, but in terms of the effective tax rate that depends on the particular circumstances of any business.”

Mark Garnier, another Conservative MP on the Treasury Committee, told City A.M. firms and individuals are “rightly protected” by HMRC’s current confidentiality rules: “Everybody may think it would be absolutely fantastic for Google to reveal its tax affairs, but they would be less happy about it if suddenly everybody had their tax affairs listed on the HMRC website.”