Top tier crypto exchanges’ market share surpasses 90% as volumes nosedive in India

Data from CryptoCompare shows that the price of Bitcoin dropped below the $40,000 mark over the weekend after maintaining its $42,000 to $40,000 range throughout it. At the time of writing, BTC was changing hands at $39,200.

Ethereum’s Ether – the second-largest cryptocurrency by market capitalisation – moved in a similar way and dropped below the $3,000 mark over the weekend. It’s now changing hands for $2,900.

Headlines in the cryptocurrency space this week were focused on a number of developments, including trading volumes plunging in India’s leading cryptocurrency exchanges since the beginning of the month after a new tax on crypto profits came into effect.

Research on the trading volumes of four Indian exchanges has found a 72% drop on WazirX, 59% on ZebPay, 52% on CoinDCX, and 41% on BitBns. The drop followed the introduction of a 30% tax on profits from crypto transactions that doesn’t allow investors to offset gains with losses from other transactions.

The most controversial provision, a 1% tax deducted at source (TDS) liability, won’t take effect until July 1. The drop in volumes on Indian exchanges, it’s worth noting, comes at a time in which the cryptocurrency market has taken a turn and may be part of a wider trend.

The situation has even seen major exchanges in the country, including Coinbase, disable deposits via the United Payments Interface (UPI), a payments system developed by the National Payments Corporation of India (NPCI).

The NPCI is part of an initiative from the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) to create a robust payment and settlement infrastructure in the country.

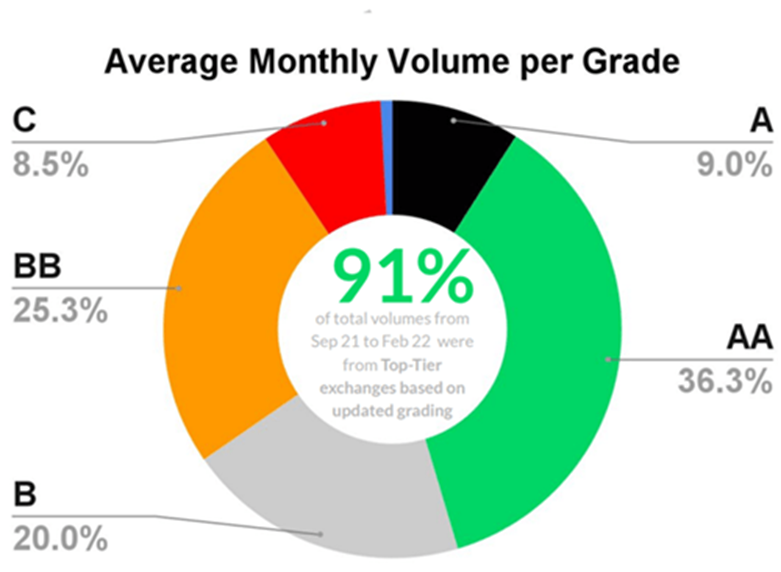

Despite the drop in India, CryptoCompare’s most recent Exchange Benchmark report has revealed higher quality cryptocurrency trading platforms have been steadily gaining market share over the last few quarters, to the point they now command more than 90% of the trading volume in the cryptocurrency space.

The report details Top-Tier exchanges traded a total of $1.5 trillion in February, compared to $62 billion for Lower-Tier exchanges. CryptoCompare ranks more than 150 global spot exchanges based on a comprehensive methodology that assesses counterparty, operational, trading, and security risks to distinguish Top Tier exchanges.

Top-Tier exchanges, it’s worth noting, are those ranked AA-B. Only four cryptocurrency exchanges – Coinbase, Gemini, Bitstamp, and Binance – have received an AA rating from the cryptoasset data provider, while 11 exchanges received an A rating, 27 received a BB rating, and 37 received a B rating. 80 crypto exchanges were ranked as Lowe-Tier.

Amazon CEO dismisses crypto payments, says it could sell NFTs

Over the week, Amazon’s CEO Andy Jassy has revealed that the online retail giant could sell non-fungible tokens (NFTs) in the future, but dismissed crypto payments. Jassy noted he does not personally own neither BTC nor NFTs, even though he believes cryptoassets will become more significant over time.

In an interview given shortly after releasing the first Amazon shareholder letter as its CEO, Jassy said he believes “it’s possible down the road on the platform” to sell NFTs, although he said Amazon isn’t close to adding crypto payment options in the future.

Meanwhile, the popular commission-free trading platform Robinhood listed four new cryptoassets on its platform: Shiba Inu (SHIB), Solana (SOL), Polygon (MATIC), and Compound (COMP). The price of each of the tokens moved up shortly after being listed.

In a statement, Robinhood’s chief brokerage officer Steve Quirk said the firm was “excited to add more choices for our customers”, and added it has a “rigorous framework in place to help us evaluate assets for listing”. Quirk also said it remained “committed to providing a safe and educational crypto platform”.

Ethereum merge delayed a ‘few months’

On the development side of things, Ethereum core developer Tim Beiko has confirmed the long-awaited Ethereum Merge, which will see ETH’s proof-of-work mainnet combine with the Beacon Chain proof-of-stake system, has been delayed by a “few months”.

Instead of June, the network’s transition to a proof-of-stake consensus algorithm is now expected to come later this year, although Beiko insisted Ethereum is in “the final chapter of PoW”.

While the merge has recently been delayed, CryptoCompare’s latest Asset Report shows Ethereum’s transaction fees fell for a second consecutive month, this time with a 37% decline to $424 million.

The drop follows a 12-month record fall of 46.7% that occurred the prior month. Ethereum’s average fee per transaction fell to $12.13. The network, as a result, was inflationary the whole month of March.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.