Top-performing investment teams: 10 ingredients to their secret sauce

What do top investment teams have in common?

To answer this question, Focus Consulting Group (FCG) undertook research into the factors shared by high-performing investment teams. We developed a list of factors that contribute to fund performance, including: ‘Do you use quantitative filters?’ (to narrow your universe) and ‘Do you personally invest in your team’s strategies?’.

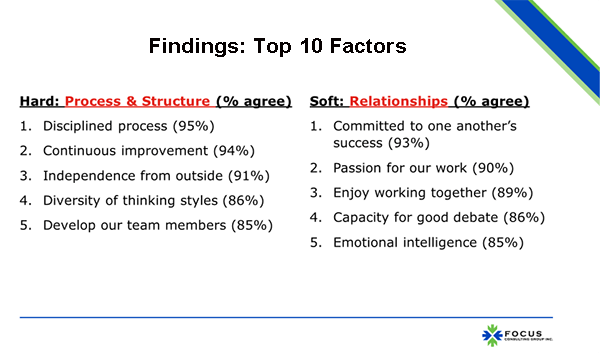

We came up with 37 factors (available upon request) and asked 96 responders from 10 investment teams to rate the importance of each factor in contributing to outperformance. The teams were selected based on having achieved ‘benchmark plus’ nominal and risk-adjusted performance, for 10 years or longer, with consistent results.

We divided team performance factors into two categories: hard skills (process) and soft skills (relationships). We wanted to find out whether top-performing teams valued one set of skills over the other, and, of course, which skills they thought contributed the most to performance.

The following factors emerged as most essential to achieving outperformance:

What was our major takeaway? Both hard and soft factors are critical to investment success.

Michael S. Falk, CFA, embeds for several days with investment teams to learn how their process works, and these results matched his experience. The successful ones have developed excellent processes and structures – but they also have healthy working relationships.

Increasingly, investment teams are realising that so-called ‘soft’ skills are essential. In research by FCG team member Jason Voss, CFA, he and his colleagues found that the greatest learning demand from investment professionals was on the soft side, not the technical side. Specifically, emotional intelligence (EQ) was recognised as a valuable skill for enhancing a team’s collaborative ability. Strong EQ means that a person has reasonably good self-awareness, as well as good ‘others’ awareness.

This understanding contributes to another key skill: capacity for good debate. Teams that make outstanding decisions have in-depth discussions about them without damaging trust or morale. Many teams with weak EQ have ‘pseudo’ debates in which much is left unsaid. They lack candour because the unspoken agreement is: ‘If you don’t rock my boat, I won’t rock yours.’

So what stood out about each of the top 10 factors? What insights could we glean about their application from the teams themselves?

1. Disciplined process

While all teams are expected to have a disciplined process, the unconventional wisdom holds that these processes need to be examined over time and continually improved. Top teams indicated that they have buy/size/sell process disciplines. Other attributes were clarity and acceptance of decision rights: everyone knows who makes the final call and what the ground rules for decision-making are.

2. Continuous improvement

The concept of ongoing improvement is a conventional one, but often there is a bit of self-deception around it. Many investment teams fail to examine their filters or engage in post-mortems regularly. By our count, only about 10% of investment teams conduct such analysis. And even those that claim to tend to fall short: they don’t keep careful journal entries when stocks are discussed, purchased and sold. Behavioural research demonstrates that our minds rewrite history, so careful records are necessary to learn from experience.

3. Independence from outside influencers

Top-performing teams serve one master: the client. They are laser-focused on process and execution and not influenced by shareholders or parent companies. While we have seen teams outperform despite such influence, our survey participants indicated that independence is important to their success. Indeed, at FCG, we have also seen how outside influencers can creep in during periods of underperformance, to detrimental effect.

4. Diversity of thinking styles

The value of cognitive diversity is supported by ample research. The problem is measurement. How do you know your team is cognitively diverse? The top teams that we researched have used the Enneagram model to measure each team members’ approach to problem solving. Top teams have a mix of different styles. Of the nine varieties, good teams typically have five or more.

5. Developing team members

James J. Valentine, CFA, has found that many research teams resist developing their analysts, believing that investment professionals with CFA designations are ‘fully-finished products’. But recent active manager track records raise the question: how much denial are these research teams in? The same firms that are underperforming – and there are a lot of them – resist developing their analysts! Our survey results suggest that the best teams develop and train their smart, hardworking analysts.

As for those factors on the relationship, or soft side, of excellence, we noticed the following themes around them:

6. Committed to one another’s success

The commitment factor was the single most important soft element of success. One participant commented: “Our process and our success is built upon the team and its commitment to each other. Without this, I don’t think we’d have the culture of trust which allows us to be creative, make mistakes, and still show up deeply excited to be there the next day.” We all know a common problem in the investment world: big egos. The best teams operate from a sense of team.

7. Passion for our work

Many finance professionals place money and winning above passion for the work. This can lead to demotivation when performance or bonuses are down. The top teams love the markets and the work: their passion carries them through inevitable down periods.

8. We enjoy working together

Teams that like and trust each other tend to have better debates. Debate is important, and many mediocre investment teams don’t achieve it. They either have a general silence as team members withhold their ideas and counterpoints, or they have arguments in which team members become defensive and take things personally. Neither environment supports good decision-making.

9. Our team members debate well

Only teams with high trust and candour can hope to achieve true debate. Top teams build healthy environments for debate and dialogue by creating trust and safetyGood post-mortems pose two important questions to each team member: what could we have known but didn’t; and what could I have contributed to add value?

10. Emotional Intelligence (EQ)

Investment professionals are waking up to EQ’s importance in good decision-making. Comments from our survey participants support this:

- “We recognise this is a very fickle business and that mistakes are made. Therefore, there is a level of ego and confidence that is mandatory, but it is also extremely important to be able to admit what you don’t know, encourage others, and learn from the inevitable mistakes.”

- “We need to be able to rigorously challenge an idea and the work that went into it and still walk away from the table as colleagues and friends. That is not easy, and it takes a lot of emotional intelligence in terms of how you conduct yourself in a debate and how you manage your emotions before and after.”

Overall, too many investment teams are in denial – they pay lip service to continuous improvement but let complacency carry the day. And from that comes the mediocre results you would expect.

Here’s hoping that your team is actually doing it, and establishing and fine tuning these critical skillsets.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

By Jim Ware, CFA, founder, and Michael S. Falk, CFA, partner at the Focus Consulting Group.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/GeorgePeters