Tokenisation: assets are regular mail, tokenised assets are email

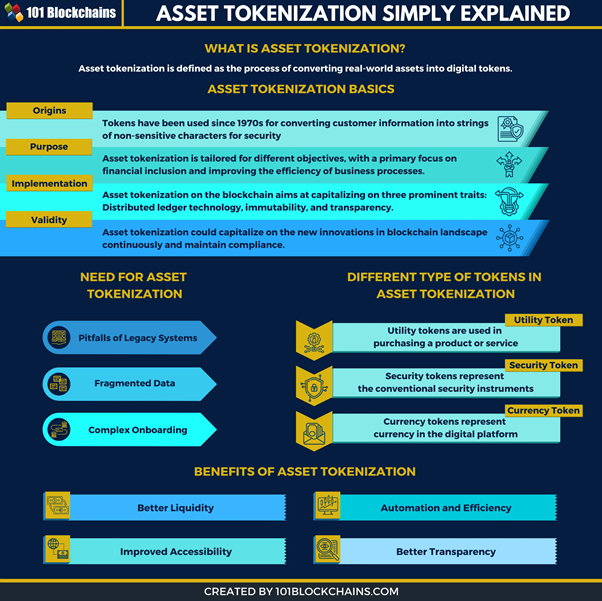

Tokenisation involves converting assets in the physical world into tokens that exist digitally on a blockchain. Assets are tokenised to distribute them digitally to owners or investors – owning a token that represents an asset equates to owning a share of the asset. The main benefits of tokenisation are that assets can be stored and sold fractionally, if required, and users can transfer the right of ownership digitally, both quickly and transparently.

The value of assets that can be tokenised in the world right now is at least $300 trillion and, in the future, tokenisation has the potential to change not only the asset market but the whole financial industry. The global real estate market was estimated in 2017 at $280 trillion and has likely grown to at least $400 trillion since then. Add the world stock market value of about $89 trillion and, without including other types of assets, the total potential for tokenising is at least $500 trillion.

The concept behind asset tokenisation

Asset management as a business process is bureaucratic and regulated, especially if we are talking about issuance of shares. In traditional finance you need to get different licenses, planning papers, and spend time on outdated procedures. Tokenisation takes a different approach to boost the asset management industry.

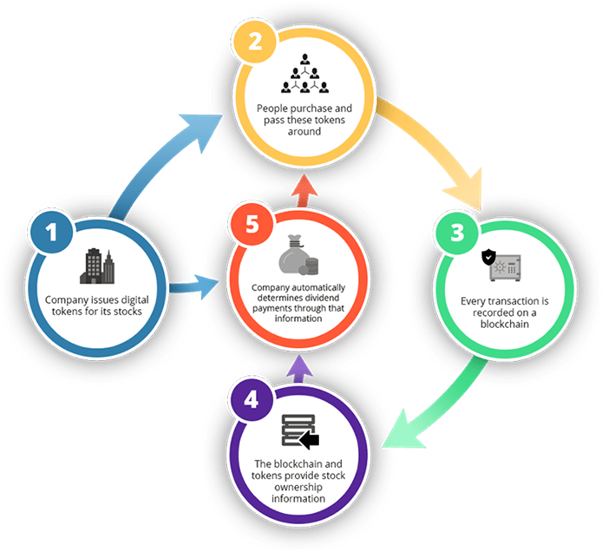

Tokenisation in the legacy financial system entails a process of securitisation. Securities in the fiat world act as a representation of ownership in an asset or firm and can be traded in secondary marketplaces. Stocks are one example of securities, which are sold on stock exchanges. The same concept has been applied in the blockchain space to create digital tokens.

For different types of assets, there are different tokenisation tools: fungible assets can be tokenised by dividing them into fractions; unique objects and collectibles can be tokenised in their entirety as NFTs.

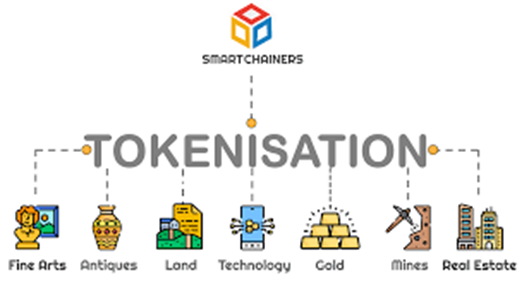

Commonly tokenized assets

Numerous types of assets can be tokenised. However, the following are the leading examples:

Real estate

Tokenising real estate has introduced the concept of fractional ownership of property. In the past, if you wanted to invest in a real estate project, you would need to have sufficient wealth, which creates a high entry barrier to many potential investors, particularly in the high-value property sector. At the same time, whole buildings, flats, or houses can be tokenised in the form of NFTs, with a unique digital token representing each property.

2017-2018 saw many discussions of potential tokenisation for real estate and implementations of blockchain for operations with it. Most ICOs for real estate tokenisation failed, though there were some successes. For example, Bitfury created the first ever blockchain land-registry system in partnership with the Republic of Georgia’s National Agency of Public Registry (NAPR).

Currently, one of the most successful projects in the industry is a real estate transaction platform called Propy that unites buyers, sellers, brokers, and notaries. Propy was a member of WeForum and TechCrunch’s Founder Michael Arrington sold his flat as an NFT on the platform this year.

Commodities

Commodities tokenisation could help open up market opportunities through their life cycle, from extraction to the final use phase. Converting physical assets into tokens could help lower entry barriers into asset classes that are currently dominated by institutional investors.

Stocks and shares

Many small and medium-sized firms use spreadsheets to record share ownership. However, these records are prone to tampering and errors. Simply put, these small firms lack the financial muscle to secure such sensitive data. Tokenising shares helps secure these sensitive records without a massive increase in costs.

The tokenisation of stocks was extremely trendy in 2018 in the form of STO, which issued tokens backed by company stocks and shares. The STO trend didn’t survive the year, due to the bear market that spawned popular brands like Overstock, tZero and the STO platform, Polymath.

Virtual assets and digital collectibles

Assets such as artwork, stakes in private firms, collectibles such as rare cars, and more can be tokenized. Doing so offers provenance and ensures easy price discovery due to the transparency inherent to a blockchain ledger. An NFT or a Non-Fungible Token is one approach to tokenising assets. Unlike other digital coins secured by the blockchain, each NFT is unique.

That simply means that two NFTs cannot be interchanged in the same way that one Bitcoin can be interchanged for another. NFTs are often used to secure pieces of art and collectibles. Digital collectibles are probably the easiest case for tokenisation. They’re widely represented on NFT marketplaces such as Rarible, OpenSea, and SuperRare, where users can tokenise and sell their artwork.

A good example of an NFT is when the source code for the World Wide Web sold at auction for $5.4 million.

Tokenisation of inflation-hedging assets

One of the latest trends in the blockchain world is the tokenisation of inflation-hedging assets, with a primary focus on gold and silver. A major reason for the increased interest in gold is the COVID-19 pandemic. As major central banks globally engage in wanton money-printing, investors have been buying gold as a hedge against looming inflation.

Copyright Tokenisation

Tokenising copyright could help open up a new world of fractional ownership of various assets and art pieces. For instance, an artist could sell the copyright to a song as a tokenised asset, which gives their fans a direct means to invest in their talent.

Tokenising services

Skilled individuals can now tokenise their services, from software developers to piano teachers and business consultants. To achieve this, they can create tokens that allow you to access a specific amount of their time or effort – for example an hour of work, a lesson, or a consultation. The tokens can be redeemed at any time, and the holder is entitled to the tokenised time or effort. The tokens can be sold or gifted to anyone, who can then benefit from the individual’s talent.

Sports players and teams

Sports teams and players have also entered the tokenisation space. One way they do this is by tokenising team memorabilia. Some players have also attempted to tokenise their contracts. However, the sector is still young, and progress has been slow. According to digital collectibles market in sports, NBA Top Shot is probably the best case for using NFTs in sports.

Tokenisation and DeFi

The DeFi and asset tokenisation sectors are the latest subsectors in the blockchain space. Together, they have the potential to reshape the financial world. Tokenising real-world assets and equity can help grant people access to the DeFi world. These tokenised real-world assets can be locked into DeFi protocols.

One viable use case for tokenised assets within the DeFi space is collateral, which is central to the operation of major DeFi protocols such as MakerDAO and Compound. Tokenising physical assets such as real estate could help to unlock billions of dollars of value for those within the budding DeFi sector.

Tokenisation of assets is a young but growing sector that holds huge potential. By combining with the DeFi space, it could help to ensure that tokenised assets can be swapped directly on blockchain platforms. The result would be a fully self-contained and self-sustaining ecosystem that is secured using the blockchain. It will lead to a decentralised marketplace that is accessible to anyone in the world, away from unfair and costly centralised control. In the future, the global economy could operate in this manner.

Current trends

Tokenising assets and property rights has several advantages, one of which is the transparency provided by storing information in the blockchain. This reduces the risk of fraud or technical failure. At the same time, a blockchain with smart contract functionality can automate transfers of assets and property rights. Tokenisation also enables fractional ownership that’s automated and doesn’t need different, detached procedures.

For many people, however, the tokenisation of stocks and shares will be considered the main criterion for asset tokenisation success. As we see in the Robinhood hearings in Congress, lack of transparency in the creation of stocks and shares and cooperation with “market-making funds” made the company the subject of criticism. If Robinhood used blockchain to create shares, this mechanism could be more transparent.

Moreover, legal protections are still far from robust for tokenised assets. For example, Binance launched trading of tokenised Tesla stocks this year but quite quickly ceased support for all stock tokens. The reason one of the biggest crypto exchanges in the world did this is clear: reinforcing regulatory pressure. One more important note here is that Binance only issued derivatives for these stocks; the exchange didn’t have their real equivalent. Tokenisation of stocks remains a complex task for the blockchain industry.

The same is true for the real estate market. The regulatory environment is still not clear for real estate NFTs, despite Propy already demonstrating progress in this field.

Even though tokenisation is still in its early stages, there are jurisdictions where things are changing. A good example is Liechtenstein’s Blockchain Act, which offers some legal protection and recognition for the tokenisation of physical assets.

Conclusion

Regulation constantly moves forward, as does tech infrastructure. It may only take months – or perhaps a few years – to reach the critical mass needed to boost the market into mass adoption of tokenisation. And one of the most important criteria in 2021 that is prerequisite for being a successful asset tokenisation platform is being mobile-friendly. Without that, we’ll never achieve mass adoption.

Alex Lightman is the founder and chairman of Keemoji and founder and CEO of Keemoji, makers of digital privacy keyboards and a new platform for cashback, including in digital currencies, payments, tokens and digital collectibles. He is the author of Brave New Unwired World and Reconciliation, the co-author of Augmented: Life In The Smart Lane, and recipient of four global awards, including the first Economist magazine Readers’ Award for innovation, beating Elon Musk in a global vote.

Crypto AM readers can meet Alex Lightman at the Unlocking Party on July 28...