To withstand future recessions, the UK needs radical supply side reform

When academics write essays, they begin with an abstract that captures the causes, effects and outcomes of the economic policy change they are examining.

Boosting the supply side has a pretty simple argument. Either increasing the volume or productivity of resources used to produce things makes a country richer. That’s it.

Let’s take a look at one of those resources: workers.

Living standards are drawing close attention at the moment because they’re tanking.

One thing is true. Countries can get away with anaemic real wage growth when inflation is low. When it enters the double-digits, problems spring up.

That real income erosion has sparked a wave of strikes disrupting the UK economy.

What’s essentially happened over the past 18 months is that the rate of increase in energy prices has far outstripped the rate of increase in the UK’s exports. We’re a net importer of energy, so those higher costs have swept through the economy.

But there are deep rooted problems that have made households more vulnerable to sudden bursts in prices.

UK worker productivity growth has stalled. That presents companies with a few tough choices.

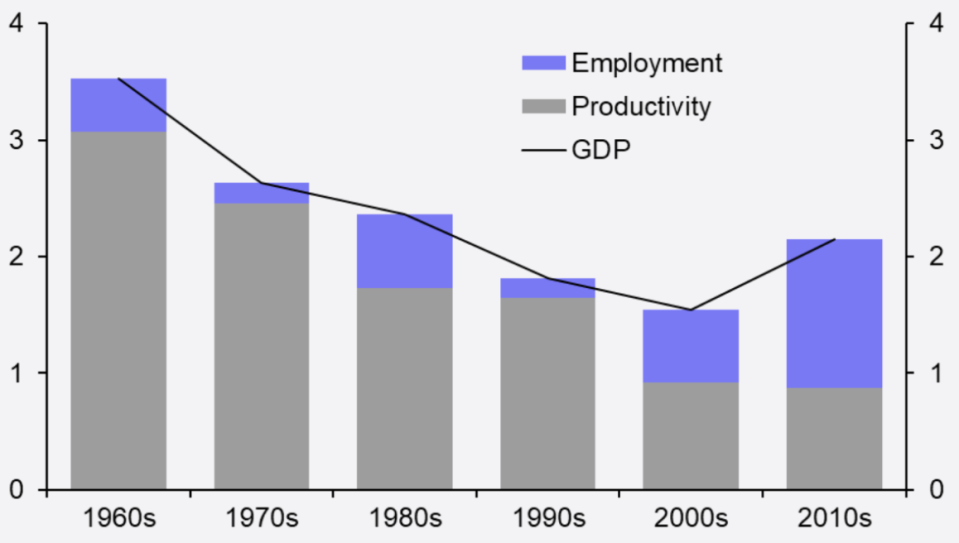

Annual average UK GDP broken down by decade and contribution (%)

Scale back unprofitable production. Take a margin hit and hand workers a pay rise. Borrow to cover short-term losses.

Now, in the real world, firms have picked a mixture of all three. However, weak productivity growth is among the main causes for why people feel like they’re not any better off compared to a decade ago.

There’s a number of reasons why this has happened. Top of the list is dismal private and public investment.

Over the last decade, according to OECD and World Bank data, investment as a share of the UK economy has actually grown at an average of one per cent each year. However, this is largely because the economy’s growth pace has slowed since the financial crisis.

In fact, in 2011, proportional business investment hit a record low of 15.6 per cent. Greece, Luxembourg and Poland are the only other OECD members that have a lower level than the UK’s current level of 17.4 per cent.

Luxembourg actually has one of the higher per capita GDP rates in the world, possibly because its ratio of workers to machines and other productive tools is pretty strong.

All else equal, jolting business investment will raise the UK’s long-term growth potential.

According to Oxford Economics, Ireland has the highest growth potential in the OECD at nearly six per cent. The UK is second last.

UK is nearly dead last in OECD potential growth table

Policymakers need to be a bit more nuanced about how to get firms investing.

Cutting headline corporation tax rates will help. But, a more effective policy tool could be offering reliefs on the best productivity enhancing investments. That should incentivise firms to channel money into areas where we’ll get the best return. Identifying those things is tricky though.

Another area the UK is fast emerging as a laggard is its workforce. Some 565,000 labourers have disappeared since the start of the pandemic, an anomaly in the developed world.

Early retirement, possibly caused by the Cameron/Osborne administration allowing older people to access their pensions earlier, has shrunk the workforce, according to a report last month from the House of Lords’s Economic Affairs Committee called Where have all the workers gone?

Tackling the supply side of an economy is tough. It takes years if not decades to bear fruit.

Arguably, the effects of Margaret Thatcher’s reforms in the 1980s didn’t emerge until Tony Blair seized power. It’s unclear what policies introduced by the government will surface in 10 years.

The UK economy doesn’t need to be restored to pre-pandemic strength. It needs its long-term health full-proofing to prevent further living standards crises. 2023 will be the year of the supply side.

DAVOS GOES OFF PISTE

This year’s annual jamboree in Davos put on by the World Economic Forum is the first normal one since before the pandemic. It’ll be noticeable for the absence of the world’s political and economic bigwigs.

Prime minister Rishi Sunak won’t be there, nor will his chancellor Jeremy Hunt.

Labour leader Keir Starmer will be though. Food for thought.

YOU MIGHT HAVE MISSED

We’re much less productive than our peers, the ONS said last week. France, Germany and the US are streets ahead.

We’re a bit better than Italy and Canada, but not by much.

Must. Do. Better.

WHAT I’M READING

Labour and the Conservatives’s track record managing the economy is broadly the same. Vicky Redwood and Paul Dales, economists at consultancy Capital Economics examined how the UK economy has performed during alternative Tory and Labour administrations since the 1960s. The former just about wins on GDP growth, but real wage growth has been better under the latter.