Tight mortgage rules slow down lending growth

TOUGH new affordability checks have knocked mortgage lending, Bank of England data showed yesterday.

Lending is still growing, but at a slightly slower pace after the mortgage market review (MMR) rules came into force in April.

The number of banks reporting rising demand for prime mortgages outweighed those reporting a fall by a margin of 27.5 per cent in the second quarter – down from 27.8 per cent in the quarter before, and from 62 per cent in the final three months of 2013.

And the Bank of England found a net balance of 18 per cent expect a rise in the coming three months – down from 27.8 per cent previously.

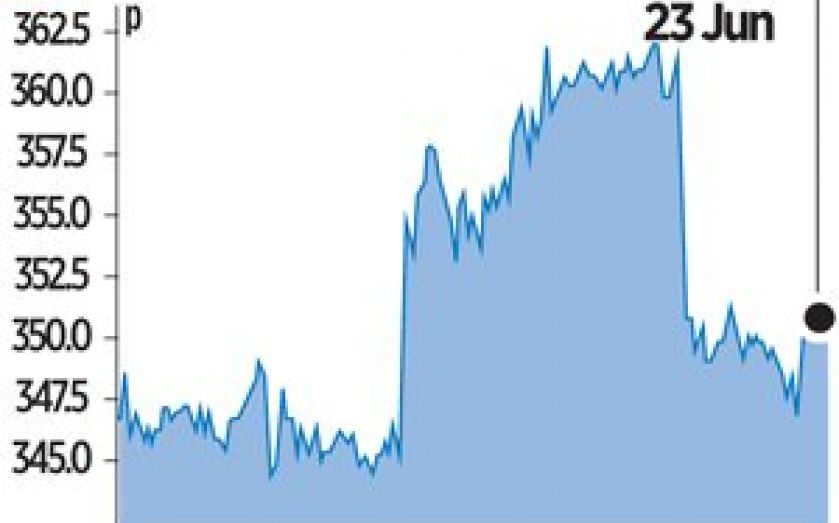

Meanwhile investors fled from building companies yesterday, fearing a slowdown in the housing market after Bank of England governor Mark Carney raised the prospect of a rise in interest rates this year.

Barratt Developments’ shares fell 2.72 per cent on the day, while Balfour Beatty’s dropped 1.85 per cent.

Remortgaging has also slowed down. The value of the loans in May fell 15 per cent on the year to £3.3bn, the lowest level seen since March 2013.

“Remortgaging continues to lead the market slowdown as lenders tighten their lending criteria, pre-empting any government cap to tackle concerns about an overheated mortgage market,” said Andy Knee from property services firm LMS, which published the figures.