Tide high on £350m valuation after Apax Digital funding

British fintech firm Tide is said to be closing in on a £350m valuation following a fresh cash injection from the growth arm of private equity giant Apax Partners.

The Apax Digital Fund is finalising an investment in the business banking platform worth tens of millions of pounds, Sky News reported.

The funding round is the company’s first since 2019, when it raised £44m from backers including Japan-based SBI Group and Augmentum Fintech.

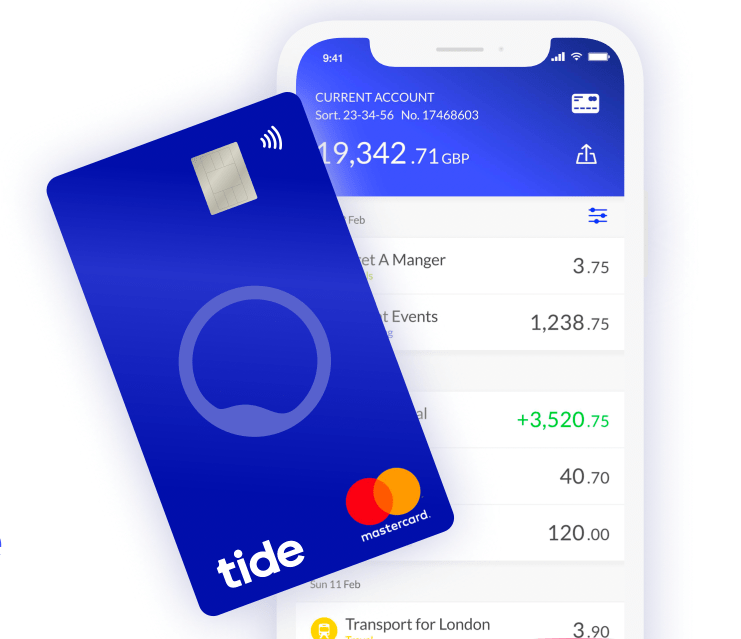

Tide, which was founded in 2015 by George Bevis, provides mobile-first banking services for small and medium-sized businesses.

It now has more than 300,000 customers, accounting for a UK SME banking share of more than 5.5 per cent.

Tide is competing in an increasingly crowded digital payments market, with rivals such as Revolut and Monzo racing to stay ahead of the crowd.

In December the London-headquartered firm announced the launch of its first payroll service in a bid to expand its offering to small business customers.

Tide is led by chief executive Oliver Prill and last year named Sir Donald Brydon, outgoing chair of Sage Group, as its new chairman.

British private equity firm Apax set up its $1bn Digital Fund in 2017 with the aim of investing in high-growth tech and internet companies around the world.

Its bets include property management software firm Guesty and fitness subscription service Classpass.

FT Partners, a San Francisco-based investment bank focused on the fintech industry, is advising on the funding round.

Tide declined to comment. Apax has been contacted for comment.