Three charts suggest a V-shaped recovery, but economists are sceptical

British businesses reported the best growth in five years in July and shoppers spent their money at close to pre-coronavirus rates in June, data showed today in a positive sign for the UK economy.

It was a stark contrast to two weeks ago, when figures showed that the economy undershot expectations in May with just 1.8 per cent growth after a record 20.3 per cent contraction in April.

Economists today said there were reasons to be cheerful about the UK economy. As the public gradually emerged from lockdown in June and July they clearly increased their spending and firms ramped up their activity.

But analysts also warned the upbeat data does not mean Britain is heading for a ‘V-shaped’ recovery. That is when the economy bounces back almost as quickly as it shrank and returns to its pre-coronavirus size in good time.

Three charts show the progress the UK economy is making after the worst second quarter in living memory. Economists warned they should be treated with caution, however.

UK economy’s private sector rebounds

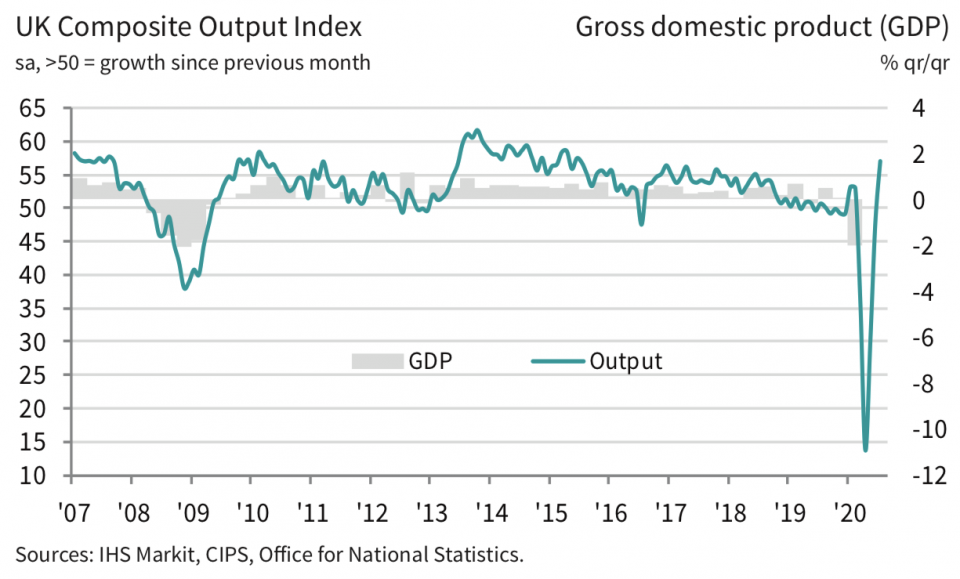

UK private sector output grew at the fastest pace in five years in July, according to a closely watched survey out today.

The IHS Markit/Cips composite purchasing managers’ index rose to 57.1 in July from 47.7 in June. That compared to a record low of 13.8 in April when the UK economy was put on ice. A score above 50 indicates expansion.

The rebound “was fuelled by the release of pent up demand,” said Duncan Brock, group director at Cips, the Chartered Institute of Procurement & Supply.

“Clients and customers returned to spending and businesses were able to open their operations as staff returned.”

However, Andrew Wishart, UK economist at Capital Economics, said: “It doesn’t suggest that the economy is anywhere near back to normal.”

He warned that the PMI gauge “has not been a reliable guide” to economic growth. “It was below 50, signalling contraction, in May and June when we know GDP started to grow again.”

Retail sales surge to near pre-pandemic levels

Retail sales rebounded to almost pre-coronavirus levels in June after “non-essential” retailers were allowed to open again in the middle of the month.

British shoppers bought 13.9 per cent more goods in June than May, the Office for National Statistics (ONS) said.

Non-food store sales rocketed 45.5 per cent month on month in June, and fuel leapt 21.5 per cent.

“Retail continued to recover from the sharp falls seen in April, with overall sales now almost back to pre-pandemic levels,” said ONS deputy national statistician Jonathan Athow.

Yet Lisa Hooker, consumer markets leader at PwC, said: “Not all stores fared equally. With restaurants and pubs still closed… it’s no surprise that supermarkets continued to trade above pre-lockdown levels.”

“The main disappointment will be for fashion retailers — still trading at less than 50 per cent of normal levels.”

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said: “The V-shaped retail sales recovery is unrepresentative of overall spending.”

“Retail sales usually account for only 31 per cent of households’ overall expenditure,” he said. “They have benefited from households reallocating funds usually reserved for services, which remained largely unavailable in June.”

Employer confidence grows as UK economy recovers

Employment prospects in the UK also looked brighter today, according to one survey.

The short-term hiring intentions of company bosses improved in July, the Recruitment & Employment Confederation (REC)’s latest jobs outlook survey said.

Firms’ confidence in hiring and investment decisions also rose for the first time since February. They hit four in July on the REC’s gauge, from minus nine in June.

REC chief executive Neil Carberry said: “It’s good to see employer confidence rising as the lockdown measures ease. At this stage we would expect things to be getting better month-by-month.”

However, the IHS Markit/Cips purchasing managers index showed that job losses in increased in July.

Melanie Baker, senior economist at Royal London Asset Management, said the PMI survey was a “worrying message” to workers.

“The employment indicator worsened, consistent with more redundancies in July.” Firms such as builders merchant Travis Perkins, cafe group SSP and the Guardian newspaper have all recently announced job cuts.

Baker said the economy was “still sending a worrying message on job security”. She added that “this recovery continues to need significant policy support”.