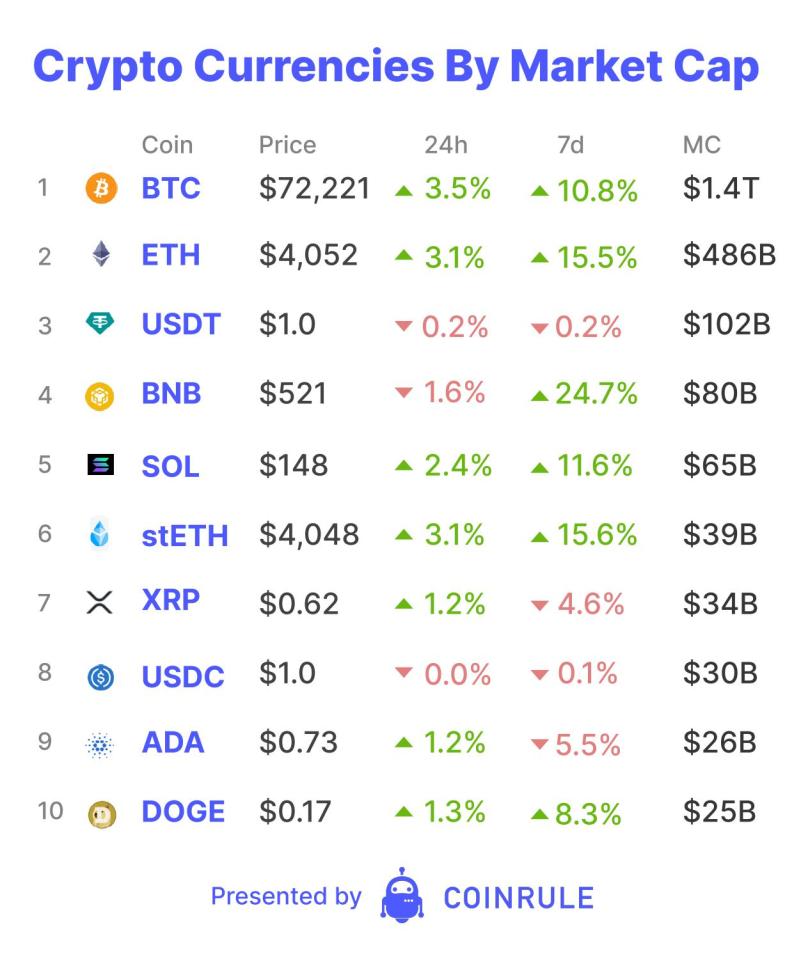

THORChain breaks volume records as Bitcoin passes $72,000

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

Yesterday, Bitcoin finally properly broke above its fabled $69,000 resistance with Michael Saylor FOMO’ing in his $800+ million from his convertible note offering. However, another protocol has also been making record highs. Last week, THORChain, the decentralised liquidity protocol, had record volumes of over $2.7 billion. This led to RUNE, THORChain’s token, entering the top 50 with a 50%+ appreciation in its price. One of the primary catalysts was a 60 million token burn – increasing RUNE’s scarcity by 12%.

Due to the protocol’s lending mechanism having limits to ensure stability, the burn allowed the protocol to lend more loans. The lending limits are also priced in RUNE, so as RUNE appreciates more potential loans can be created. The creation of loans also has a deflationary effect on RUNE. “But, aren’t there loads of DeFi products that lend money?” we hear you ask. Yes, but what’s unique about THORChain is its loans can borrow up to 50% of posted collateral, and have no interest, expiry or risk of liquidation. With these characteristics, THORChain’s ‘loans’ are more like perpetual call options. This provides another way for crypto natives to access leverage and potentially excess returns without the risk of liquidation.

THORChain also allows cross-chain swaps. On Traditional DEXs, you can only trade with one chain at a time. But, on THORChain you can trade tokens from different chains. Last week the protocol facilitated its largest swap to date. This was 100 BTC to around 1,730 ETH, worth around $7 million. What was special about the swap, and THORChain, was the extremely low slippage of 0.03%. If you were to try that on Uniswap and Ethereum, using wrapped BTC to ETH, the slippage would be almost 17x more at over 0.5%. This demonstrates the capabilities of THORChain’s liquidity with the potential of it becoming the go-to place for whales to swap cross-chain.

However, as with any nascent technology, there are risks to its lending dynamic. Similar to Terra’s LUNA, as the protocol expands RUNE is deflationary, as more loans are created. But, as it contracts and loans are repaid, RUNE becomes inflationary. To avoid liquidation, the protocol also immediately sells the collateral and buys it back when the loan is repaid. This also relies on the value of its reserves increasing faster than the value of whatever the collateral was. However, THORChain has measures in place to mitigate a LUNA-like death spiral. In reality, will they work though?