Think short-term for lockdown but not for investing

The UK’s second lockdown means everyone’s winter plans have been torn up and thrown away. Even seemingly modest weekend activities – going to a museum, meeting a friend for lunch – are now off the table.

As many of us learnt during the first lockdown, the trick is to focus on what is possible in the short term. A walk round the park today is achievable; a dinner party next month may not be. Recent news on a vaccine is very encouraging but there’s a long way to go until it becomes widely available. Until then, a lot of our plans will remain on hold.

But when it comes to investing, it’s important to focus on the future. As long-term stewards of our clients’ capital, we need to ensure that our decision-making is not overly swayed by near-term or temporary events.

Lockdown and Brexit pose near-term challenges

The second lockdown represents a huge challenge for UK companies, particularly those non-essential retailers and hospitality businesses who had to close once more. Then there are other industries such as events and travel that had barely restarted after the original lockdown.

There is also the ongoing uncertainty of Brexit, with a trade deal between the UK and EU still unresolved at the time of writing.

And it’s fair to say that the performance of UK equities has reflected these challenges, with the FTSE All-Share down 23% and the FTSE 250 down 20% in the ten months to 31 October, compared to a 1.5% gain for the MSCI World index.

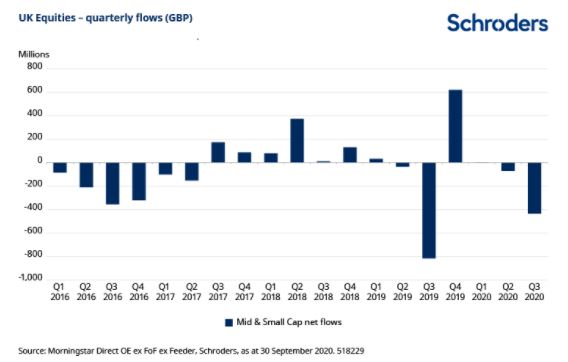

This is reflected in flows too, as the chart below shows. It shows flows into small and mid cap UK equity funds, which are more representative of the domestic UK economy than the larger companies of the FTSE 100. As we can see, the apparent certainty generated by last December’s general election result saw flows rise steeply, only to fall this year.

However, the recent results from various vaccine trials are cause for renewed optimism and could be a catalyst for a reawakening of investor interest in the UK.

Discover more from Schroders:

– Learn: Can asset management’s Covid-19 response help regain public trust?

– Read: Is the vaccine the shot in the arm the market needs?

– Watch: How climate change could affect your investment returns?

Companies looking to grow need equity not debt

Even prior to good news on the vaccine front, we felt there was an opportunity in the UK for investors willing to look beyond the pandemic. In particular, the small and midcap segment of the UK equity market offers some interesting opportunities.

As stockpickers, we’re not looking to invest in the market as a whole, but in the individual companies that have the best business models and prospects for the coming years. Such companies can be found across a range of sectors and industries, and among both listed and privately held firms.

The UK is home to many companies currently experiencing high growth and benefiting from trends that have been sped up by the pandemic: the rise of e-commerce and the use of digital health tools are examples that look to be here to stay.

On the other hand, there are also high quality UK companies that have come under pressure, but will be in a position to grow rapidly once we are all able to travel and socialise freely again.

And there are others with exciting technology or products that can address the myriad challenges – such as climate change – that will still be with us long after the pandemic.

Debt is readily available with interest rates at rock bottom levels and many companies have taken advantage of it. But we feel there needs to be an alternative for companies so that they don’t saddle themselves with too much extra debt at this time of high uncertainty. As equity investors, we have a chance now to invest fresh capital in these companies, support them through the pandemic, and potentially make good returns by sharing in future growth.

Sustainable investing requires a long-term view

What’s more, the long-term nature of equity investing – both public and private – means we can work with investee companies to shape their strategy. Using the UN’s Sustainable Development Goals (SDGs) as a framework, we can help companies ensure they retain a long-term focus on sustainability and governance.

The 17 SDGs reflect the biggest challenges facing the world today, including climate change and poverty. They are not going to be solved by a short-term approach. Equity investors like ourselves can support companies in incorporating the SDGs into their planning. We can help ensure they are on a secure path to delivering growth for all their stakeholders, from employees to investors.

None of this can happen if we focus solely on the events happening right now. Thinking short term may be sensible to help weather the current lockdown as individuals. But if we want to build responsible businesses offering sustainable future growth, then we need to look ahead.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.